The Japanese Yen hardens versus the US Dollar as positive domestic data and policy divergence with the Federal Reserve underpin its attractiveness. Japan’s real wages became positive for the first time in seven months, while household spending also indicated an increase, supporting prospects of further normalization in Bank of Japan policy direction. Meanwhile, market speculations about upcoming Fed rate reductions continue to bear down on the USD, pinning down USD/JPY around the 148.00 level. Trade sentiment, in the wake of the US reducing tariffs on Japanese auto imports, also weighs in favor of the Yen, and traders now look to the US Nonfarm Payrolls report for better guidance.

KEY LOOKOUTS

• Strong wage growth and steady inflation above target fuel expectations of an imminent BoJ rate hike.

• Markets widely anticipate at least two Fed rate cuts this year, weighing on the USD.

• USD/JPY struggles near the 148.00 mark, with 147.40–146.70 seen as key supports and 148.75–149.20 as resistance zones.

• The upcoming Nonfarm Payrolls report will be crucial in shaping Fed policy expectations and near-term USD/JPY direction.

Japanese Yen remains strong against the US Dollar, buoyed by positive domestic news and policy divergence from the Federal Reserve. Japan’s real wages increased for the first time in seven months, accompanied by increased household expenditure, supporting hopes that the Bank of Japan will continue down its policy normalization process. In comparison, the USD continues to come under pressure as markets start to increasingly price in future Fed rate reductions. Contributing to the firmness of the Yen, trade optimism has firmed up after the US announced the reduction of tariffs on Japanese auto imports. With USD/JPY stalled around the 148.00 level, traders now look to the US Nonfarm Payrolls report for new direction cues in the pair.

Japanese Yen holds firm versus the US Dollar as solid domestic data and expectations of BoJ policy improve its prospects. On the other hand, USD is under pressure due to Fed rate cut expectations, keeping USD/JPY subdued near 148.00 levels before the US Nonfarm Payrolls announcement.

• Japanese Yen gets stronger as positive domestic data improves sentiment.

•Japan’s real wages turn positive for the first time in seven months.

• Household spending rises in July, reinforcing BoJ policy normalization expectations.

• Inflation remains above the BoJ’s 2% target, supporting a hawkish outlook.

• Fed rate cut bets keep the US Dollar under pressure.

• US lowers tariffs on Japanese automobile imports, adding to trade optimism.

• USD/JPY struggles near 148.00, with traders awaiting the US Nonfarm Payrolls report for direction.

The Japanese Yen is finding support as new local data points to strength in the economy of Japan. Real wages finally became positive for the first time in seven months, indicating improving household buying power, with spending also showing growth, though below expectations. This reinforces the belief that the Bank of Japan will remain on its path of policy normalization, particularly with inflation remaining above 2% target. Meanwhile, trade sentiment got a boost after the United States dropped its plan to reduce tariffs on Japanese auto imports, easing a major source of worry for businesses and investors.

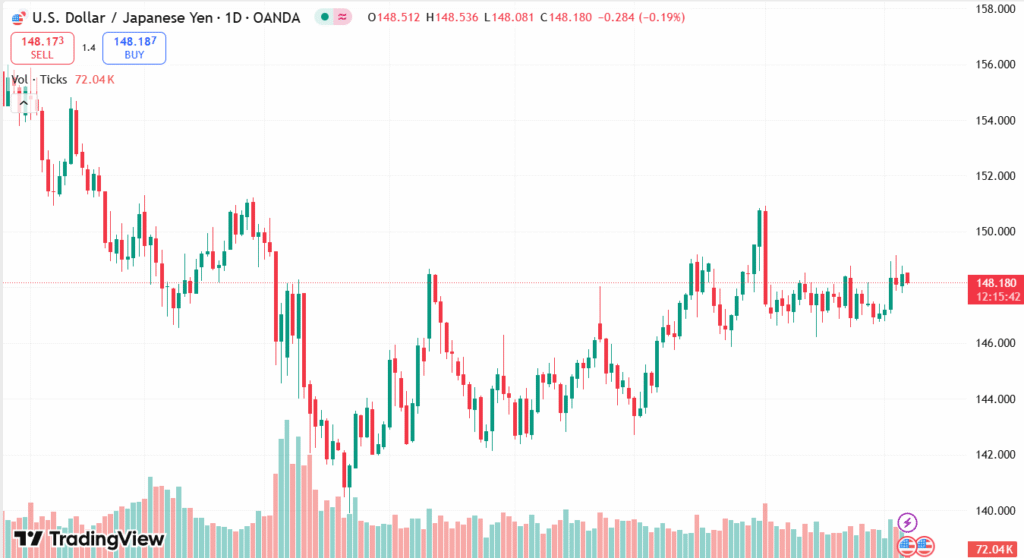

USD/JPY DAILY CHART PRICE

SOURCE: TradingView

Meanwhile, the US Dollar continues to find it tough to inspire a robust buying interest with expectations growing that the Federal Reserve will soon initiate cutting borrowing costs. Markets are already discounting the likelihood of several rate cuts throughout the year, which has kept demand for USD in check. In this context, market participants are keenly awaiting the publication of the US Nonfarm Payrolls report to get an updated picture of US labor market health and Fed policy direction. The information will probably have a key part to play in determining near-term sentiment around the USD/JPY pair.

TECHNICAL ANALYSIS

USD/JPY is under intense pressure as the pair fails to maintain itself above the 148.00 level, an important psychological and structural support level. Repeated inability to break through the 200-day Simple Moving Average, located around 148.75–148.80, indicates weak bullish momentum in the short term. A persistent break below 148.00 might open the way towards the 147.40–147.00 area, with further losses revealing the 146.20–146.00 area. On the other hand, a decisive break above the 149.20 resistance, which coincides with the 61.8% Fibonacci retracement of the latest drop, might restore momentum in favor of buyers and clear the way for a move towards the 150.00 psychological level.

FORECAST

If USD/JPY is able to stay above the 148.00 support and break above the 148.75–149.20 resistance area, the onus would shift back in favor of buyers. This would pave the way for a rally to the 150.00 psychological level, with the chances of further upmove towards the August swing high around 151.00. Stricter-than-anticipated US economic figures, especially those in the Nonfarm Payrolls report, might be the stimulus for this rally by momentarily lowering expectations for Fed rate cuts.

Conversely, a persistent decline below the 148.00 level would strengthen bearish momentum and initiate fresh selling pressure. This would enhance declines towards the 147.40 support level, and then further downwards towards the 147.00 and 146.70 levels. A decisive breach of 146.70 would reveal the 146.20–146.00 area, potentially triggering a more extensive corrective move. Poor US data or more robust hints of BoJ tightening would tend to be drivers towards this downside route.