Gold remained steady around $3,350 on Tuesday after yesterday’s steep fall, as investors waited for the July US CPI figures to get new leads on the Federal Reserve’s policy outlook. Market sentiment was positive following US President Donald Trump’s declaration exempting Gold imports from new levies, together with hopes of Russia-Ukraine peace negotiations and an extension of the US-China tariff moratorium. Although geopolitical and trade dynamics gave some respite, investors remained on guard, with the next inflation data due soon to be the catalyst for Gold’s next direction.

KEY LOOKOUTS

• July inflation report should reveal headline CPI at 0.2% MoM and 2.8% YoY, with core CPI expected to increase 0.3% MoM.

• Trump’s revelation exempting Gold imports from new tariffs relieved supply chain fears but markets are holding out for an official executive order.

• Hopes for Russia-Ukraine peace negotiations and a 90-day US-China tariff truce extension have soothed near-term market nerves.

• Gold continues below important resistance at $3,400 with bears risks to $3,320 and $3,250 unless CPI data triggers a bounce.

Gold prices recovered around $3,350 on Tuesday after Monday’s steep 1.6% decline to a one-week low as markets waited for the release of the US Consumer Price Index (CPI) data for July. The valuable metal gained modest support from a weaker US Dollar and stable Treasury yields, as well as relief at US President Donald Trump’s announcement that Gold imports would be excluded from new tariffs. Hopes of possible Russia-Ukraine peace talks and the extension of the US-China tariff truce have alleviated near-term geopolitical and trade tensions. But with Gold still below the crucial $3,400 resistance level and technical indicators pointing to declining momentum, the next inflation report may be the ultimate catalyst for near-term price direction.

Gold is trading at near $3,350 as market players wait for crucial US CPI data for new policy signals. Tariff relief on Gold imports and reduced geopolitical tensions provide comfort, but prices continue to be capped below $3,400 resistance.

• Gold stabilizes around $3,350 after Monday’s 1.6% loss to a one-week low.

• Traders look to July US CPI figures, due to demonstrate headline inflation at 2.8% YoY.

• Trump declares Gold imports to be exempt from new US tariffs, alleviating supply fears.

• Hopes for Russia-Ukraine peace talks and a 90-day US-China tariff truce extension improve mood.

• US Dollar and Treasury yields are still subdued ahead of inflation data.

• Technical charts indicate resistance at $3,400, with downside objectives at $3,320 and $3,250.

• Weaker CPI might favor Gold prices, while hotter inflation might support the US Dollar and weigh on bullion.

Gold prices traded around $3,350 on Tuesday as investors remained on their guard before the release of the US Consumer Price Index (CPI) for July, a key event likely to shape the next policy action by the Federal Reserve. The market gleaned some respite after US President Donald Trump announced Gold imports would be exempt from fresh US tariffs, easing fears over near-term supply chain disruptions. Optimism regarding potential Russia-Ukraine peace talks and the 90-day extension of the US-China tariff truce also eased market tensions, although investors continue to look for near-term economic data for clearer direction.

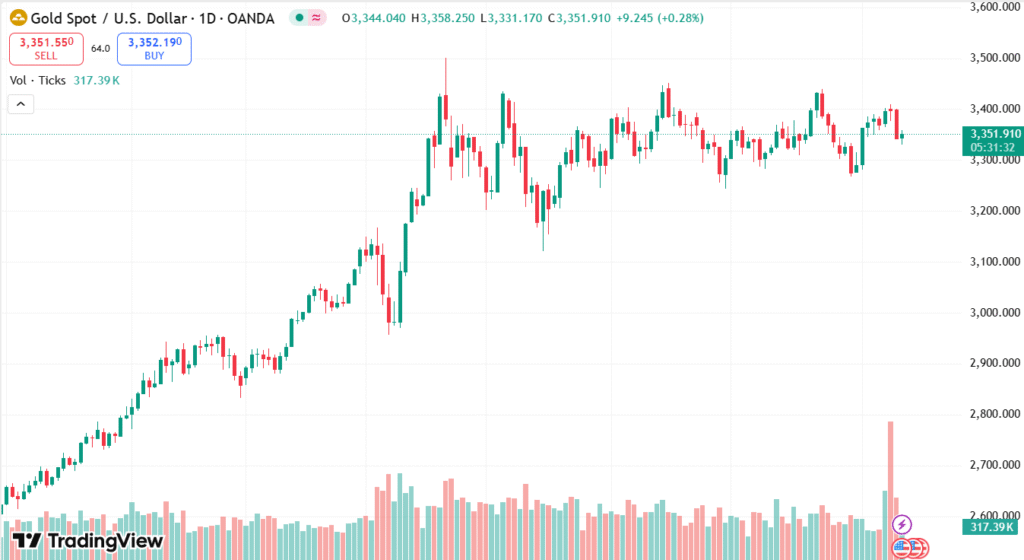

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

July CPI is seen to report headline inflation increasing 0.2% MoM, with the year-over-year rate rising to 2.8%. Core CPI, stripping out food and energy, is seen increasing 0.3% MoM and 3% YoY, reflecting continued underlying pressures. These are watched closely for evidence that tariffs are being passed through into inflation and for their likely influence on the Fed’s September interest rate decision. Further focus will shift to comments from Fed officials later in the day, as well as future economic releases such as the Producer Price Index (PPI) and Retail Sales that may continue to influence market forecasts.

TECHNICAL ANALYSIS

Gold continues to struggle beneath the crucial $3,400 psychological level, with repeated failure to push higher maintaining it as a firm resistance area. On the 4-hourly chart, the prices are below both the 21-period SMA at $3,377 and the 50-period SMA at $3,363, showing diminishing bullish momentum. Relative Strength Index (RSI) is around 37, reflecting increasing downside momentum short of oversold levels, while the MACD remains in negative levels with a bearish crossover, reinforcing seller supremacy. There is immediate resistance at $3,363 and $3,377, with support at $3,330–$3,320, a break below which could reveal the $3,250 range floor.

FORECAST

If the US CPI report later this week is softer than forecasted, it may cement market views of a September interest rate reduction, weakening the US Dollar and enhancing the demand for Gold. A dovish turn in Fed commentary, combined with geopolitical and trade calm, may give Gold the push to retest the $3,377–$3,400 resistance range. A clear break above $3,400 would pave the way for a move to $3,450, with still higher gains on offer should safe-haven demand pick up.

On the other hand, a hotter-than-anticipated CPI print would curb rate cut hopes, advance the US Dollar, and bear heavily on Gold prices. A breakdown below the $3,330–$3,320 support level may initiate a more severe correction to the floor of the $3,250 range. An extended violation of this level might intensify selling pressure, which could bring the $3,000 level back into play if risk appetite turns against safe-haven assets.