Gold (XAU/USD) slid on Thursday after a hawkish FOMC minutes tone bolstered the US Dollar, while peace hopes for Russia and Ukraine further bruised safe-haven demand. The officials’ concerns over inflation and diminished chances of sharp rate cuts in September kept the USD firm. Geopolitical events, such as comments by Russian and US officials, in addition to market expectations surrounding near-term global PMIs and Fed Chair Jerome Powell’s Jackson Hole address, will likely drive the short-term trend of the yellow metal. On a technical basis, Gold has support at $3,312 and resistance at $3,352, so a conservative trading range is in the offing.

KEY LOOKOUTS

• Investors will look to the Federal Reserve’s rate-cut trajectory and policy direction, which may influence short-term Gold action.

• Flash Purchasing Managers’ Index reports might shape risk sentiment and influence safe-haven Gold demand.

• Hawkish FOMC minutes are making the USD stronger, which usually puts pressure on non-yielding Gold.

• Developments in Russia-Ukraine peace talks and statements from world leaders might influence Gold’s safe-haven appeal.

Gold remained under pressure on Thursday, weighed down by a strong US Dollar after hawkish FOMC minutes and optimism on the resolution of the Russia-Ukraine war. The minutes emphasized inflation fears, downscaling expectations for aggressive rate cuts in September and lending support to the Greenback. Traders are now looking forward to soon-to-be-released flash global PMIs and Fed Chairman Jerome Powell’s address at the Jackson Hole Symposium for further guidance. Technically, Gold sees near-term support at $3,312 and resistance at $3,352, suggesting cautious trading range as investors consider economic and geopolitical signals.

USD/CHF inches up to 0.8050 with the US Dollar finding refuge in the Fed’s cautious stance on inflation. Investors keep an eye on Powell’s Jackson Hole address, Swiss Trade Balance data, and US PMIs for fresh direction in markets.

• Gold drifts lower on a stronger US Dollar propped up by dovish FOMC minutes.

• July FOMC meeting minutes emphasized inflation pressures and decreased the risk of aggressive September rate cuts.

• Hopes for a possible Russia-Ukraine peace agreement are curbing demand for the safe-haven metal.

• Market participants are waiting closely for upcoming flash global PMIs that will reflect the health of the economy and sentiment towards risk.

• Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium continues to be a key market driver.

• Technical support for Gold is around $3,312, whereas resistance is around $3,352 and $3,375.

• A break below $3,300 would trigger additional technical selling, whereas strength above $3,352 might produce a short-covering rally towards $3,400.

Gold came under fresh pressure on Thursday as the combination of a stronger US Dollar and geopolitical optimism depressed the safe-haven metal. The hawkish tone in the July FOMC minutes, highlighting fears of inflation, cooled the expectations for forceful interest rate cuts in September. Meanwhile, optimism over a possible end to the Russia-Ukraine conflict also lowered demand for Gold, which usually gains from geopolitical tensions.

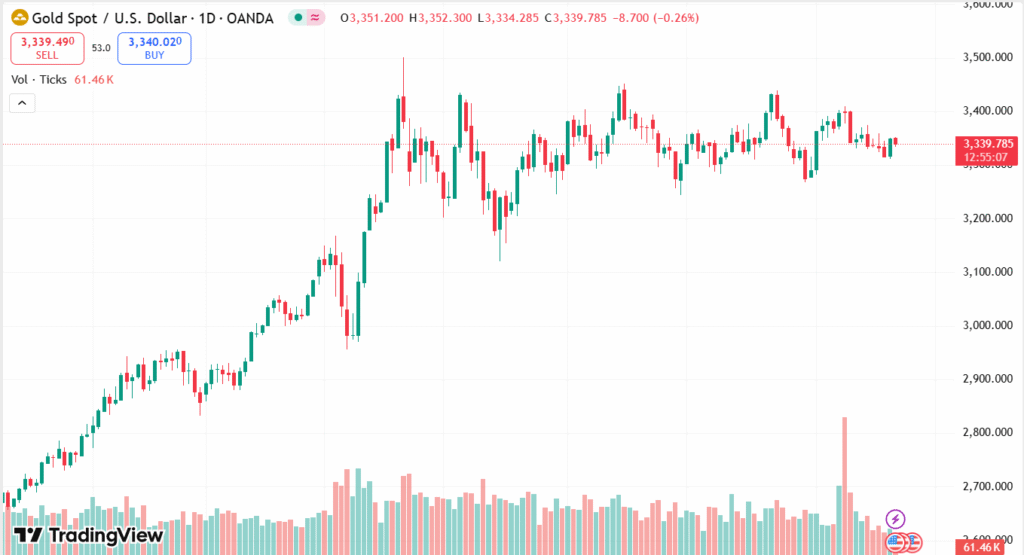

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Market participants are currently looking ahead to forthcoming economic indicators, such as flash global PMIs, and also to Fed Chair Jerome Powell’s address at the Jackson Hole Symposium. Investors will be searching for indications on the direction of central bank policy and overall economic environment, which could shape risk sentiment and commodity flows. In the meantime, political events, like US President Trump’s verbal attacks on Fed officials, contribute to an additional layer of uncertainty in the market climate.

TECHNICAL ANALYSIS

Gold (XAU/USD) is trading at near major support and resistance levels, thus reflecting a conservative market attitude. Short-term support is seen in the vicinity of the $3,312 area, which previously served as a pivot point and assisted in capping downside endeavors. On the positive side, resistance at $3,352–$3,375 represents near-term obstacles that may precipitate a bounce if broken. A continued breakdown below support might pave the way to $3,300 and the lower edge of the range around $3,270–$3,265, while a firm breakout above resistance might lay the ground for additional upside momentum to $3,400 and higher.

FORECAST

If Gold can hold on to the buying momentum over the near resistance of $3,352, short-covering and fresh buying interest may propel prices towards $3,375 and even breach the $3,400 level. A break above these levels might set up the stage for extended advances to the top edge of the multi-month trading range around $3,434–$3,435, which will be a very bullish phase in XAU/USD.

On the negative, a move below the crucial support of $3,312 may provoke technical selling, driving Gold to $3,300. If this resistance level is not maintained, the following key support is close to $3,270–$3,265, which is the lower end of the three-month range. A breakdown there can signal further near-term weakness, adding more pressure to the yellow metal.