NZD/USD currency pair continues to face pressure at the 0.5900 level after the People’s Bank of China (PBoC) lowered its one-year Loan Prime Rate by 0.10 percentage point to 3.00% from 3.10%, a move that dented the New Zealand Dollar because of China’s close economic relationship with the latter. While blended Chinese data contributed to market volatility, New Zealand Q1 data revealed the steepest increase in producer prices in close to three years, fueling inflation fears. In contrast, the US Dollar softened following Moody’s downgrade of the US credit rating from Aaa to Aa1 due to increasing federal debt and fiscal difficulties. Market players now look forward to the Reserve Bank of Australia’s rate decision later today.

KEY LOOKOUTS

• Ongoing market response to the PBoC’s reduction of the Loan Prime Rate and how that affects demand for the New Zealand Dollar, considering the nations’ robust trade relationship.

• Look out for news or commentary on domestic inflation, particularly after Q1’s steep increase in producer input and output prices, which may be affecting RBNZ policy expectations.

• Market sentiment may change considerably on the Reserve Bank of Australia’s future interest rate decision and guidance, affecting overall risk sentiment and AUD-cross flows.

• Keep track of the market’s continuous reaction to Moody’s US credit rating downgrade and how it influences USD strength, Treasury yields, and overall risk appetite.

Markets are watching carefully various factors that are affecting the NZD/USD pair. The People’s Bank of China’s recent rate cut still dents the New Zealand Dollar, evidencing the tight trade nexus between the two countries. Locally, New Zealand’s Q1 producer price surge has concerned observers with a possible resurgence in inflation pressures, which would have implications for monetary policy in the future. Also on the radar is the Reserve Bank of Australia’s decision next week, with a likely cut anticipated even with solid employment figures. The US Dollar, on the other hand, is under pressure after Moody’s downgrade of its credit rating, triggering wider fears about American fiscal stability.

NZD/USD is under pressure with China’s rate cut and New Zealand’s renewed inflationary fears. Traders are also awaiting the RBA’s rate decision and the weakening of the US Dollar after Moody’s credit downgrade.

• NZD/USD is trading close to 0.5900, still subdued after the PBoC reduced its one-year Loan Prime Rate to 3.00%.

• China policy relaxation puts the New Zealand Dollar under pressure as both nations have robust trade links.

• Chinese economic data is mixed, with stronger-than-expected industrial production but soft retail sales.

• New Zealand’s Q1 statistics revealed the steepest increase in producer input and output prices in almost three years, triggering inflation fears.

• Market focus turns to the RBA, due to be cutting interest rates by 25 basis points even after solid jobs data.

• The US Dollar falls after Moody’s lowered the US credit rating to Aa1 from Aaa, citing increased debt and fiscal issues.

• Broad risk sentiment remains delicate in the face of global rate policy divergence and fiscal policy uncertainty in large economies.

New Zealand Dollar continues to be pressured by developments in the global economy, which continue to influence the sentiment of investors. The recent move by China to reduce its one-year Loan Prime Rate is indicative of persistent efforts to spur its economy, which has been reporting mixed signals with higher industrial output but lower retail sales. With New Zealand having a strong trade connection with China, these policy actions always have a major influence on the NZD. And at the same time, domestic inflation worries are re-emerging with the latest figures indicating a significant increase in producer prices—highlighting possible cost pressures within the economy.

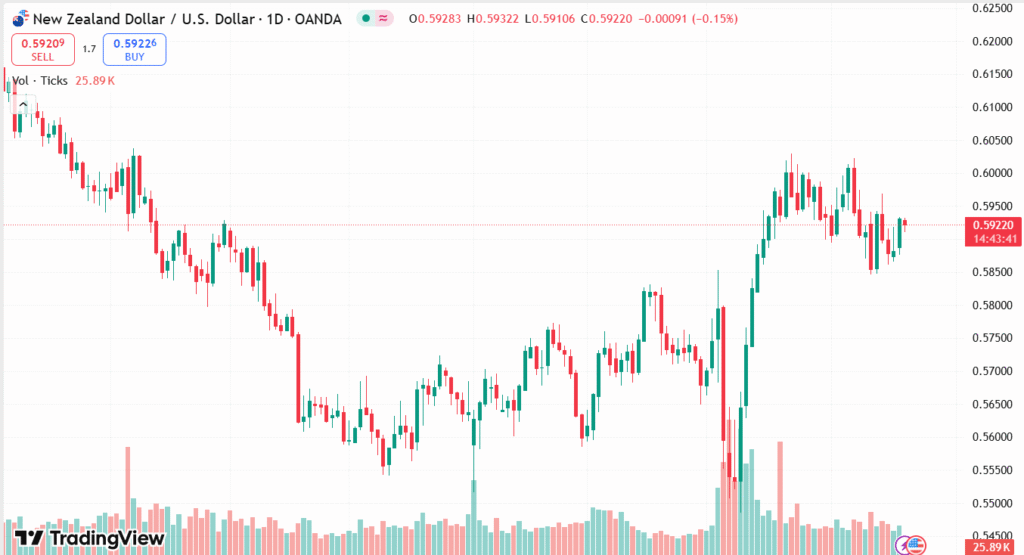

NZD/USD DAILY PRICE CHART

CHART SOURCE: TradingView

And the general market is absorbing Moody’s downgrade of the credit rating of the United States, a step that mirrors increasing concern about long-term fiscal sustainability. This move, coupled with projections of increasing debt and expanding deficits, has made markets wary globally. The Reserve Bank of Australia’s rate decision is now catching investors’ attention, with expectations of an indication on how another major regional economy is coping with changing economic conditions. All these events as a whole shape market sentiment and could direct monetary policy expectations in the weeks to come.

TECHNICAL ANALYSIS

NZD/USD is finding it difficult to make a strong move up from the 0.5920 level, indicating sustained resistance at this point. The pair is still trading below major moving averages on the daily chart, signifying a bearish short-term bias. In case of sustained downward pressure, support may be tested in the 0.5860–0.5880 region. In the up direction, a sustained move above 0.5950 would be necessary to show signs of a change in momentum. Technical levels like RSI are still neutral to slightly bearish, mirroring the pair’s guarded tone in the face of general market uncertainty.

FORECAST

Should market sentiment recover and global risk appetite improve, NZD/USD may recover towards the 0.5950–0.5980 resistance level. Upside surprises in New Zealand’s economic reports, for instance, stronger growth or contained inflation, can also help the Kiwi. In addition, any stabilization or improvement in China’s economy would improve New Zealand’s export prospects and spur bullish pressure in the NZD. A weaker US Dollar due to fears of fiscal health or poor economic data could also further contribute towards an upside move.

On the negative side, NZD/USD could see renewed selling pressure if risk appetite weakens or Chinese economic data continues to weaken. A firmer US Dollar, fueled by safe-haven buying or hawkish rhetoric from the Federal Reserve, might send the pair down to the 0.5860 support level or lower. Locally, if New Zealand inflation pressures prompt worries about weakening demand or if the Reserve Bank is prudent, the Kiwi might stay on the back foot. Geopolitical tensions or global growth worries might also cap upside potential and predispose towards downside risks.