Gold prices began the week with a small bearish gap but regained their poise within short order as muted US Dollar demand provided some relief prior to the important Federal Reserve FOMC meeting. Although dip-buying re-emerged around the $3,312–3,311 level, investor trepidation dominated as a result of forthcoming US macroeconomic data releases such as GDP, PCE, and NFP. Hope for US trade agreements with the EU, Japan, and continued negotiations with China fueled risk appetite, capping gold’s upward potential. In contrast, political stress on the Fed and conflicting rate-cut expectations kept the USD under pressure, providing a lightly supportive environment for the safe-haven metal.

KEY LOOKOUTS

• Market attention turns to the Federal Reserve’s interest rate announcement and forward guidance, which will have a substantial influence on USD strength and gold demand.

• Advanced Q2 GDP, PCE Price Index, and Nonfarm Payrolls will be key in determining the near-term movement of both the USD and gold.

• Bullish sentiment from US trade agreements with the EU and Japan, and additional negotiations with China, might persist in keeping a lid on gold’s safe-haven demand.

• Political pressure from President Trump on the Fed, particularly on interest rates, could add volatility and direct investor sentiment to the USD and gold.

Gold prices opened the week tentatively, filling a small bearish gap amidst tepid demand for the US Dollar as investors awaited the Federal Reserve FOMC meeting. Though the weaker dollar supported the non-yielding yellow metal to some extent, overall market enthusiasm fuelled by fresh US trade deals with the EU and Japan capped gold’s safe-haven bid. As with major US economic indicators—GDP, PCE, and NFP—due out later this week, traders are likely to exercise caution until more definitive signals come through regarding the Fed’s monetary policy direction and how it translates into both the dollar and gold.

Gold prices rallied support around $3,312 as the US Dollar weakened before the key FOMC decision. But recent trade optimism and next US economic releases may cap further gains. Investors are cautious, expecting signals on the Fed’s policy shift.

• Gold price filled a small bearish gap, touching support near the $3,312–3,311 area in the Asian session.

• Mild USD demand prior to the FOMC meeting supported dip-buying interest in gold.

• Investors look to important US data releases this week, including GDP, PCE, and Nonfarm Payrolls, that may affect USD and gold prices.

• Recent US trade agreements with the EU and Japan supported risk sentiment, limiting gold’s safe-haven demand.

• The Federal Reserve will likely keep rates unchanged, in spite of political pressure from President Trump for a cut.

• Market attention is on the FOMC decision and Powell’s words, which may influence expectations of future monetary policy.

• Gold’s rally seems limited in the near term, as optimism in trade offsets the effect of a softer dollar.

Gold prices began the new week in a guarded manner, winning modest buy interest as investors waited on the sidelines for the closely watched Federal Reserve FOMC meeting. As the US Dollar retreated from a two-day winning streak, gold attracted some dip-buyers, particularly since markets anticipate direction on future monetary policy. Over all, the market mood remained upbeat, fueled by developments on the trade front recently, including pacts between the US and major partners such as the European Union and Japan. These accords contributed to wider optimism, directing some investors into riskier assets while maintaining interest in conventional safe-havens such as gold in check.

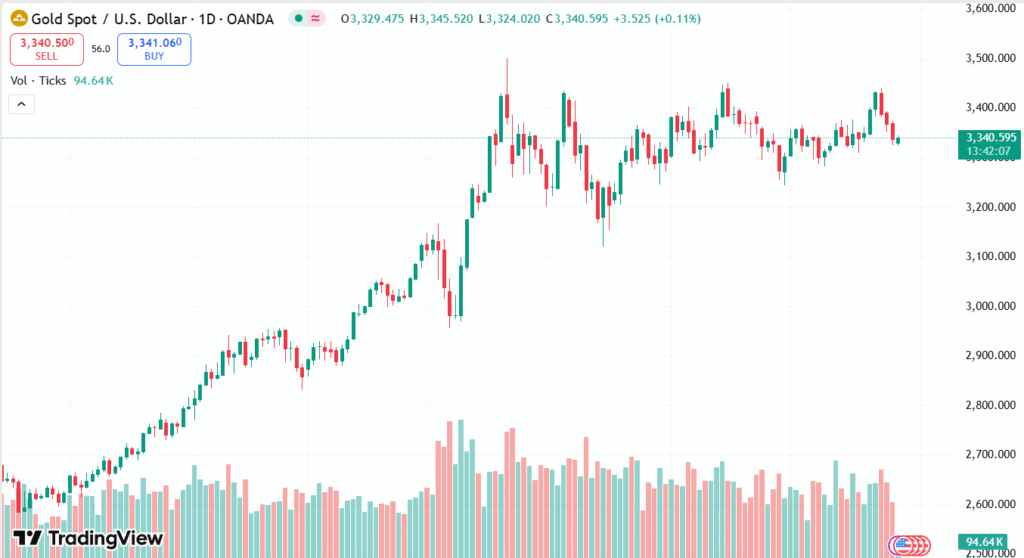

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Meanwhile, focus is shifting to a range of high-impact US economic reports due out this week, such as second-quarter GDP, the PCE Price Index, and Nonfarm Payrolls. These figures are likely to give greater insight into the US economy’s health and may have a significant role to play in determining investor hopes on inflation and direction of policy. In the meantime, political pressure on the Federal Reserve from President Trump’s public calls for rate cuts remains raising questions about the independence of the central bank. This combination of economic and political developments is making it a complicated scene for gold traders, leading to a wait-and-watch scenario without any near-term triggers.

TECHNICAL ANALYSIS

Gold is exhibiting signs of consolidation after closing a small bearish gap, with the price action finding support in the vicinity of the $3,312–3,311 support zone. This zone is drawing dip-buying interest, indicating that buyers are short-term defending this level. But momentum gauges are neutral, indicating investor indecision in advance of important macroeconomic events. A break above the $3,325 resistance level could pave the way for a rebound, while slipping below the $3,311 support area may leave gold vulnerable to further losses. Overall, the technical context remains range-bound until a clear directional catalyst is established.

FORECAST

Gold can witness bullish momentum if the Federal Reserve hints at a dovish policy during the next FOMC meeting, particularly if Chair Jerome Powell indicates future rate reductions or economic imperfections. Moreover, below-estimate US macroeconomic data—like a deceleration in GDP growth, lower inflation through the PCE index, or a poor NFP report—can drag on the US Dollar, further enhancing gold’s attractiveness. Any rise in geopolitical tensions or market volatility could also push investors back to the safe-haven metal, potentially bringing prices above the $3,325 resistance level and opening the way towards higher targets.

Conversely, however, if the Fed retains a more hawkish or neutral tone and rejects the requirement for rate cuts, the US Dollar is likely to regain strength, placing downward pressure on gold. Robust US economic data this week, especially higher-than-expected GDP and jobs data, could further suppress demand for the non-yielding metal. In addition, more optimism about developing global trade, including a possible breakthrough in US-China trade talks, may direct investor attention towards riskier assets, suppressing gold’s safe-haven demand and enhancing the possibility of a pullback towards the $3,300 or even $3,285 support levels.