Gold (XAU/USD) climbed to new all-time highs over $3,600 per ounce on safe-haven buying panic and growing speculation of a Federal Reserve rate cut later this month. Soft US labor market numbers, topped by a big miss in Nonfarm Payrolls and an increase in unemployment, confirmed expectations of a 25 bps cut, with some speculators even looking at a bigger move. A declining US Dollar, declining Treasury yields, and international geopolitical and political doubts continued to fuel the rally, maintaining Gold’s bullish momentum as the markets now anticipate the next US PPI and CPI releases for confirmation of the Fed’s next policy action.

KEY LOOKOUTS

• Markets price in a full 25 bps September Fed cut, with mounting speculation of a bigger 50 bps move.

• This week’s PPI and CPI releases will be important in building expectations for the policy inclination of the Fed.

• Geopolitical tensions, Japanese and French political unrest, and trade risks across the globe continue to enhance the attraction of Gold.

• Support at the moment is close to $3,550–$3,500, while targets on the upside extend towards $3,650 and $3,700.

Gold extends record-breaking surge, trading above $3,630 as safe-haven buying and strong Federal Reserve rate cut expectations keep the trend in motion. Poor US labor market statistics, such as a big miss in Nonfarm Payrolls and increasing unemployment, added to the expectation of a September rate cut, and declining Treasury yields and a softer US Dollar provided additional support. Geopolitical concerns and political uncertainties in France and Japan have strengthened the safe-haven strength of Gold, with buyers firmly in command as the market looks at major US inflation data later this week to see if the Fed chooses to make a standard 25 bps cut or weigh a bigger move.

Gold jumps to new record highs near $3,630 on rising safe-haven demand and bets on Fed interest rate cuts, fueled by weak US labor, a weaker Dollar, and declining Treasury yields. Traders look to near-term PPI and CPI reports for policy direction.

• Gold rises further above $3,630, posting new record highs.

• Markets price almost a sure 25 bps September rate reduction with only a 10% chance of 50 bps.

• August NFP created only 22K jobs versus 75K anticipated; unemployment level rose to 4.3%.

• PPI on Wednesday and CPI on Thursday are more important for determining Fed’s move.

• Benchmark 10-year yield falls closer to 4.05%, favoring Gold’s bullish side.

• Political instability in Japan and France together with trade risks perk up safe-haven demand.

• Firm support at $3,550–$3,500 with upside targets at $3,650 and $3,700.

Gold has risen to new all-time highs above $3,600 per ounce as a mix of safe-haven buying and increasing optimism that the Federal Reserve will lower interest rates in September pushed the yellow metal to the highest level ever. The rally took hold after softer-than-anticipated US jobs numbers revealed a mere 22,000 jobs created in August, with the unemployment rate reaching its worst level since 2021. This supported expectations of a rate cut, which markets now perceive as nearly certain, as policymakers turn their attention to stabilizing the labor market and boosting growth. A weaker US Dollar and falling Treasury yields have added to the metal’s attractiveness, making Gold one of the year’s best-performing assets.

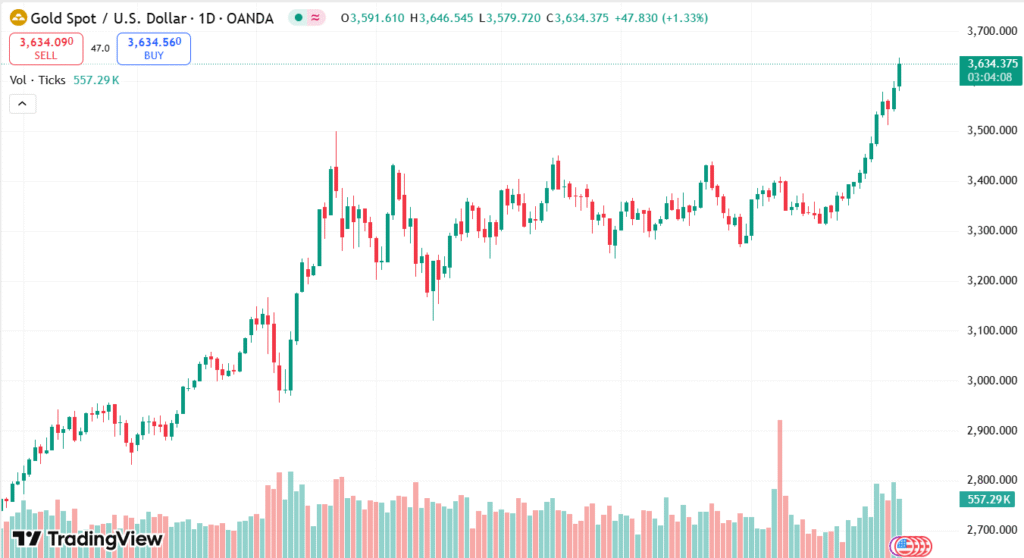

XAU/USD DAILY CHART PRICE

SOURCE: TradingView

Aside from economic releases, outside factors are also driving investor appetite for Gold. Central banks globally are still diversifying their reserves out of the US Dollar, and geopolitical risks and political instability in nations such as Japan and France are strengthening the demand for safe-haven assets. Trade policy risk in the United States provides investors with an additional note of caution, as they are increasingly looking toward Gold as a store of value. With inflation readings coming out later this week, attention now turns to how these points will influence the Federal Reserve’s next move, keeping Gold in the forefront as investors look for stability in times of uncertainty.

TECHNICAL ANALYSIS

Gold is solidly bullish as it trades way above its short- and medium-term moving averages, indicating high underlying momentum. The breach of the $3,500 consolidation range has laid the way to higher grounds, and the initial upside targets are at $3,650 and $3,700. The Relative Strength Index (RSI) remains in overbought levels, which implies the threat of near-term pullbacks, but the trend continues as long as prices stay above the support zone of $3,550–$3,500. The Average Directional Index (ADX) greater than 30 also indicates the strength of the current rally, where the buyers are in command.

FORECAST

Gold’s momentum continues strong as investors price in nearly certain Fed rate cut in September, and growing speculation on a bigger 50 bps move if inflation data remains weak. Weak US Dollar, declining Treasury yields, and continued geopolitical tensions offer further support, with the bias still upward. If safe-haven demand continues, Gold may test new psychological levels at $3,650 and perhaps $3,700 in the coming term.

Despite the dominant bullish trend, threats of a corrective pullback persist as technical measures signal overbought readings. Any better-than-anticipated US PPI or CPI reading this week could reduce expectations of Fed rate cuts, triggering profit-taking in Gold. Supportively, $3,550 is instant support, and a deeper retracement to $3,500 is possible if market sentiment changes.