Japanese Yen moved sideways against the US Dollar on Wednesday, burdened by a mixed bag of fundamental signals. Japanese political uncertainty and a better global risk sentiment capped the safe-haven appetite for the Yen, while a rate hike by the Bank of Japan in the second half of this year provided support. At the same time, growing bets on a US Federal Reserve rate cut next week limited the Dollar’s upside. With markets awaiting key US inflation data, the USD/JPY pair is likely to remain range-bound, though the broader policy divergence suggests the downside potential for the Yen remains limited.

KEY LOOKOUTS

• Expectations of a BoJ rate hike by year-end versus imminent Fed rate cuts continue to shape USD/JPY dynamics.

• Prime Minister Ishiba’s resignation introduces uncertainty, which can delay BoJ policy normalization.

• Near-term USD direction will be determined by upcoming PPI and CPI releases.

• Support is located at 146.30–146.20, with resistance at 147.75–148.00, capping the pair’s upside.

The Japanese Yen traded flat against the US Dollar on Wednesday in a tug-of-war between supportive and restrictive forces. On the one side, hopes that the Bank of Japan will increase interest rates later in the year, underpinned by better economic data and increasing household consumption, limit downside risks to the Yen. On the other side, political uncertainty after Prime Minister Ishiba stepped down and upbeat global risk appetite diminishes its safe-haven attractiveness. Meanwhile, the Dollar stays firm ahead of major US inflation releases, with hopes of a Fed rate cut keeping strong upside momentum at bay. Consequently, USD/JPY remains in a tight range, with markets waiting for fresh direction.

Japanese Yen traded range-bound against US Dollar as expectations of BoJ rate hikes were countered by political risk and high global appetite for risk. With Fed rate cuts imminent and US inflation data pending, USD/JPY is expected to remain capped in the vicinity of important technical levels.

• Japanese Yen remains range-bound against the US Dollar amidst conflicting market cues.

• Political risk in Japan post-PM Ishiba’s resignation dampens the Yen.

• Robust global equity markets cut safe-haven demand for JPY.

• Favorable Japanese economic news and increasing household consumption boost expectations for a BoJ rate hike.

• The US Federal Reserve is all but certain to lower rates at the next FOMC.

• Traders wait for US PPI and CPI news for short-term direction in USD/JPY.

• Important support is found at 146.30–146.20, with resistance at 147.75–148.00.

The Japanese Yen is moving tentatively against the US Dollar as markets consider a combination of domestic and external factors. Domestically, hopes are rising that the Bank of Japan may increase interest rates by the year-end, amid improved recent trends in GDP growth, household consumption, and real wages. Meanwhile, political tension after Prime Minister Shigeru Ishiba’s resignation has added a new level of uncertainty, which can briefly pause the pace of policy normalization by the BoJ. This provides the context for a sensitive balance between economic stability and political tension in dictating Yen sentiment.

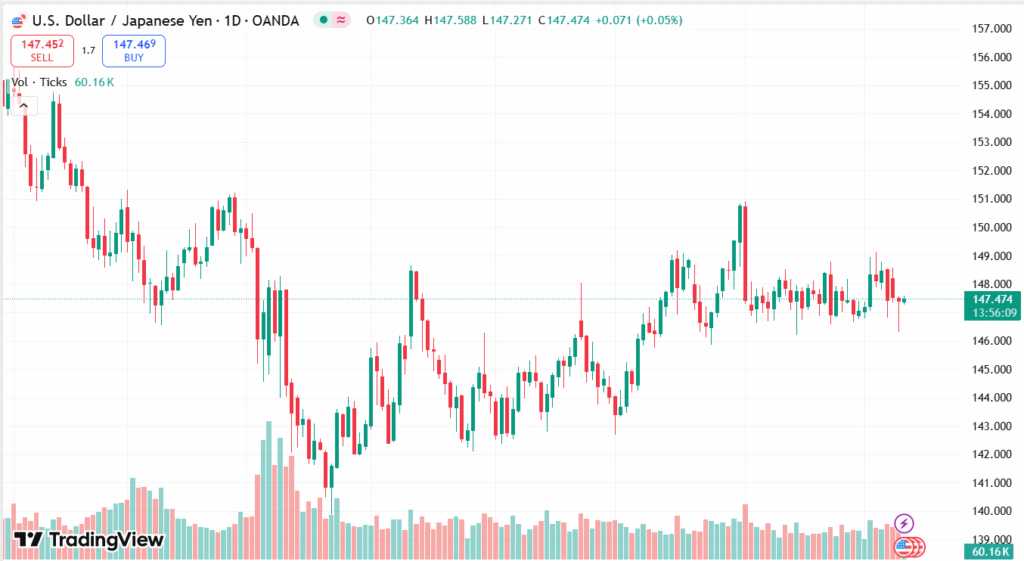

USD/JPY DAILY CHART PRICE

SOURCE: TradingView

Worldwide, the safe-haven demand for the Japanese Yen has eased with US and Asian equity markets reaching new highs, indicating the upbeat risk appetite of investors. In the meantime, the market eye is on the Federal Reserve, with markets widely expecting the beginning of a rate-cut cycle next week after softer-than-anticipated US labor market data. This Fed-BoJ policy divergence still dictates investor positioning in the currency space, with the Yen stuck in a consolidative mode as market participants wait for guidance from future US inflation releases.

TECHNICAL ANALYSIS

USD/JPY is still in the process of consolidation after rebounding from the 146.30 area support level, although the absence of follow-through and poor daily momentum indicators indicate minimal upside risk. Resistance is likely at the 147.75–148.00 area, which may draw new selling pressure and limit further advancement. On the downside, support is near 147.00, with a breach below paving the way for a test of the 146.30–146.20 region. A move below 146.00 would consolidate bearish grip and risk the pair lower toward 145.35 and the psychological 145.00 level.

FORECAST

If purchasing momentum picks up, USD/JPY may challenge the 147.75–148.00 resistance level, where it is expected that sellers will re-appear again. A firm break above this could induce short-covering, paving the way toward the 148.75 area close to the 200-day Simple Moving Average. Continued advances beyond this level would turn sentiment in the bulls’ favour and could further extend the recovery of the pair.

Conversely, inability to breach the 148.00 resistance may attract fresh selling pressure. Near-term support lies at the 147.00 psychological level, with a further decline threatening the 146.30–146.20 horizontal bottom. A clean breakdown below 146.00 would be interpreted as a new bearish catalyst, underpinning the fall towards 145.35 before challenging the psychological 145.00 barrier.