Gold prices maintain a firm bias for the second day running on the back of safe-haven demand due to rising trade tensions and a weakened US Dollar. Even as risk aversion is heightened by uncertainty about President Trump’s recent tariff policies, divided cues from the Federal Reserve on further rate cuts leave investors hesitant. The release of the FOMC minutes showed limited immediate support for a rate cut, capping gold’s upside despite falling US bond yields. As markets await US jobless claims data and further comments from Fed officials, gold remains range-bound near the $3,320 mark, with key resistance and support levels in focus.

KEY LOOKOUTS

• A key short-term trigger that could influence Fed rate cut expectations and Gold’s direction.

• Any dovish or hawkish language would affect market sentiment surrounding interest rates and the USD.

• Ongoing USD weakness and falling Treasury yields might be bullish for gold prices.

• Reactions to Trump’s fresh tariffs and any retaliation will be a primary driver of safe-haven flows.

Gold prices are holding up near $3,320 as investors grapple with a blend of global trade tensions and ambiguous Fed policy indications. President Trump’s most recent tariff announcements, such as a 50% tariff on copper imports, have further fueled market anxiety, pushing safe-haven flows into gold. The Fed’s meeting minutes meanwhile showed the policymakers were divided in their stance on rate cuts this month, although most policymakers continue to foresee easing later this year. This volatility, complemented by declining US bond yields and a weaker US Dollar, still provides underlying support to the non-yielding metal despite upside being capped by better risk sentiment in the equities.

Gold prices are supported by increasing trade tensions and a weakening US Dollar, trading firmly around $3,320. Yet, dovish Fed signals and firmer equities are capping further gains. US jobless claims and Fed commentary are now awaited for direction.

• Gold trades at $3,320 with a small intraday gain for the second consecutive day.

• Trade tensions rise following Trump’s announcement of new tariffs and warning of no exemptions or extensions.

• Mixed opinions about rate cuts in FOMC minutes, with minimal near-term support but anticipation of easing towards year-end.

• US Dollar again weakens for the second straight day, supporting Gold’s safe-haven status.

• US bond yields fall, following the strong 10-year Treasury auction, underpinning non-yielding assets such as Gold.

• Technical resistance at $3,335 and $3,360; breaking through could take Gold up to the $3,400 level.

• Key data ahead includes US Weekly Jobless Claims and Fed speeches, which could drive short-term market direction.

Gold continues under the spotlight as international financial markets respond to heightened trade tensions and shifting monetary policy expectations. The latest action from US President Donald Trump to introduce new tariffs on various trading partners, including a hefty 50% tariff on copper imports, has created uncertainty among investors. This geopolitical tension has rekindled demand for classic safe-haven assets such as gold, with market players seeking stability in the face of growing policy uncertainty and the possibility of retaliation from impacted countries.

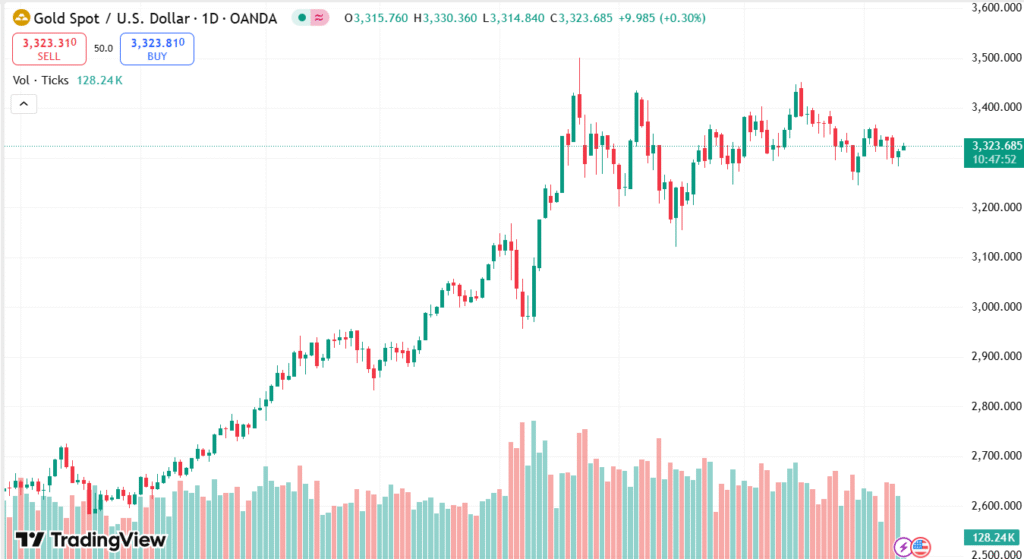

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Concurrently, the Federal Reserve’s most recent meeting minutes reflect intramural discord, as some policymakers are not keen to reduce interest rates in the near future. Nonetheless, there is a general agreement that rate reductions might be necessary later in the year if inflation remains benign and trade tensions suppress economic growth. These themes, together with a deteriorating US Dollar and risk-averse sentiment, continue to provide a bullish environment for gold in the larger market context.

TECHNICAL ANALYSIS

Gold remains at the $3,320 level with a marginal bullish bias. Initial resistance is at the 100-period Simple Moving Average (SMA) on the 4-hour chart around $3,335, followed by a stronger zone of supply between $3,358 and $3,360. A forceful breakout above this area might initiate more bullish pressure, perhaps driving prices towards the $3,400 psychological mark. To the downside, a break below the support at $3,300 might reveal the $3,283–3,282 area, with additional losses risking a descent towards the monthly low at $3,248–3,247. Generally, traders need to look out for a definitive breakout or breakdown from these decisive technical levels for affirmation of the next move.

FORECAST

If geopolitical tension continues to spike and the US Dollar stays pressured, gold prices may witness fresh buying interest. A breakout above the $3,335 resistance level would set the stage for a move towards the $3,358–3,360 supply zone. Sizing through this barrier may initiate a short-covering rally, which has the potential to drive prices towards the $3,400 psychological level in the near future, provided that forward US economic data or Fed rhetoric aids the rate-cutting case.

On the other hand, if the US is not able to negotiate trade deals by the August 1 tariff deadline, worldwide trade tensions could rise aggressively, boosting the safe-haven US Dollar. Also, if near-term UK economic releases are disappointing or worry over rising national debt and geopolitical tensions picks up pace, the GBP could be underpinned. A breakdown below the 1.3500 psychological support level may result in additional declines towards the next major point at 1.3400.