Gold prices jumped as softer-than-anticipated US economic reports and rising US-China trade tensions fueled safe-haven buying. The ISM Services PMI flashed a contraction in business activity, while the ADP employment report registered slower private-sector hiring, highlighting a slowing US economy. President Trump’s executive order increasing tariffs for steel and aluminum to 50% added to trade fears in the meantime. While US Treasury yields and the US Dollar weakened, gold strengthened above $3,380 on hopes of possible Federal Reserve easing later this year.

KEY LOOKOUTS

• Monitor coming Initial Jobless Claims and Nonfarm Payroll (NFP) reports, which will further indicate the condition of the US labor market and will impact Federal Reserve policy expectations.

• Keep an eye on continuing trade negotiations and any fresh tariff news or executive orders that have the potential to ratchet tensions up and fuel safe-haven demand for gold.

• Watch for comments from Fed officials and interest rate cut market pricing, as dovish monetary policy almost invariably supports gold prices at higher levels.

• Watch gold’s price action around major resistance levels of $3,400, $3,438, and the all-time high of $3,500 for breakout or reversal signs.

Gold’s recent run-up is a reflection of increasing fears that the US economy is slowing down and escalating geopolitical tensions between the US and China. The publication of softer-than-anticipated economic reports, such as a decline in the ISM Services PMI and less robust private job growth numbers, has cooled US growth expectations. At the same time, President Trump’s move to double the tariffs on steel and aluminum raised the uncertainty around international trade flows, pushing investors to take cover in safe-haven assets such as gold. As US Treasury yields declined and the dollar weakened, gold prices have gathered strength though resistance at the $3,400 level is a significant obstacle to keep an eye on.

Gold prices jumped as signs of slowing US economic activity and US-China trade tensions picked up. Falling economic data and escalating tariffs fueled safe-haven demand, sending gold past $3,380. Attention now turns to coming US employment reports and Fed policy cues.

• Gold prices bounced more than 0.80% in the North American session, hitting more than $3,380.

• Downbeat US economic reports, such as a decline in ISM Services PMI and weaker ADP employment, pointed towards slowing economy.

• President Trump signed an executive order that raised tariffs on steel and aluminum from 25% to 50%, raising US-China trade tensions.

• Declining US Treasury yields and a declining US Dollar fueled gold’s safe-haven demand.

• The US Dollar Index (DXY) fell 0.44% to 98.81, propelling gold higher.

• Speculation about Federal Reserve rate cuts in the latter part of this year has bolstered gold demand.

• The critical technical resistance for gold is at $3,400, $3,438, and the record high of $3,500, while support is around $3,300 and $3,235.

Gold prices have jumped in recent times, fueled by a mix of softer-than-expected US economic indicators and rising trade tensions between the United States and China. The Institute for Supply Management’s report showed a contraction in the services sector for the first time in almost a year, as employment data indicated a deceleration in private hiring. These moves have heightened concerns over the health of the US economy, causing investors to look for safer alternatives like gold. Concurrently, US President Donald Trump’s decision to increase tariffs on steel and aluminum to 50% has added to overall uncertainty surrounding global trade relations, further fueling the metal as a hedge against geopolitical uncertainties.

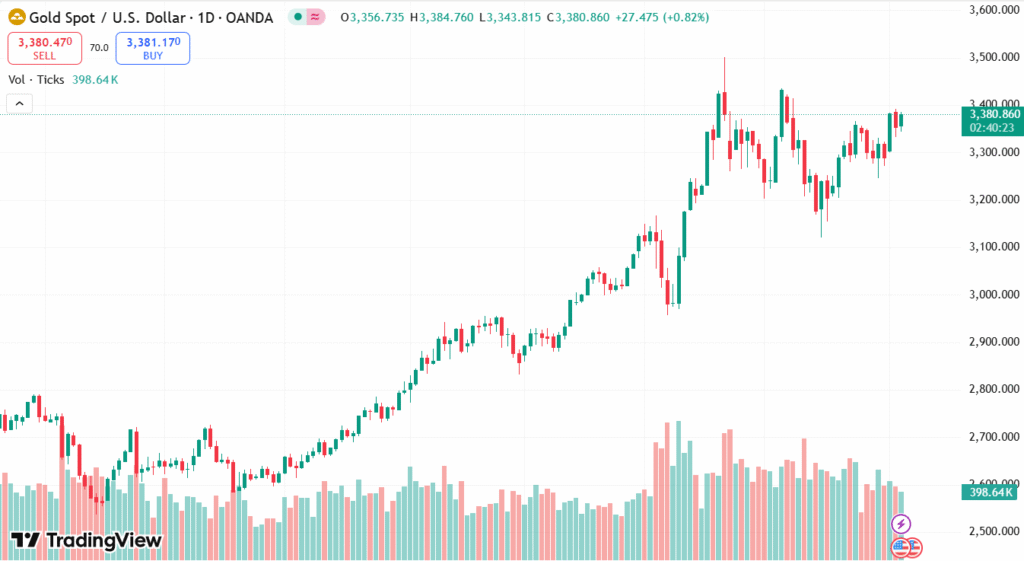

XAU/USD DAILY PRICE CHART

CHART SOURCE: TradingView

The current trade war and indicators of cooling in the economy have also weighed on Federal Reserve policy expectations. Market participants are increasingly expecting the Fed to ease monetary policy toward the end of this year to stimulate growth, particularly with the effect of tariffs on inflation uncertain. This expectation, coupled with a weakening US Dollar and declining Treasury yields, has provided a good climate for prices for gold. While traders look forward to the release of future US jobs data and trade talks, gold is still an asset worth monitoring in the face of the changing economic environment.

TECHNICAL ANALYSIS

Gold is in a positive trend but is facing resistance at the $3,400 zone, where it has not been able to break decisively of late. The Relative Strength Index (RSI) is showing high buying momentum, which implies that the buyers are still dominant. If gold does break above $3,400, it may set the stage for testing upper resistance points at $3,438 and all-time highs near $3,500. Alternatively, a move below the $3,300 support could prompt a correction, taking prices to the 50-day Simple Moving Average around $3,235 or lower to support at $3,167.

FORECAST

If gold prices manage to overcome the $3,400 resistance level, then the rally may develop strong momentum, driving the metal towards strategic targets of $3,438 and even test the all-time high around $3,500. More deterioration in US economic indicators, combined with sustained trade tensions and hopes for Federal Reserve easing, would most probably fuel further gains in gold. Safe-haven demand among investors can rise, particularly in case geopolitical tensions escalate or inflation worries mount.

On the flip side, if gold cannot hold ground at the $3,400 level and breaks the $3,300 support level, a bearish phase can materialize. This can bring about a fall to the 50-day Simple Moving Average at about $3,235 and further to the support around $3,167. Such a pullback can be caused by a stronger US Dollar, favorable trade relations, or more positive than expected US economic data that reduce safe-haven demand. Traders need to monitor these levels for a reversal or consolidation.