Japanese Yen jumped to a three-week high versus a relatively soft US Dollar on Thursday, its third consecutive day of increase, after the Bank of Japan (BoJ) and the Federal Reserve developing differing monetary policy outlooks pushed demand for the safe-haven currency. Increasingly anticipation of further BoJ policy normalization and interest rate hikes by year-end was offset by increasing bets of a September Fed rate cut, leaving the USD on the back foot. Although risk-on mood and worries over Japan’s decelerating real wage growth might dampen further advances, the overall market environment continues to be skewed in favor of JPY bulls, with the market waiting for the next US Producer Price Index prints and Japan’s Preliminary Q2 GDP for new direction.

KEY LOOKOUTS

• BoJ hawkishness vs. expected September Fed rate cuts remains supportive of JPY strength.

• US Producer Price Index (PPI) and Japan’s Preliminary Q2 GDP will be driving factors for USD/JPY action.

• Consistent break below 147.00 SMA could fasten downward momentum towards 146.00 and 145.30 support levels.

• Strong equity markets globally could limit safe-haven buying, but underlying JPY bullishness is intact.

Japanese Yen continued its three-session rally on Thursday by rising to a three-week high against a generally weaker US Dollar as policy divergence between the Bank of Japan and the Federal Reserve fueled market flows. Bets that the BoJ will continue to hike rates by the end of the year, defying fear over poor wage growth and possible economic pressures, were sharply contrasted with increased wagers for a rate cut from the Fed in September. Though optimistic global risk appetite has supported equity markets, it has had scant impact on curbing demand for the safe-haven JPY, which remains supported ahead of influential US PPI data and Japan’s Preliminary Q2 GDP release.

Japanese Yen rose to a three-week high, buoyed by predictions of additional BoJ rate increases and weakening US Dollar amidst hanging bets for Fed rate cuts. Market participants now await US PPI and Japan’s Q2 GDP releases for new market direction.

• Japanese Yen rises for the third straight day to a three-week high against the USD.

• BoJ set to maintain policy normalization by possibly raising rates by the end of the year.

• US Dollar is burdened with September Fed rate cut expectations.

• Risk-on mood does not penetrate robust demand for the safe-haven JPY.

• Real wages in Japan drop for the sixth consecutive month, worrying about economic recovery.

• Technical breakdown below 147.00 SMA can potentially set the stage for 146.00 and 145.30 supports.

• US Producer Price Index and Japan’s Preliminary Q2 GDP are watched for new direction by traders.

The Japanese Yen continued its three-day winning streak on Thursday, as the currency moved higher for a third day against a weaker US Dollar. The strength of the currency was largely fueled by growing policy divergence between the Bank of Japan and the Federal Reserve. Investors are growing more and more convinced that the BoJ will continue along its track of policy normalization, with an interest rate increase likely within the year. This is in marked contrast to bets in the market that the Fed would reduce interest rates in September, a sentiment underpinned by weaker US economic data and moderating inflationary pressures.

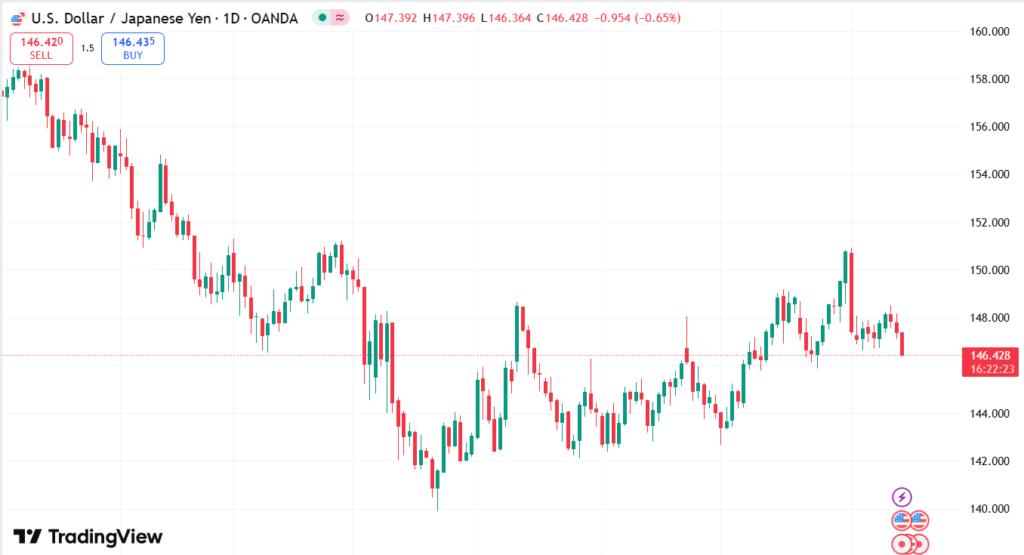

USD/JPY DAILY PRICE CHART

SOURCE: TradingView

In spite of overall favorable global risk sentiment that has driven stock markets to new highs, safe-haven demand for the Yen continues to be strong. Apprehensions regarding Japan’s domestic economy—underscored by six straight months of falling real wages and decelerating corporate goods price inflation—have not dissuaded optimistic sentiment towards the currency. The traders now focus on future economic data releases, such as the US Producer Price Index and Japan’s Preliminary Q2 GDP, that may bring new insights regarding the economic environment and future policy action by both the central banks.

TECHNICAL ANALYSIS

USD/JPY’s continuous break and acceptance below the 200-period Simple Moving Average (SMA) on the 4-hour chart, near the 147.00 level, indicates a bearish inclination for the pair. The Relative Strength Index (RSI) is heading towards oversold levels, indicating that there is a chance of a temporary consolidation or weak rebound before more selling. Any attempted rebound is set to meet stiff resistance at the 147.00 level, now serving as a pivotal level. A bold fall below current lows would expose the market to a decline towards 146.00, with further support levels at 145.40-145.30 and then the 145.00 psychological level.

FORECAST

If USD/JPY is able to regain and hold above the 147.00 resistance-turned-support, a short-covering bounce could play out, driving the pair to the 147.45–147.50 area. A breach of this area might see more buying interest, setting the stage for a drive to the 148.00 psychological mark. This positive scenario would probably need more robust US data, bullish Fed commentaries, or a slowdown in BoJ rate hike expectations.

Conversely, sustained pressure below 147.00 would maintain the bearish momentum and create room for a slide towards the July 24 low of 146.00. A clean break below this level might fuel losses towards the 145.40–145.30 support level, with the 145.00 level being the next significant downside target. Deteriorating US data or reiterating of BoJ’s hawkish policies would reinforce this bearish expectation.