Japanese Yen (JPY) plummeted to a new four-month low against the US Dollar (USD) following a dovish sentiment from the Bank of Japan (BoJ) as well as fresh USD strength. While the BoJ upgraded its inflation projections and kept the door ajar for future rate hikes, Governor Ueda’s prudent words sent no signal of policy tightening urgency. In the meantime, a firmer US Dollar—aided by falling hopes for a September Fed rate cut, strong US economic fundamentals, and escalated global trade tensions—still pins down the JPY. Market players now look to the US Nonfarm Payrolls (NFP) report for firmer guidance on the USD/JPY currency pair.

KEY LOOKOUTS

• Markets look to July NFP data, due to indicate 110K job gains, which could have a strong bearing on USD/JPY momentum.

• Even with positive inflation revisions, BoJ’s cautious stance and political risks in Japan deter near-term JPY strength.

• Favorable US economic data and aggressive Fed rhetoric lower the probability of a September rate cut, underpinning USD appreciation.

• Trump’s presidential order applying fresh tariffs will have additional implications on risk sentiment and propel safe-haven flows, impacting the JPY.

The Japanese Yen remains under pressure against a rising US Dollar, marking a new four-month low as the differing central bank projections and escalating global trade tensions confront the currency. As the Bank of Japan continued its dovish tone even as it upgraded inflation expectations, the more hawkish Fed tone and good US economic reports have sparked renewed demand for the US currency. Political instability in Japan and doubts over the fiscal condition of the country also cast a cloud over sentiment for the Yen. With investors being subdued in anticipation of the important US Nonfarm Payrolls data, the USD/JPY pair looks set to experience further volatility, with technical indicators suggesting that there could be a pause or a pullback in the trend.

Japanese Yen fell to a multi-month low versus the US Dollar on the back of the BoJ taking a dovish tone and political risk dominating sentiment. In contrast, solid US data and waning Fed rate cut expectations supported USD gains. Everyone is now waiting for the release of the US NFP report for more guidance.

• The Japanese Yen fell to a four-month low versus the US Dollar in the Asian session.

• The Bank of Japan left rates steady and indicated policy normalization patience even with increased inflation projections.

• BoJ Governor Ueda’s dovish statement undermined market sentiment for a near-term rate hike.

• Political instability in Japan after the ruling party’s defeat contributed to JPY stress.

• The US Dollar strengthened on firm economic data and lower wagers for a September Fed rate cut.

• Trump’s latest tariffs spurred trade tensions once again, gaining some safe-haven traction but not enough to push the Yen upwards.

• Traders are looking to the US Nonfarm Payrolls and ISM Manufacturing PMI later in the week for short-term guidance in USD/JPY.

The Japanese Yen remains under pressure as the Bank of Japan (BoJ) is slow to budge on monetary policy despite an increased forecast for inflation. BoJ Governor Kazuo Ueda highlighted the importance of patience and evidence-based decision-making, dismissing the imperative to raise interest rates. This measured approach, combined with political uncertainty following the recent election defeat of the ruling party, has sparked fears over Japan’s fiscal stability and eroded investor faith in the Yen. In the meantime, Japan’s manufacturing PMI fell back into contractionary territory, and possible trouble in the wider economic upswing.

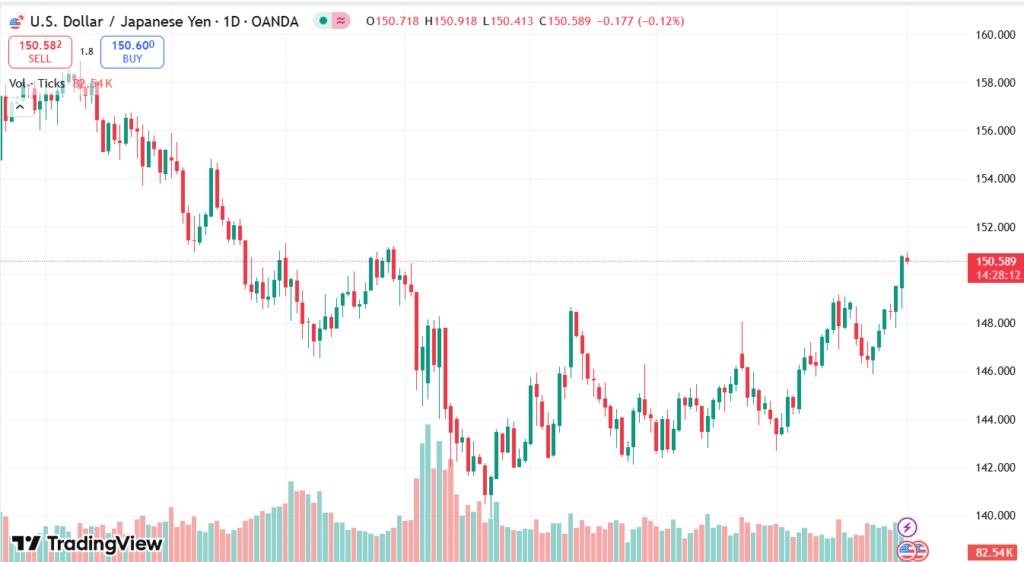

USD/JPY DAILY PRICE CHART

SOURCE: TradingView

On the world stage, the US Dollar continues to hold strong, supported by a robust domestic economy and hawkish tones from the Federal Reserve. The American economy recorded strong growth in the second quarter, underpinned by improving consumer spending and income. Secondly, President Trump’s move to slap high tariffs on the country’s major trading partners has created market wariness, contributing to worldwide economic uncertainty. While investors wait for major US labor market reports, such as the Nonfarm Payrolls report, market players continue to eye policy divergence between the Fed and the BoJ as they speculate about what to expect next in currency markets.

TECHNICAL ANALYSIS

The USD/JPY cross has broken above the key 200-day Simple Moving Average (SMA) and surpassed the 150.00 psychological level, which reflects renewed bullish pressure. This breakout has set the path for the March swing high in the vicinity of the 151.20 level, which now serves as the next major resistance point. Nonetheless, the daily Relative Strength Index (RSI) is inching towards the overbought level, indicating the potential for a short-term consolidation or slight pullback. Any decline towards the 150.00 level is bound to find buyers, with firm support around 149.55 (200-day SMA), which can cap bear risks in the short run.

FORECAST

If the US economic reports, specifically the Nonfarm Payrolls and ISM Manufacturing PMI, remain strong, the US Dollar can continue its positive trend against the Japanese Yen. A continued breakout above the 151.20 resistance level would potentially unlock stronger gains, which could target the 152.00 level or beyond. In addition, lower expectations of a Fed rate cut and ongoing divergence in policy between the Fed and BoJ may also further ignite USD/JPY bullish momentum in the coming weeks.

Conversely, any hints of frailty in future US labor market indicators or an unexpected change in Fed speak may prompt a USD retreat, resulting in a correction in the USD/JPY exchange rate. If the pair falls below the 150.00 psychological benchmark, it may encounter initial support at 149.55, with a drop below this revealing the next downside objective around 149.00. A more hawkish-than-anticipated BoJ shift or relaxation of geopolitical tensions could also spur demand for the Japanese Yen, putting pressure on the pair.