Japanese Yen remained unchanged against the US Dollar on Tuesday, while hawkish indications from the Bank of Japan and a higher revision in Japan’s Services PMI offered foundational support for the currency. Nevertheless, political uncertainties within Japan and a generally optimistic market mood muted safe-haven demand for the Yen. In the meantime, the US Dollar struggled to push gains as expectations of a September Fed rate cut increased, particularly after softer US job data and political pressure on the Federal Reserve. The USD/JPY pair floated above the 147.00 level, with investors looking to the upcoming US ISM Services PMI and FOMC comments for new direction.

KEY LOOKOUTS

• June BoJ meeting minutes reiterated the potential for a year-end rate hike, keeping the JPY bears on their toes.

• More than 80% chance of a September Fed rate cut continues to pressure the US Dollar.

• The recent election defeat of the ruling party has raised some concerns about fiscal policy, potentially hampering BoJ tightening.

• The attention of the market now turns to the US ISM Services PMI and comments from Federal Reserve officials for short-term USD/JPY direction.

The Japanese Yen continued to trade range-bound versus the US Dollar on Tuesday, as market participants weighed hawkish cues from the Bank of Japan with increasing bets on a September rate cut by the Federal Reserve. Though optimistic domestic data and BoJ’s renewed pledge to policy tightening provided support to the Yen, fears about Japan’s political situation and rising global risk appetite capped its upside. Conversely, the US Dollar received modest support from bond yields but failed to achieve significant traction with softer labor market data as well as political meddling with Fed policy. The market now waits for US ISM Services PMI and FOMC commentary for additional clarity regarding the USD/JPY direction.

Japanese Yen remains flat in response to BoJ’s hawkish stance and better domestic data. But political instability in Japan and anticipation of a Fed rate cut limit large USD/JPY movements. Markets wait for US ISM Services PMI and Fed commentary for short-term direction.

• June Bank of Japan meeting minutes reinforced the probability of a rate increase in case inflation and growth conform to expectations.

• July Services PMI for Japan was 53.6, the highest growth since February.

• The election loss of the ruling party impacts the fiscal stability, which may slow BoJ’s tightening trajectory.

• Political pressure on the Fed and weak US job statistics drive the rate cut expectation in September.

• The currency pair is unchanged on mild USD buying and positive sentiment in the market.

• Improved equities in Asia lower the demand for the Yen as a safe-haven currency.

• The US ISM Services PMI and FOMC member remarks are the key to short-run USD/JPY action.

The Japanese Yen was unchanged against the US Dollar on Tuesday as investors balanced conflicting economic and political indications from Japan and the US. Bank of Japan meeting minutes in June confirmed year-end rate hike expectations, particularly with Japan’s Services PMI experiencing its fastest growth in months. These events gave some respite to the Yen. Political uncertainty due to the poor performance of the ruling party in recent election results has questioned the fiscal future of the country as well as the policy direction of the BoJ, keeping sharp bullish momentum for the Yen in check.

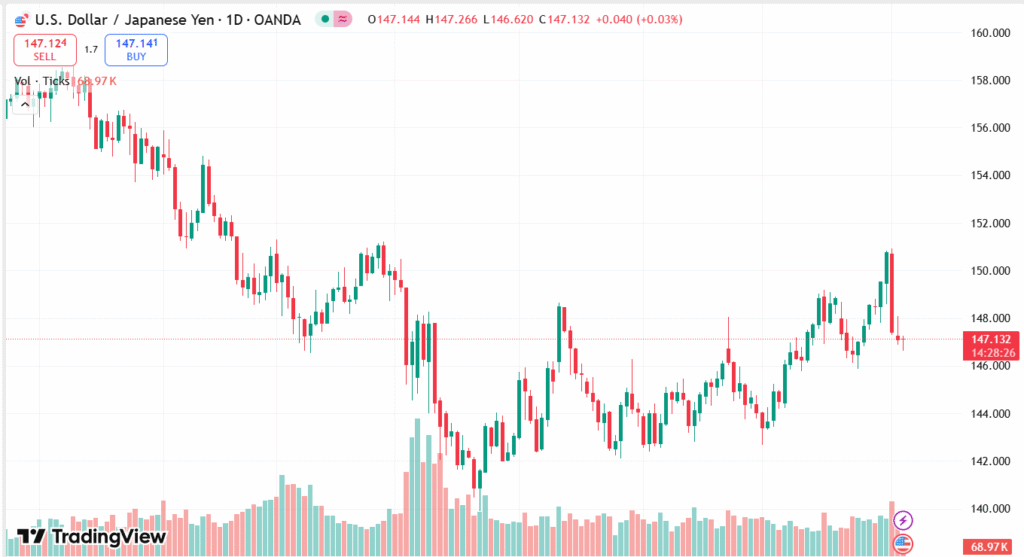

USD/JPY DAILY PRICE CHART

SOURCE: TradingView

At the same time, the US Dollar received faint support from a generally positive risk mood and optimistic market sentiment, but is increasingly coming under pressure as a result of rising bets for the Federal Reserve to cut interest rates in September. Recent US employment data, coupled with political actions targeting the Fed’s autonomy, have contributed to such expectations. Traders are cautious ahead of some significant US data releases, such as the ISM Services PMI, as well as future speeches from Federal Reserve officials, which would influence near-term market mood and set direction for the USD/JPY cross.

TECHNICAL ANALYSIS

USD/JPY cross has demonstrated strength above the 50% Fibonacci retracement level of the July rally, maintaining support above the 147.00 level. Closest resistance is around the 147.35 level, then the 147.75 area and the 148.00 psychological level, which also happens to be the 38.2% retracement level. A break and hold above this area has the potential to solidify a near-term low and continue to support the bullish thesis. To the detriment, there’s initial support at 146.85, and a break below 146.60 on a decisive note could gain further downwards momentum to 146.00 and even to the 145.85 area, which is the 61.8% Fibonacci mark. Neutrality of oscillators on the daily chart advises caution, with no robust momentum either way currently.

FORECAST

If the USD/JPY currency pair can remain above the 147.00 level and break through the near-term resistance at 147.35, it would set the stage for additional advancement. A continued break above the 147.75 area and the 148.00 psychological level would signal fresh bullish energy, and prices might head to 148.50 or even beyond. This bullish scenario would be sustained by any hawkish surprise comments by Fed officials or better-than-anticipated US economic data, which will temporarily counter the overall rate cut expectations.

On the negative side, inability to stay above 146.85 will leave the pair vulnerable to further selling pressure. A breakdown below the 146.60 support could provokes a steeper decline to the 146.00 area, and then to the 145.85 level, which is the 61.8% Fibonacci retracement of the prior rally. This bearish scenario may unfold if future US data slows or if political realities in the US further erode confidence in the Fed’s independence, reinforcing expectations of rate cuts.