Gold prices are kept in check below the $3,300 level as tame U.S. Dollar firmness puts pressure to the downside before the highly anticipated release of the U.S. PCE Price Index. Despite the dip, downside movement appears limited amid renewed trade tensions, ongoing geopolitical risks, and persistent expectations of Federal Reserve rate cuts later in 2025. A reinstated tariff ruling and uncertainty surrounding global conflict zones have kept investor sentiment cautious, lending support to the safe-haven metal. Though technical indicators imply further downside potential, the majority of traders are in waiting mode for new impetus from U.S. inflation data, which could dictate the Fed’s policy direction.

KEY LOOKOUTS

• Everyone is watching for the next U.S. inflation data release, which has the potential to have a meaningful impact on the Federal Reserve’s rate cut expectations and near-term direction for the USD and gold.

• Russia-Ukraine conflict developments and Middle East ceasefire negotiations still underpin safe-haven demand for gold, offering a potential defense against further losses.

• Re-imposition of Trump’s tariffs and rumors of additional trade actions could inject pressure into the markets and indirectly support gold’s appeal in risk-off conditions.

• Unclear signals from Fed officials regarding the timing and probability of interest rate reductions leave markets in suspense, rendering short-term gold direction dependent on upcoming data and comments.

Investors should pay close attention to the publication of the U.S. PCE Price Index since it has the potential to dramatically alter expectations regarding the Federal Reserve’s interest rate policy and subsequently affect gold prices. Geopolitical tensions, such as the lack of progress in Middle East ceasefire talks and doubts over Russia-Ukraine peace negotiations, continue to provide support to gold’s safe-haven allure. Furthermore, the revival of trade policy uncertainty since the reinstatement of Trump-era tariffs has added additional market volatility, which has made gold a popular hedge. In contrast, conflicting signals from Federal Reserve officials underscore the significance of future economic releases in informing monetary policy, leaving traders nervous and price dynamics in gold very responsive to further developments.

Gold traders are monitoring the next U.S. PCE Price Index closely for hints at the Fed’s rate trajectory. Geopolitical tensions and trade policy uncertainty remain in favor of gold’s safe-haven status, limiting downside even with nascent USD firmness.

• Gold stays under $3,300 due to mild U.S. Dollar strength suppressing demand.

• Markets look to the U.S. PCE Price Index, which may frame rate-cut expectations at the Fed.

• Reinstalled Trump-style tariffs introduce trade uncertainty that favors safe-haven assets such as gold.

• Geopolitical tensions in the Middle East and Eastern Europe keep supporting gold’s demand.

• Fed officials are still divided, sending conflicting signals on upcoming rate action.

• Technical indicators indicate bearish momentum, and there could be downside towards $3,245–$3,200.

• Resistance is at $3,325–$3,350 and the breach above might unleash fresh buying interest.

Gold prices continue to weaken as market participants wait for the U.S. Personal Consumption Expenditures (PCE) Price Index to be released, a core inflation measure that may have implications for the monetary policy of the Federal Reserve. The information is likely to give more guidance on whether the Fed will continue with rate cuts in the second half of the year, a consideration that has made market players conservative. Although the U.S. Dollar has been mildly firmer, prospects of a more dovish Fed position in the months ahead still underpin interest in gold as a non-yielding asset generally.

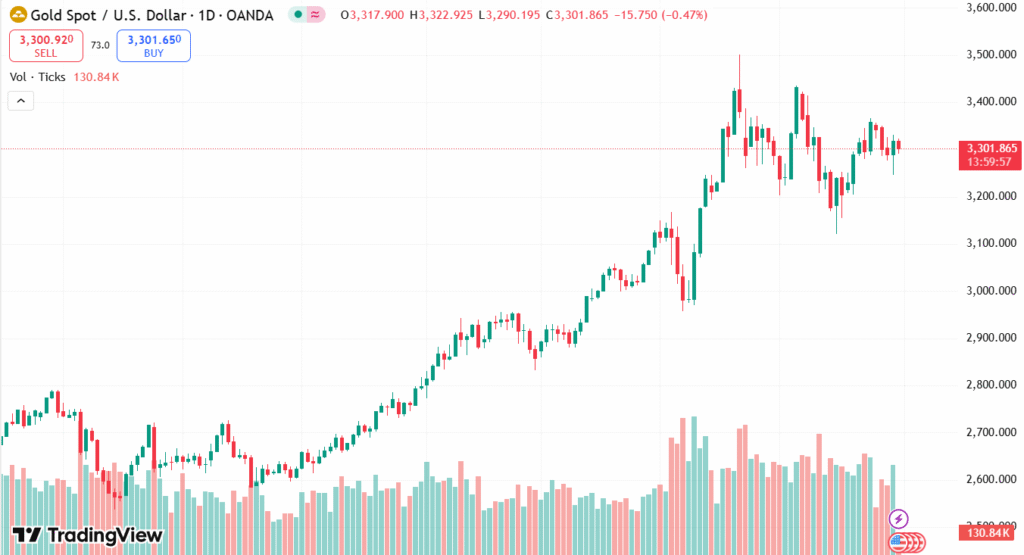

XAU/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Besides economic statistics, growing geopolitical tensions and reviving trade policy anxieties are keeping gold in the spotlight as a safe-haven asset. The latest imposition of tariffs by a U.S. federal appeals court, along with concurrent wars in Eastern Europe and the Middle East, have contributed to worldwide uncertainty. These together with dovish comments by several Federal Reserve officials have been adding to a watch-and-wait mood in the market that has been upholding gold as a hedge against general macroeconomic and political uncertainty.

TECHNICAL ANALYSIS

Gold comes up against near-term resistance in the $3,325–$3,326 area, which has already failed to breach on higher attempts. The inability to break above the $3,300 level indicates no strong bullish strength, and short-term indicators are starting to reflect renewed selling pressure. If the price continues to have trouble below important resistance levels, a downward move to the next support zones could be expected. Yet any such sustained break above the $3,325 ceiling may initiate fresh buying interest and potentially leave the way open for a retest of upper levels.

FORECAST

If the future U.S. PCE figures indicate slowing inflation, this may further support Federal Reserve rate cuts later in the year, weakening the U.S. Dollar and driving gold prices higher. In that case, gold could see fresh buying interest, with room to test levels higher than the $3,300 mark. A continued break past the $3,325–$3,350 resistance level could prompt short-covering and propel prices towards the $3,400 area, buoyed by safe-haven demand as geopolitical and trade tensions continue to hold sway.

Conversely, in the event of PCE data surprise to the upside signifying sticky inflation, it might temper hopes of near-future Fed rate cuts and enhance the U.S. Dollar, putting fresh downward pressure on gold. In such a scenario, prices might fall further, with scope to test support levels at $3,280 and potentially carry losses up to the $3,245–$3,200 region. Further dollar strength or resolve on trade and geopolitical fronts would also diminish the safe-haven demand for gold, contributing to the bearish risk.