NZD/USD pair continued its bull run during Monday’s Asian trading, moving beyond the 0.5950 level on further weakness in the US Dollar and on increasing US-China trade discussion momentum. Statements from President Trump on possible cuts to tariffs and the continued dialogue over trade added volatility to the market, with even stronger-than-projected US job numbers having little effect on the greenback. In the meantime, expectations of sharper unemployment numbers in New Zealand have driven speculation over additional monetary accommodation by the RBNZ, with a cut of 25 basis points highly anticipated later in the month.

KEY LOOKOUTS

• Any developments or setbacks in the trade negotiations will have a serious impact on the market mood and the direction of NZD/USD.

• An increase in the unemployment level could reinforce anticipation of additional RBNZ monetary easing.

• The markets are factoring in a 25 basis point rate cut; even a change in tone or guidance from the central bank has the potential to influence the Kiwi’s appreciation.

• Following a robust NFP reading, ongoing weakness in the US Dollar indicates that traders are paying attention to larger macroeconomic indicators and possible Fed policy action.

NZD/USD currency pair is building a firm upside momentum, trading around 0.5970 as the US Dollar loses strength with fresh attention being given to US-China trade negotiations and the dovish tone of central banks. President Trump’s comments on the possibility of reducing tariffs and the likelihood of resumed negotiations have strengthened risk appetite, propping up the Kiwi. Meanwhile, investors are closely watching upcoming labor data from New Zealand, with expectations of a higher unemployment rate likely reinforcing forecasts of further monetary easing by the RBNZ. Despite stronger-than-expected US job growth in April, the Dollar remains under pressure, keeping the NZD/USD pair supported for a second consecutive session.

NZD/USD hovers around 0.5970 as the US Dollar loses strength on fresh US-China trade hopes. New Zealand’s future labor statistics are in the market’s focus, with hopes of a rate cut from the RBNZ. Even with strong US employment figures, the Kiwi keeps finding support for the second consecutive session.

• NZD/USD hovers around 0.5970, posting gains for the second consecutive session.

• US Dollar declines, led by trade uncertainty and dovish policy expectations.

• US-China trade talks in the spotlight, with Trump affirming that there are still talks but no meeting with Xi this week.

• Trump suggests future tariff cuts, improving market mood and risk assets.

• US Nonfarm Payrolls beat forecasts, but the USD did not rally as broader concerns persist.

• New Zealand unemployment likely to rise, boosting chances of RBNZ monetary easing.

• Markets already price in a 25 bps RBNZ rate cut, with rates set to bottom at 2.75% by October.

New Zealand Dollar is finding steady support as market focus shifts to general economic and geopolitical trends. One driving sentiment is the current US-China trade issue, and President Trump has confirmed negotiations are ongoing, although there are no scheduled direct discussions with Chinese President Xi in the week ahead. His words that he might cut tariffs have provided a welcome note of optimism to the market, particularly for nations such as New Zealand which are so reliant on world trade. At the same time, China’s Commerce Ministry said it is examining an American proposal to resume talks, adding further to the optimism.

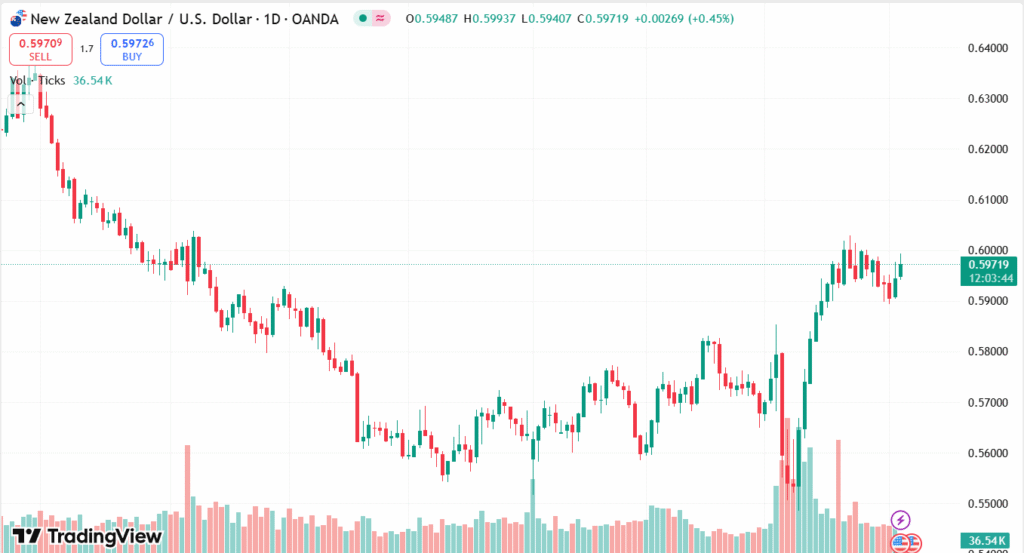

NZD/USD DAILY CHART PRICE

CHART SOURCE: TradingView

Together with the trade story, economic news from the US and New Zealand is driving expectations. While the US posted good job growth in April, worries regarding long-term economic policy and worldwide conditions have left the Dollar under pressure. In New Zealand, forthcoming labor market figures are due to indicate a modest increase in unemployment, supporting the prognosis for additional policy assistance from the Reserve Bank of New Zealand. Markets are already pricing in a rate cut this month, signaling a guarded but defensive climate for the Kiwi.

TECHNICAL ANALYSIS

NZD/USD continues to display bullish momentum after breaking out above the 0.5950 resistance point and now trading close to 0.5970. This higher motion indicates buyer demand is increasing, fueled by a softer US Dollar and favorable risk environment. The pair could reach the next resistance level at around 0.6000 if it holds above 0.5970. Support is lower in 0.5920, and a break below there could mark a possible halt to the ongoing uptrend. Momentum gauges such as the RSI continue to be positive, supporting the short-term bull bias.

FORECAST

NZD/USD may continue its advance towards the psychological level of 0.6000, with additional resistance anticipated around 0.6030. Such an advance would be supported by ongoing US Dollar weakness, a breakthrough in US-China trade talks, or a dovish policy change from the Federal Reserve. Also, if New Zealand economic numbers, especially labor market data, arrive better than anticipated, it may restrict the margin for RBNZ easing and provide further encouragement to the Kiwi. Under such circumstances, the pair may keep going up in the short term as buyers drive it in that direction.

On the flip side, if upcoming New Zealand labor data shows a significant uptick in unemployment or if risk sentiment deteriorates due to stalled trade talks, NZD/USD could face downward pressure. A drop below the 0.5920 support zone might trigger further selling, potentially pulling the pair toward the next support level around 0.5880. Moreover, any surprise hawkish comments from the US Federal Reserve or better-than-anticipated US data could support the Dollar and dampen the NZD. The pair might then find it difficult to sustain its latest bullish trend.