Gold prices remained close to the $3,350 level, falling from a near four-week high as the US dollar maintained modest intraday gains. Despite some profit-taking pressure associated with the dollar’s recovery and upbeat risk sentiment in global markets, continued geopolitical tensions, US-China trade tensions, and fears about the US fiscal situation continue to drive demand for the safe-haven metal. Market participants also are wary in anticipation of Federal Reserve rate reductions in 2025, which could cap substantial price falls in gold. Technical indications indicate limited downside risk around key support points, but a breakout above $3,400 might set the stage for a new challenge of the $3,500 psychological level.

KEY LOOKOUTS

• Keep an eye out for additional USD strength or weakness, as it will be one of the main drivers of gold’s short-term price action.

• Market expectations of rate cuts in 2025 will act as a ceiling for USD gains and will give underlying support to gold.

• Continuing US-China trade tensions and escalating geopolitical tensions, such as the situation in Ukraine, may boost safe-haven demand for gold.

• Monitor key support near $3,324–$3,326 and resistance around $3,400–$3,432, which will determine gold’s next directional move.

Investors should closely monitor the US dollar’s trajectory, as its strength or weakness continues to heavily influence gold prices in the near term. Expectations for Federal Reserve rate cuts in 2025 are likely to limit aggressive USD rallies, providing a supportive backdrop for gold. In contrast, surging geopolitical tensions, notably between the US and China, and simmering conflicts like Ukraine are driving safe-haven demand for the metal. From a technical standpoint, gold’s action around crucial support points of $3,324–$3,326 and resistance levels of $3,400 to $3,432 will be decisive in ascertaining if the precious metal can continue its upward momentum or experience further pullbacks.

Watch the US dollar’s action and Fed rate cutting expectations, which significantly influence gold prices. Geopolitical tensions and trade tensions are still supporting safe-haven demand. The next direction of gold will be driven by key technical levels between $3,324 and $3,432.

• Gold price slightly below $3,350, easing from a near four-week high as there is a modest US dollar bounce.

• Stronger USD and upbeat global risk appetite are weighing on haven gold.

• Continuing US-China trade tensions and geopolitical risks sustain gold’s safe-haven demand.

• Market anticipation of Federal Reserve rate cuts in 2025 serves to cap sharp falls in gold prices.

• US fiscal outlook concerns contribute to USD caution, helping indirectly to support gold.

• Technical support is around $3,324–$3,326, with resistance around $3,400–$3,432 key to further advances.

• A sustained breakout above $3,432 may prompt an effort to try and retest the all-time highs around $3,500.

Gold prices are currently trading just above the $3,350 level, somewhat driven by the US dollar’s modest retreat from recent lows. The strength of the dollar has prompted some investors to take some profits in gold, which is perceived as a safe-haven commodity. Yet the metal remains to gain from continued geopolitical tensions such as increasing trade tensions between China and the US and increased threats of the Ukrainian conflict. These risks are causing investors to remain defensive and underpinning gold demand as a hedge against global uncertainty.

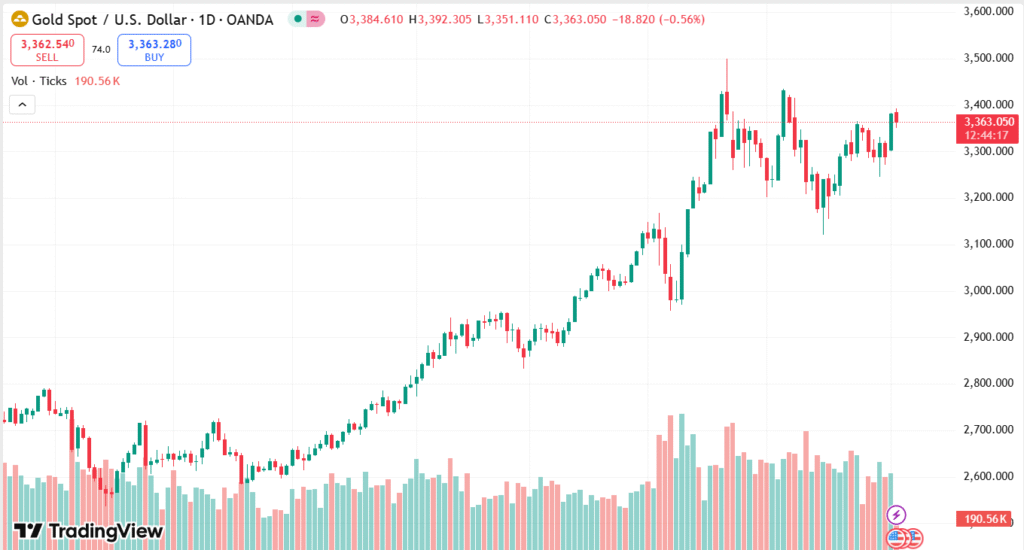

XAU/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Concurrently, hopes that the Federal Reserve would reduce interest rates in 2025 are capping any sudden gains in the US dollar and offering underlying support to gold. Fears regarding the US fiscal outlook are also leading to a defensive mood towards the dollar, which tends to favor non-yielding assets such as gold. With these dynamics in place, gold stands to continue being an important asset for those investors who want to hedge in the face of a messy and uncertain global economic landscape.

TECHNICAL ANALYSIS

Gold just broke above important resistance levels of $3,324 to $3,326, indicating bullish sentiment among dealers. The ability of the price to stay above these levels of support indicates underlying strength, and the next key area to monitor is the $3,400 to $3,432 range, which may serve as resistance before gold tries to challenge its all-time highs. Technicals on daily and hourly charts continue to be bullish, suggesting that the overall direction remains towards more upside. But any protracted fall below the set support levels can pave the way for a more profound correction towards the $3,300 level.

FORECAST

If gold manages to maintain support above the $3,324–$3,326 area, it could gain momentum and push toward the next resistance zone around $3,400–$3,432. Breaking through this level would likely open the way for gold to challenge its all-time highs near $3,500, fueled by ongoing safe-haven demand amid geopolitical and economic uncertainties.

On the flip side, a consistent drop below the $3,324 support might intensify selling pressure, which could propel gold prices lower to the $3,300 level or even beyond. Enhanced US dollar strength or an unexpected relief in geopolitical tensions may suppress the demand for gold, heightening the chances of a more extensive pullback in the short term.