NZD/USD pair jumped above 0.5950 on Friday, continuing its three-day winning streak as dovish Federal Reserve policy expectations and robust Chinese trade figures supported the New Zealand Dollar. The Kiwi picked up speed following China, New Zealand’s biggest trading partner, announcing a greater-than-anticipated trade surplus in July and support from the Reserve Bank of New Zealand’s inflation expectations. Market mood was again boosted by increasing speculation of a September 25 basis point Fed rate cut, with the CME FedWatch tool indicating a 93% chance. Though, upside potential is still contained with worries regarding the economic cost of newly implemented 15% US tariffs on New Zealand exports.

KEY LOOKOUTS

• Pair continues three-day win streak on dovish Fed view and robust Chinese trade surplus.

• Statistics favor Kiwi despite weaker 12-month and two-year forecasts.

• CME FedWatch indicates 93% chance of 25 September bps reduction, sharply up from last week.

• New 15% US tariff on New Zealand exports could cap further progress.

NZD/USD broke above 0.5950 in Friday’s Asian session, its third day running of gains, as dovish Fed bets and strong Chinese trade figures supported the New Zealand Dollar. The Kiwi derived its strength from China’s wider-than-anticipated July trade surplus, in conjunction with dovish Reserve Bank of New Zealand inflation expectations data, while softening US labor market readings fueled rumors of a September Fed rate cut. Nonetheless, ongoing concerns over the economic implications of a recently introduced 15% tariff on New Zealand exports to the US may cap the pair’s upward momentum.

NZD/USD pushed higher past 0.5950 on the back of robust Chinese trade data and increasing Fed rate cut prospects. Nevertheless, upside could be constrained by the recently imposed 15% US tariff on New Zealand exports.

• NZD/USD is trading at 0.5960, extending a three-day winning streak.

• Robust Chinese July trade surplus bolsters New Zealand Dollar sentiment.

• RBNZ inflation expectations underpin Kiwi despite marginal reductions in outlook.

• US Initial Jobless Claims increase to 226K, indicating cooling labor market.

• CME FedWatch indicates 93% chance of a September 25 bps Fed rate cut.

• Dovish Fed stance further bolsters risk sentiment.

• Newly imposed 15% US tariff on NZ exports presents possible economic risks.

The New Zealand Dollar found strong support on Friday as positive economic cues from China and dovish expectations for US monetary policy boosted investor confidence. China, New Zealand’s largest trading partner, posted a significantly higher trade surplus in July, signaling robust export performance. This, combined with the Reserve Bank of New Zealand’s latest inflation expectations data, helped strengthen the Kiwi’s position in the market. The general mood was also supported by increasing speculation that the US Federal Reserve would start cutting interest rates from as soon as September, which helped improve overall risk appetite.

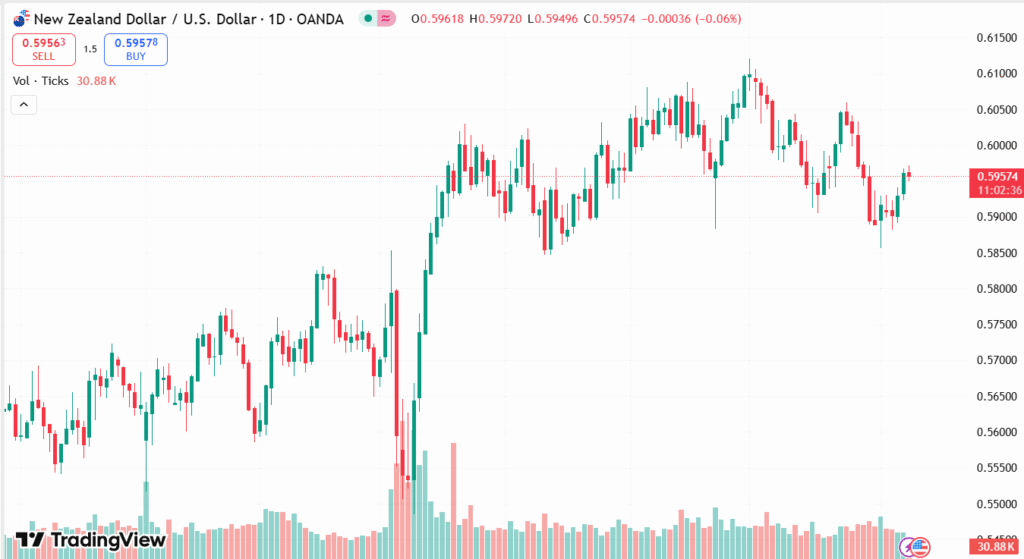

NZD/USD DAILY PRICE CHART

SOURCE: TradingView

The positive mood, however, is balanced by trade-related fears. A 15% tariff on New Zealand goods being shipped to the United States took effect on Thursday, which has sent concerns over its possible effect on the nation’s export-led economy. As the US is one of New Zealand’s major markets for its products, these tariffs might put pressure on some sectors and burden overall growth. Market players now are closely observing forthcoming Chinese inflation numbers for additional indication on regional economic momentum, which might affect both trade flows and currency movements in the short term.

TECHNICAL ANALYSIS

NZD/USD is in a bullish mood as it is trading above the pivotal 0.5950 level, boosted by unwavering buying interest in the last three sessions. The pair is trading firmly above its short-term moving averages, reflecting unabated momentum higher, while the Relative Strength Index (RSI) is still in positive territory without yet indicating overbought conditions. A decisive spike above the nearest resistance around 0.5980 may allow for a push toward the 0.6000 psychological level, while initial support is around 0.5920, followed by the 0.5900 area, which may serve as a pivot point should bearish pressure surface.

FORECAST

Should bullish momentum hold, NZD/USD may drive further towards the 0.5980 resistance point, a sustained break of which would see the psychological 0.6000 level within reach. Encouragement from solid Chinese trade data, along with dovish Fed policy expectations, may supply the necessary tailwind to force the currency higher. Further cues of softening US inflation and weaker labor market data may further boost buying interest and sustain an extended uptrend.

Conversely, fresh selling pressure may arise if market attention turns to the bearish economic implications of the newly introduced 15% US tariff on New Zealand exports. A fall below the 0.5920 support point may expose the pair to further losses toward 0.5900 or even 0.5880. Poor Chinese inflation readings or surprising hawkish remarks from the Federal Reserve may also bear on the Kiwi, prompting a possible reversal in recent advances.