Gold (XAU/USD) is moderately higher, holding on to a slightly weaker US Dollar as investors go cautious in anticipation of the US Consumer Price Index (CPI) release. Although it posted gains, the commodity is encountering strong resistance around the $3,345 area, after a recent retreat from the previous week’s $3,400 top. Market sentiment is still weak following doubt about the sustainability of the US-China trade deal, with potential for further volatility if inflation data next week exceeds expectations. Technically, gold still seems to be in a corrective A-B-C sequence with the ability to test higher levels before continuing its southward trend.

KEY LOOKOUTS

• The market is keenly observing the next US Consumer Price Index reading, which has the potential to shape inflation expectations and the Federal Reserve’s policy direction.

• Concern about the longevity of the US-China “framework” accord remains over market sentiment and go-safe-haven demand

• Gold is experiencing stiff resistance around the $3,345 level, with further upside limited unless there is a breakthrough.

• The ongoing A-B-C corrective phase points toward eventual short-term gains to $3,375 before bearish momentum resumes.

Gold prices are trading with a modest positive bias as the US Dollar tapers globally, fueled by investor wariness prior to the highly anticipated US CPI report. XAU/USD, still under pressure below $3,345 resistance, continues to fail to revisit last week’s highs of around $3,400. The subdued market reaction to the US-China trade agreement, owing to its vagueness, contributes to the uncertainty. With inflation numbers set to bring in new signals, traders are being cautious, holding gold in a tight range of consolidation.

Gold maintains modest gains as the US Dollar falters in anticipation of significant US CPI numbers. Resistance at $3,345 is holding back further gains, as doubts about the US-China trade agreement have investors in wait-and-see mode. Markets look to inflation numbers for the next move.

• Gold (XAU/USD) makes modest gains in the face of widespread US Dollar weakness.

• Resistance at $3,345 still caps further up-limits.

• Investors are hesitant in anticipation of the release of US CPI.

• Doubts surrounding US-China trade deal augment gold’s safe-haven buying.

• Technicals indicate an ongoing A-B-C corrective pattern.

• Potential short-term price higher towards $3,375 before possible further downswing.

• Critical support is at $3,290 and then $3,245.

Gold is supported since market players take a defensive approach prior to the US Consumer Price Index (CPI) announcement. The inflation reading is likely to give vital clues regarding the monetary policy of the Federal Reserve going forward. With the uncertainty of price pressure and potential interest rate hikes, investors are shunning big positions, especially in the US Dollar, to provide indirect support to gold.

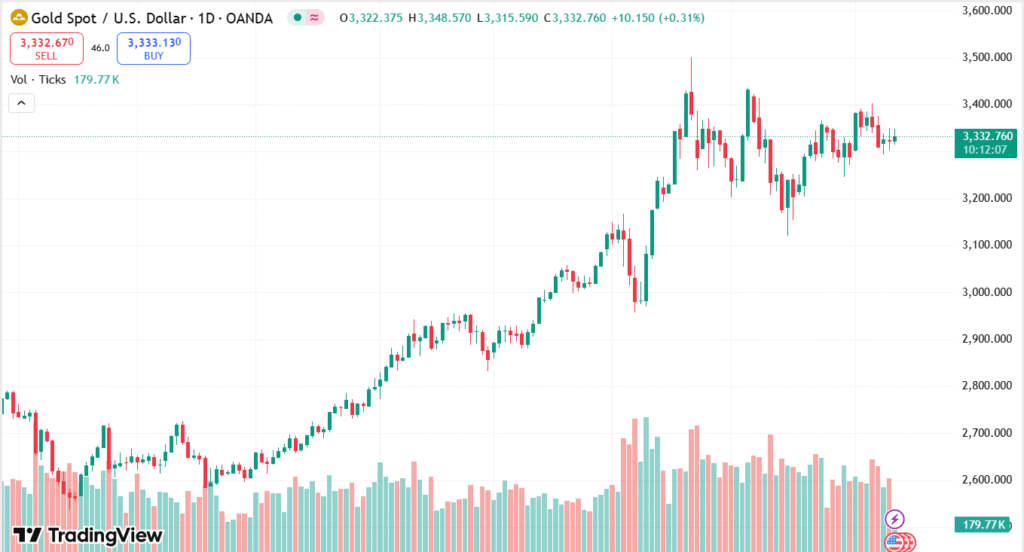

XAU/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Meanwhile, the newly signed US-China trade deal, presented as a “framework” to ease tensions, has not been able to generate robust market optimism. Insufficient tangible specifics and doubts over the long-term sustainability of the deal have kept the market mood cautious. This prevailing uncertainty continues to drive demand for safe-haven instruments such as gold, with investors seeking cover against possible global economic turbulence.

TECHNICAL ANALYSIS

Gold is in a corrective phase after its pullback from the recent high at around $3,400. Price is forming a narrow range, with resistance at $3,345 capping upside attempts. Relative Strength Index (RSI) on the 4-hour chart is drifting around the neutral 50 level, reflecting indecision among traders. Elliott Wave shows a current A-B-C correction, with potential extension up to the $3,375 zone before any fresh selling momentum. Key support levels at $3,290 and $3,245 could attract buyers if approached.

FORECAST

If bullish momentum strengthens, gold may break above current resistance at $3,345. A breakout would potentially clear the way to the $3,375 area, which sits along the reverse trendline and may encourage additional buying interest. Further US Dollar weakness and a softer-than-anticipated US CPI print may serve as the catalyst needed for gold to retest higher prices and move toward last week’s high near $3,400.

On the negative side, inability to breach the $3,345 resistance level can result in fresh selling pressure. A drop below near-term support at $3,290 can leave gold vulnerable to further losses, with the subsequent support area at $3,245, seen by past highs and lows. A higher-than-expected US CPI figure or favorable risk sentiment due to geopolitical events can push gold down as appetite for safe-haven assets fades.