Gold prices (XAU/USD) stayed under the $3,400 level on Friday, cutting intraday losses thanks to profit-taking and a small US Dollar rebound. An overall risk-on tone in international markets constrained safe-haven seeking, but trade tensions, sparked by US President Donald Trump’s newly announced tariff policies, and robust expectations of a September Federal Reserve rate cut softened the downside. Further support was provided by China’s ongoing gold buying for a ninth consecutive month, as weak US labor market indicators supported dovish Fed sentiment. Technical levels are overall bullish biased, albeit short-term gains are resisted, while investors wait for new signals from future FOMC speeches.

KEY LOOKOUTS

• Markets are pricing more than a 90% chance of a September rate cut, with at least two cuts by end-year, underpinning gold price.

• Trump’s new tariffs on Indian imports and scheduled levies on semiconductors and pharma keep safe-haven demand in the limelight.

• Upside capped at $3,422–$3,435, with robust support at $3,350 and the 200-period SMA on the 4-hour chart.

• Ongoing accumulation by China’s central bank for the ninth straight month provides a fundamental tailwind for bullion.

Gold prices remained below the $3,400 level on Friday as profit-taking and a modest US Dollar recovery dented the metal, even as trade tensions and dovish Federal Reserve expectations provided support. Market sentiment favored the day on the back of Asian equity gains, damping safe-haven demand, but Trump’s new tariff moves and China’s nine months of consecutive buying of gold capped the downside. Weak US labor market data further supported expectations for a September rate cut, maintaining the overall outlook as cautiously bullish while technical resistance levels remain to cap near-term gains.

Gold prices remained below $3,400 on Friday as profit-taking negated the positive impacts of trade tensions and expectations for Fed rate cuts. China’s ongoing gold purchases and soft US labor data supported, though robust technical resistance curbed further advances.

• Gold price (XAU/USD) still below $3,400 due to profit-taking and a modest recovery in the US Dollar.

• Risk-on mood from rallying Asian equities diminishes safe-haven demand.

• Trump’s new Indian import tariffs and forthcoming levies on other products maintain trade tensions.

• China’s central bank is buying gold for the ninth consecutive month in July.

• Soft US labor market data supports hopes of a September Fed rate cut.

• Technical resistance at $3,422–$3,435 and robust support at $3,350.

• General bullish tilt remains in place, but investors look for new direction from future FOMC orations.

Gold prices remained firm below the $3,400 mark on Friday as markets weighed profit-taking against continued support from international economic and geopolitical realities. Risk-on sentiment in equities, especially in Asia, relaxed some safe-haven demand, while a slight US Dollar rebound placed mild pressure. But increased trade tensions—fueled by US President Donald Trump’s recent tariff action against Indian imports and impending tariffs on semiconductors and pharmaceuticals—kept investors on guard. Meanwhile, China’s central bank continued its gold shopping binge for the ninth straight month in July, adding to demand for the metal from a strategic reserve viewpoint.

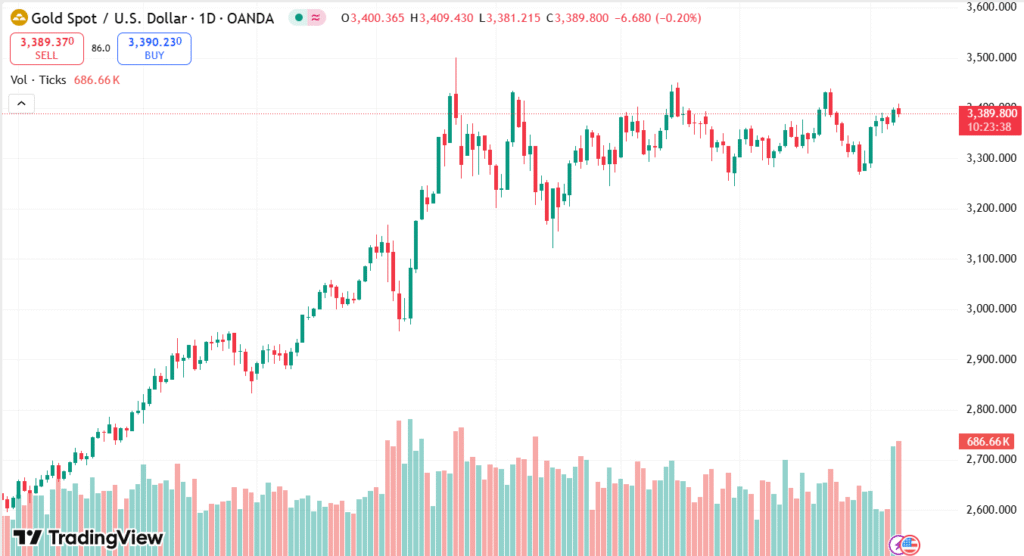

XAUUSD DAILY PRICE CHART

SOURCE: TradingView

On the macro level, soft US labor market data put more credibility to bets that the Federal Reserve will restart its rate-cutting cycle this September as markets are pricing in a high probability of several cuts by the end of the year. The US Jobless Claims report indicated an increase in unemployment applications, indicating a slowing jobs market and building the case for easier monetary policy. At the same time, political events surrounding the leadership of the Fed—like the President Trump’s nomination of Stephen Miran and possible successors to Chair Jerome Powell—provided an added layer of uncertainty for investors. These factors combined still dictate gold’s position as both a hedge against economic uncertainty and an overarching strategic asset for central banks.

TECHNICAL ANALYSIS

Gold’s recent climb through the $3,383–$3,385 zone of supply, combined with upbeat daily chart oscillators, is bearish for now, but short-term upside momentum is held back at around $3,422–$3,423 and the $3,434–$3,435 area. A convincing break above here may send the door ajar toward the $3,500 psychological level last visited in April. On the negative side, the $3,353–$3,350 region—coinciding with the 200-period SMA on the 4-hour chart—is still a critical support level, with a break below opening up $3,315 and $3,300 before revisiting the one-month low of $3,268.

FORECAST

If gold can hold on to its buying momentum beyond the $3,385 support area, the metal may revisit the $3,422–$3,423 resistance zone, with added strength leading towards $3,434–$3,435. A break above this area would most likely prompt bullish investors to head for the $3,500 psychological level, spurred possibly by ongoing Fed rate cut hopes, trade tensions, and central bank buying.

Conversely, a breakdown below the $3,353–$3,350 support—underpinned by the 200-period SMA on the 4-hour chart—may change sentiment in favour of sellers, highlighting $3,315 as the next bearish target. Subsequent weakness below this level may drive prices towards the $3,300 round number and eventually the one-month low at $3,268, if risk appetite firms up and the US Dollar mounts a stronger recovery.