Gold (XAU/USD) continues to come under pressure for the second day in a row, down due to a climbing US Dollar and higher Treasury yields before Federal Reserve Chair Jerome Powell’s highly awaited speech at the Jackson Hole Symposium. The gold bullion is floating in the vicinity of $3,325, still within its tight $3,320–$3,350 trading range, while investors wait for policy signals from Powell’s last Jackson Hole speech before his term expires in 2026. With Fed officials adopting a generally cautious and hawkish stance, markets have trimmed hopes of a September rate reduction, keeping bullion underpinned despite persistent geopolitical tensions surrounding Russia-Ukraine that still underpin safe-haven demand.

KEY LOOKOUTS

• Markets look for cues on the Fed’s stance, with investors interested in assessing if Powell supports a data-dependent strategy or suggests easing.

• Strong dollar and steep yields are the largest headwinds for Gold, limiting its upside potential.

• Markets have reduced the probability of a September rate cut to about 70%, from near-certainty last week, making coming labor and inflation reports pivotal.

• Russia-Ukraine uncertainty keeps on offering safe-haven support, capping deeper losses in Gold irrespective of bearish pressure.

Gold prices are lower for a second consecutive session as a firmer US Dollar and higher Treasury yields sour the mood ahead of Federal Reserve Chair Jerome Powell’s keynote address at the Jackson Hole Symposium. The valuable metal is stuck in the $3,320–$3,350 bandwidth, with investors holding back ahead of Powell’s comments, as they might alter expectations around future monetary policy action. The Fed is not likely to provide a September rate cut signal, but the market continues to be responsive to inflation and employment data, which will determine the next move from the central bank. Meanwhile, geopolitical risks associated with Russia-Ukraine tensions also continue to provide some safe-haven support, thus avoiding a steeper fall in bullion prices.

Gold remains under pressure at $3,325 as a strong US Dollar and higher Treasury yields dictate in anticipation of Powell’s Jackson Hole speech. Markets look for policy signals from his words, while geopolitical risks provide some safe-haven support to bullion.

• Gold (XAU/USD) is trading at around $3,325, down for a second consecutive day.

• Bullion continues to be the main headwinds with strong US Dollar and higher Treasury yields.

• Investors are looking forward to Fed Chair Jerome Powell speaking at Jackson Hole, his final appearance before his 2026 term expires.

• The markets now assign a 70% probability to a 25 bps rate decrease in September from almost certainty last week.

• Recent hawkish comments by Fed officials have cooled expectations of aggressive easing.

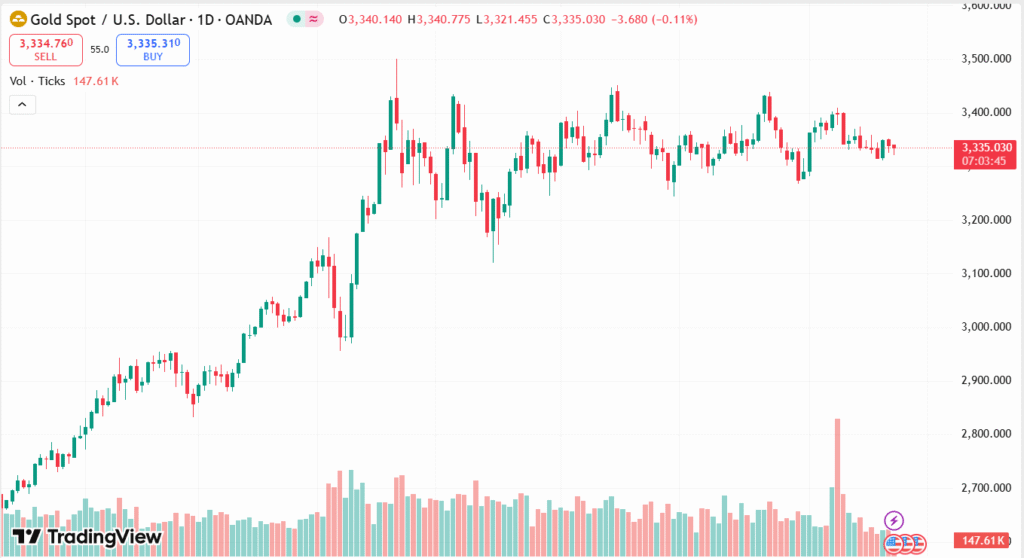

• Technical charts indicate Gold trading above crucial support at $3,330, with resistance set at $3,350.

• Geopolitical tensions surrounding Russia-Ukraine negotiations continue to support safe-haven demand.

Gold is muted as investors await Federal Reserve Chair Jerome Powell’s highly expected speech at the Jackson Hole Symposium. His words are likely to influence market mood on the Fed’s policy course, particularly in the face of conflicting economic messages in the US. While consumer spending is holding up, the labor market is slowing and inflation remains above target. Powell is expected to reassure markets by highlighting the Fed’s data-dependent approach over rushing to make changes right now, a diplomatic stance that has kept markets nervous.

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Outside of the Fed, the larger geopolitical tensions backdrop remains shaping market mood. Continuing uncertainty on Russia-Ukraine peace discussions and the US move to take a step back from direct mediation remind of persistent threats that keep safe-haven Gold demand in check. With political pressure mounting on the Fed and global risks yet to be solved, investors remain on edge, looking for direction from policymakers while holding exposure to safe assets such as bullion.

TECHNICAL ANALYSIS

Gold is probing a critical support area around $3,330 that also represents the upper edge of a downtrend channel on the 4-hour chart. The Relative Strength Index (RSI) sits at around 44, just below the neutral 50 level, indicating waning momentum and a modestly bearish inclination. The MACD continues to trade below the zero line as well as the signal line, further supporting a lack of bullish enthusiasm. A decisive fall below $3,330 would provide a route for the downtrend to continue towards $3,310 and $3,300, whereas a bounce above $3,350 on the back of the 100-period SMA would make the argument for the bounce back towards $3,370 and possibly $3,400 more appealing.

FORECAST

If Gold can hold above the $3,330 support and gain traction, a bounce back to the $3,350 resistance level is imminent. A consistent push higher, supported by positive signals from Powell’s address or new geopolitical risks, could set the stage for testing $3,370 again. If the buying pressure intensifies, the next target on the upside would be in the vicinity of $3,400, providing the bulls with a stronger technical grip to rise further.

On the other hand, a decisive fall through the $3,330 level will leave the metal vulnerable to further losses, with immediate support at $3,310 and then at $3,300. A continued fall below these levels would increase bear pressure, which could lead to a change in market sentiment and open the way for a larger retracement. Under such circumstances, Gold’s safe-haven demand could come under pressure unless fresh support comes from renewed geopolitical tensions or softer US data.