The prices of gold (XAU/USD) continued their three-day winning streak, rising to almost $3,340 levels due to renewed global trade tensions, which triggered safe-haven demand. The rise comes after U.S. President Donald Trump’s declaration of significant 35% tariffs against Canada and the potential to add 15–20% duties on other countries, including the EU, has shaken world risk sentiment. Market players are thus keeping a keen eye on the release of the U.S. Consumer Price Index (CPI) data in June, which may further drive the direction of gold prices, particularly considering that the metal has a good track record during inflationary times.

KEY LOOKOUTS

• President Trump’s action to impose a 35% tariff on Canada and potential additional tariffs on the EU may heighten global trade tensions, fueling safe-haven gold demand.

• The U.S. Consumer Price Index (CPI) figure for June will be a key gold catalyst, as elevated inflation usually buoys precious metal prices.

• Gold is approaching a critical resistance around $3,500; a convincing breakout above here would send prices into new realms, with subsequent targets at $3,550 and $3,600.

• On the bearish side, monitor support at $3,245; a close below here might send prices lower to $3,200 and $3,121.

Gold prices have risen to near $3,340 as investors buy safe-haven assets in response to rising global trade tensions. U.S. President Trump’s 35% tariffs declaration against Canada and the potential for further duties against the European Union have unsettled market sentiment, decreasing risk appetite for riskier assets. The geopolitical risk has made gold more attractive, particularly as investors watch for influential U.S. inflation data for June. As inflation worries still persist, the coming CPI report can decisively influence gold’s movement, perhaps solidifying its upward momentum if price pressures continue.

Gold prices move towards $3,340 as new U.S. tariff threats drive safe-haven demand. The markets now focus on the next U.S. CPI data, which might further drive gold’s momentum.

• Gold continues its streak, increasing for the third straight day and getting close to $3,340.

• U.S. President Trump institutes 35% tariffs on Canada, triggering global trade tensions.

• More EU tariffs are anticipated, further adding to market uncertainty.

• Safe-haven demand surges as investors flee riskier assets.

• Gold nears critical technical levels, with resistance at $3,500 and support at $3,245.

• June U.S. CPI data is a prime impending trigger that will determine gold’s next move.

• RSI reflects sideways movement, while a breakout or breakdown may determine short-term direction.

Gold prices have gained solid traction as investors respond to escalating global trade tensions fuelled by U.S. President Donald Trump’s most recent tariff actions. The imposition of 35% tariffs on imports from Canada, as well as threats of further tariffs on the European Union, has caused broad-based market anxiety. Consequently, demand for safe-haven assets such as gold has increased sharply, reflecting investor nervousness amid rising geopolitical and economic risks.

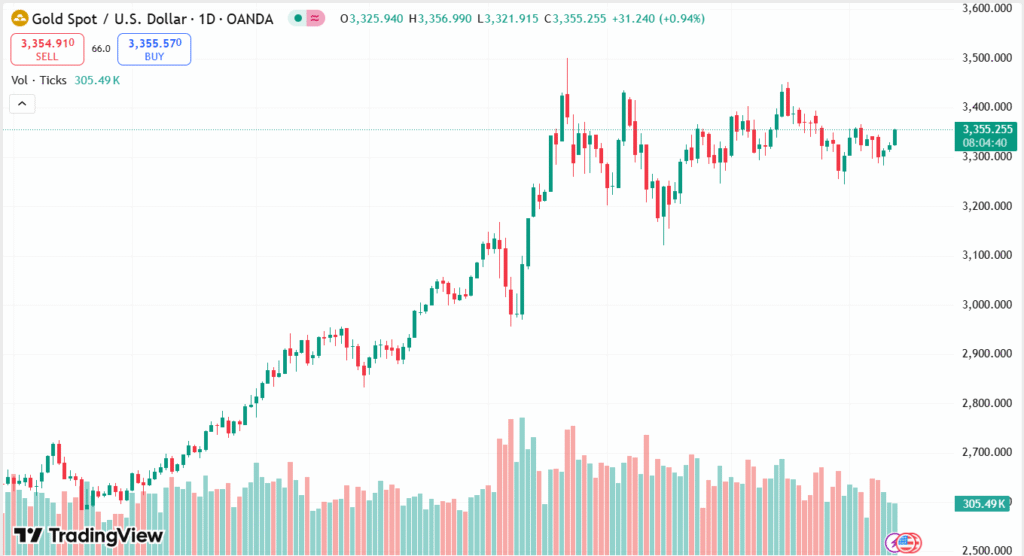

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

This ramp-up in gold demand is also fuelled by hopes for U.S. inflation, with markets looking intensely at the imminent publication of June’s Consumer Price Index (CPI) statistics. During periods of high inflation or economic turmoil, gold is historically considered a sure thing for safekeeping. The increasing fears surrounding disrupted global trade and possible domestic cost pressures are turning gold into a desirable option for investors looking for stability in a volatile world.

TECHNICAL ANALYSIS

Gold is hovering close to the 20-day Exponential Moving Average (EMA) of about $3,330, indicating possible stabilization following recent advances. That said, it is still below the top line of an Ascending Triangle pattern, with the main resistance at about the $3,500 level. A decisive move above this level would set the stage for new highs, but inability to hold above support around $3,245 could initiate a pullback to $3,200 or $3,121. The 14-day Relative Strength Index (RSI) is neutral, trading between 40 and 60, and this indicates the absence of strong short-term directional momentum.

FORECAST

If geopolitical tensions keep increasing and inflation persists, gold may breach the $3,500 psychological level. A breakout above this level, once confirmed, can trigger a healthy bullish move, possibly setting its sights on $3,550 and even $3,600 in the near future. Sustained demand for safe havens, combined with dovish central bank signals, would add strength to this upward move.

Conversely, should trade tensions subside or future U.S. CPI figures indicate tempering inflation, gold can reverse recent gains. A fall below the important support level of $3,245 might unleash further losses towards $3,200 and $3,121. Even a more robust U.S. dollar or more hawkish Fed statements might exert downward pressure on gold prices.