Japanese Yen continues gaining against a declining US Dollar, pushing the USD/JPY pair towards the 145.00 level amid increasing policy divergence between the Federal Reserve (Fed) and the Bank of Japan (BoJ). As the BoJ is set to raise rates again on the back of lingering inflation and robust domestic data, the Fed is more and more intimating future rate reductions, perhaps beginning in July. This dichotomy has taken a heavy toll on the USD, making the lower-yielding JPY more attractive. Further uplift for the Yen is also provided by hopes of a possible US-Japan trade agreement and continued safe-haven demand in the face of geopolitical events, such as a tentative Israel-Iran ceasefire.

KEY LOOKOUTS

• Ongoing expectations of Bank of Japan rate hikes against possible Federal Reserve rate cuts are likely to continue exerting downward pressure on USD/JPY.

• Market sentiment would change depending on the result of ministerial-level negotiations on or about June 26, which could have implications for trade flows and the strength of the JPY.

• Jerome Powell’s testimonial before Congress, as well as other speeches from FOMC officials, will be eyed for hints on the Fed’s interest rate trajectory in the next few months.

• Traders will be watching if the pair falls convincingly below the 145.00 psychological level support, which could fuel more bearish momentum.

The Japanese Yen is holding steady against the US Dollar, with the USD/JPY pair hovering near the crucial 145.00 support level as markets respond to differing monetary policy expectations. Expectations of the Bank of Japan hiking interest rates in the face of persistent inflation and better economic data stand sharply contrasted with increasing expectation of the Federal Reserve cutting interest rates, potentially as early as July. This divergence still undermines the USD and props up the JPY. Further fueling the Yen’s popularity are hopes for an imminent US-Japan trade deal and ongoing safe-haven appetite, in spite of worldwide geopolitical shifts.

Japanese Yen extends gains against a weaker US Dollar, pushing USD/JPY toward the 145.00 level. Divergent BoJ-Fed rate expectations and safe-haven buying continue to underpin the Yen. Traders now look to important US data and Powell’s testimony for direction.

• The Japanese Yen advances sharply, pulling USD/JPY towards the 145.00 psychological level.

• BoJ will likely raise rates further, while the Fed is inclined to cut rates, perhaps as early as July.

• Japanese core inflation at or above the 2% target keeps the argument for tighter monetary policy alive.

• Upbeat Japanese PMI data enhance optimism over the outlook in Japan.

• Conflicting US PMIs and soft Fed rhetoric put pressure on the US Dollar.

• Expectations of a US-Japan free trade agreement before the July 9 deadline to impose tariffs add strength to the Yen.

• USD/JPY looks to break below the 145.00 level; resistance is observed around 146.00 and 147.00 levels.

The Japanese Yen draws robust demand as investors react to a changing global monetary environment. With Japan’s underlying inflation remaining above the central bank’s 2% target for more than three years and recent PMI readings registering strength, markets are growing optimistic that the Bank of Japan can go ahead with further rate hikes. In contrast to the U.S., where uneven economic data and weakening labor forecasts have encouraged Federal Reserve policymakers to begin reducing the central bank’s stimulative monetary policy in the near term. Such divergence in central bank policies is sending investors to the Yen, which appears to be a safe and more appealing currency in the face of current conditions.

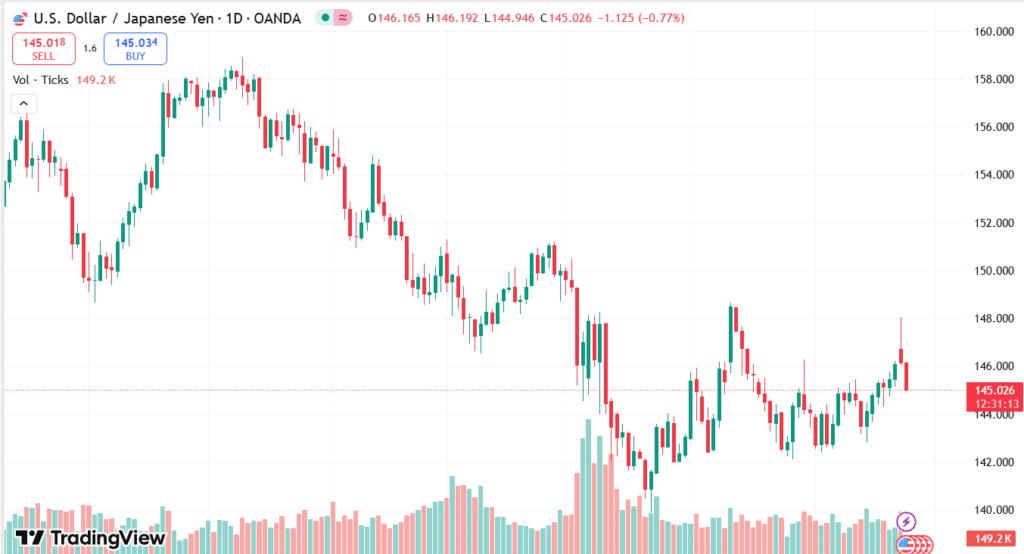

USD/JPY DAILY PRICE CHART

SOURCE: TradingView

On top of the Yen’s strength is rising optimism of a US-Japan trade deal, as Japan’s Economy Minister plans high-level talks with U.S. officials. The fact that these talks come early, prior to an imminent tariff deadline, indicates an active attempt to put trade tensions on the backburner, viewed favorably by the market. Additionally, the Japanese Yen has not been significantly impacted by recent geopolitical events, such as a reported Israel-Iran ceasefire, further solidifying its safe-haven status. All of these combined point to a robust fundamental foundation for the Yen moving forward.

TECHNICAL ANALYSIS

USD/JPY has fallen below the 100-hour Simple Moving Average (SMA) to indicate short-term bearish pressure. Yet, the fall has come to an impasse around the 145.40 zone, which coincides with the 50% Fibonacci retracement of the last upward move, and hence, a critical support zone to monitor. A clean break below this zone would set the stage for a drop to the 145.00 psychological level, which might unleash further bearish momentum. On the plus side, resistance is evident at 146.00 supported by the 38.2% Fibonacci retracement, and a move above it would switch attention to 147.00–147.45. Interim mixed signals from momentum indicators imply that traders will be awaiting confirmation before entering strong directional positions.

FORECAST

If the USD/JPY currency pair holds above the 145.00 level of support and resumes its uptrend, a short-term rebound can send the pair as high as the 146.00 resistance area, which coincides with the 38.2% Fibonacci retracement level. A decisive breakout above this resistance may pave the way for additional gains towards 146.70–146.75 and possibly even to the 147.40–147.45 region. Continued buying interest above these levels might take the pair to the 148.00 psychological mark and the May peak around 148.65.

Conversely, a convincing breakdown below the 145.00 psychological level might strengthen the bearish outlook and provoke fresh selling. This could propel the pair into a more pronounced correction towards the 144.50 support level, then 144.00. If downside pressure persists, the next significant target may be 143.30–143.00, which are former consolidation areas. The overall trend may become increasingly biased towards sellers if fundamentals and sentiment remain in favor of the Japanese Yen against the US Dollar.