Gold price (XAU/USD) enjoys a modest intraday bullish bias, trading well above the $3,300 level on mixed market directions. Although expectations for impending Federal Reserve interest rate cuts keep the US Dollar in check and provide support to the non-yielding metal, hawkish remarks by Fed Chair Jerome Powell and a generally upbeat risk sentiment cap strong upside strength. Lack of confidence in the sustainability of the Israel-Iran ceasefire introduces a geopolitical risk premium that underlies gold’s safe-haven status. Market participants now look to major US macroeconomic indicators, such as GDP, jobless claims, and the PCE Price Index, which can offer further guidance for the USD and prices of gold.

KEY LOOKOUTS

• At least 50 bps of Fed rate reductions by year-end are being priced in by markets, with attention on whether July will see a move and the testimony by Powell for additional indications.

• Ongoing anxiety regarding the Israel-Iran ceasefire and looming concerns about renewed hostilities are continuing to fuel gold’s safe-haven demand.

• Traders look to Q1 GDP, Durable Goods Orders, Jobless Claims, and the PCE Price Index later this week, potentially altering Fed expectations and affecting USD and gold.

• Strong support at around $3,300 with scope for downside towards $3,245 if broken; upside limited near $3,370–$3,400 unless robust bullish momentum is seen.

Gold price stays firm above the $3,300 level on Wednesday, buoyed by subdued US Dollar sentiment and persisting geopolitical volatility around the Israel-Iran ceasefire. Although the precious metal is buoyed by safe-haven buying and anticipations of rate cuts by the Fed this year, dovish comments from Fed Chair Jerome Powell have cooled bullish enthusiasm. Investors seem guarded before critical US macroeconomic releases, such as GDP numbers and the PCE Price Index, which may determine forthcoming Fed policy and, therefore, affect gold’s short-term direction.

Gold price remains above $3,300 despite conflicting signals from Fed rhetoric and geopolitical tensions. Soft USD and tenuous Israel-Iran ceasefire remain in place to underpin safe-haven demand for the metal. Bulls remain on hold pending crucial US data releases that will determine the direction in Fed policy and gold pricing.

• Markets expect at least 50 bps of rate cuts by end of year, keeping the USD on back foot.

• Additional information from the Fed Chair will provide more clarity to the central bank’s policy direction.

• The major releases such as Q1 GDP, Durable Goods Orders, Jobless Claims, and PCE Index will have an impact on sentiment.

• Any escalation in tensions may push gold demand towards safe-haven.

• Gold’s direction is still very much dependent on USD weakness or strength.

• Keep an eye on price action in the $3,300 support and $3,370–$3,400 resistance areas.

• Short-term gold price direction will be influenced by equity market trends and geopolitical announcements.

Gold price remains in a modestly bullish stance, underpinned by increasing market optimism that the Federal Reserve can start its rate-cutting journey towards the end of this year. Fed Chief Jerome Powell’s comments in recent times presaged a subtle move towards easing policy, yet investors are still eyeing the general economic context, which indicates decelerating inflation and weakening labor markets. This kindles hopes of policy accommodation, which usually helps non-yielding assets such as gold. Uncertainty in global markets also preserves the safe-haven credentials of gold despite overall sentiment remaining cautiously optimistic.

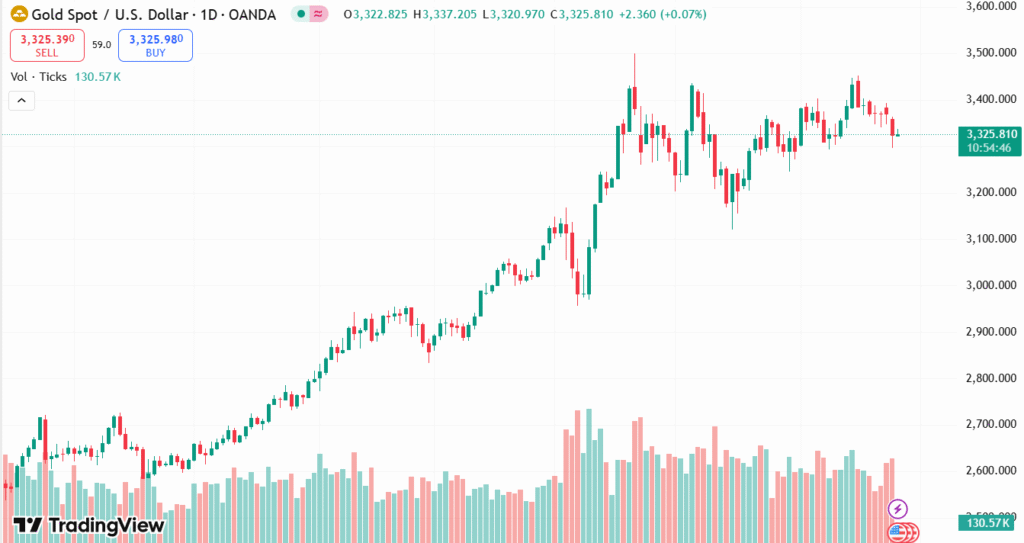

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Geopolitical events also prove instrumental in sustaining support for gold. Although a formal ceasefire has been observed between Israel and Iran, recent cross-border military operations by both nations have thrown its longevity into doubt. The tensions are a promoter of a risk-averse environment, pushing investors to hold on to safe-haven assets. In the meantime, some expectation is building for major US economic data releases this week, which may have implications both for the Federal Reserve’s positioning and subsequent market action. Therefore, gold is still in the spotlight as traders weigh interest rate expectations against continuing geopolitical threats.

TECHNICAL ANALYSIS

Gold price has recently broken below a short-term rising channel, confirming the potential for a change in momentum to the downside. Oscillators on the daily and 4-hourly charts are gaining bearish momentum, reflecting increasing pressure from the bears. The level of major resistance is now close to the $3,368–$3,370 area, which was earlier acting as channel support. Unless bulls overcome this level with strength, any rallies can be met with selling. On the bearish side, a clear break below the $3,300 level can pave the way for fall towards the $3,245–$3,210 support level.

FORECAST

If the geopolitics further deteriorate or if future US macroeconomic indicators continue to support the expectation of a near-term Fed rate cut, gold may regain positive bullish traction. A follow-through above the $3,370 resistance band could trigger new buying interest, prompting the price towards the psychological $3,400 level. Additional strength above this level may set the stage for a test of the $3,420–$3,450 region, particularly if the US Dollar further depreciates.

Conversely, if the ceasefire in Israel-Iran persists and future US economic releases are stronger than anticipated, it might reduce the attractiveness of gold as a safe-haven asset. If the price breaks below the support level of $3,300, it would be a bearish indicator and might result in a fall to $3,245. Sustained selling pressure can continue the decline even lower to the $3,210–$3,200 level, while further losses can be envisaged if the US Dollar gains traction or Fed rate cut expectations are diminished.