New Zealand Dollar (NZD) extended its losing streak for the fifth consecutive session, dropping to a four-month low of near 0.5800 against the US Dollar prior to Federal Reserve Chair Jerome Powell’s speech at Jackson Hole. The Kiwi continues to come under pressure following the dovish rate cut by the Reserve Bank of New Zealand earlier this week, while the US Dollar is supported by safe-haven demand and hopes of hawkish policy cues. Market participants are wary, but a break below 0.5800 for an extended period is viewed as a catalyst for further losses, despite the oversold conditions hinting at the possibility of a short-term bounce.

KEY LOOKOUTS

• The markets wait with bated breath for policy signals from Fed Chair Jerome Powell, and hawkish comments will send the US Dollar higher again.

• The recent 25 bps OCR reduction and dovish split voting keep weighing on the Kiwi, setting up higher expectations for further easing to come.

• Support is at 0.5800 immediately, with greater risk of downside to 0.5765 should it break, and resistance at 0.5835–0.5870.

• Risk-off sentiment and safe-haven demand for the US Dollar can continue to weigh on NZD/USD in the short term.

NZD/USD declined to the 0.5800 level, a four-month low, as investors grew cautious before Fed Chair Jerome Powell’s much-awaited speech in Jackson Hole. The duo is under pressure from the Reserve Bank of New Zealand’s dovish rate cut late in the week, which boosted expectations of more monetary easing, while the US Dollar remains buoyant on safe-haven buying. Market attention now is on comments by Powell, with hawkish messages expected to push the pair down to the next support level of 0.5765, although oversold levels could curb further decline in the short term.

NZD/USD fell to 0.5800, four-month low, as risk appetite continues to be weak in anticipation of Powell’s speech at Jackson Hole. The Kiwi remains vulnerable to the dovish tilt by the RBNZ, while the US Dollar benefits from safe-haven demand.

• NZD/USD fell to 0.5800, the lowest since mid-April.

• The pair is set to post a nearly 2% weekly loss.

• Pre-Powell’s Jackson Hole risk-averse sentiment is supporting the US Dollar.

• A dovish tone is suppressing the Kiwi after the Reserve Bank of New Zealand reduced the OCR by 25 bps to 3%.

• Technical analysis pinpoints 0.5800 as key support, with more downside to 0.5765 if breached.

• High resistance at 0.5835 and 0.5870 now caps potential rebounds.

• Overbought conditions indicate a potential short-term rebound, although general sentiment is still bearish.

The New Zealand Dollar is still under intense pressure as investors respond to changing global monetary policies and increasing uncertainty in financial markets. The Reserve Bank of New Zealand’s rate reduction by 25 basis points this week has cemented a dovish tone, with policymakers indicating room for additional easing in the future. The action has eroded confidence in the Kiwi, with traders still expecting weakening domestic growth and softer labor market conditions.

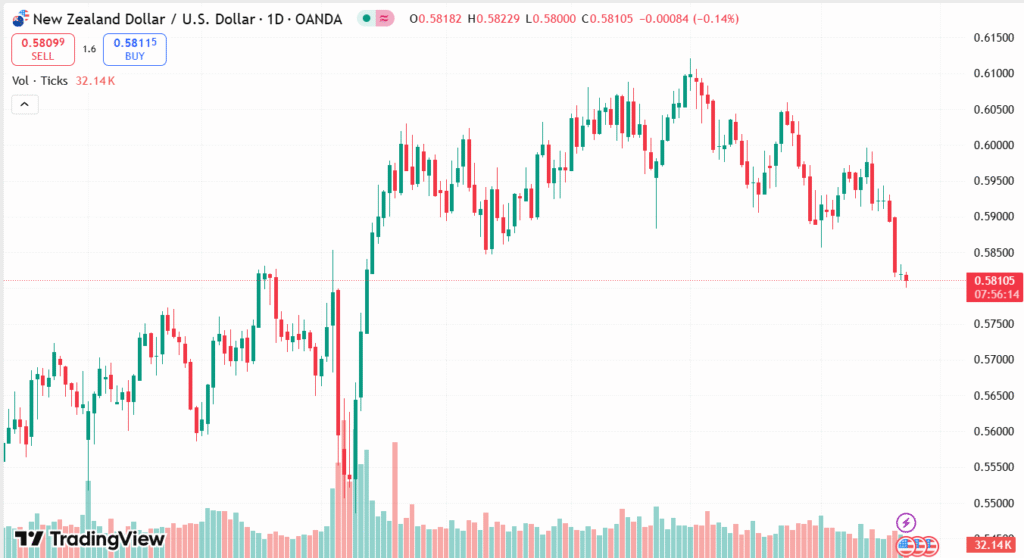

NZD/USD DAILY PRICE CHART

SOURCE: TradingView

Meanwhile, the US Dollar is getting support from risk aversion and investor hesitancy before Federal Reserve Chair Jerome Powell’s address at Jackson Hole. Markets are closely monitoring for any signal on the Fed’s future actions, with the chance of hawkish comments to support the Dollar’s superiority. Joined with the ongoing international economic worries, the defensive sentiment has left the New Zealand Dollar fighting to find buyers, underpinning the general spread of central bank divergences.

TECHNICAL ANALYSIS

NZD/USD is at the level of critical support of 0.5800, a breakdown below which could pave the way toward the next bearish target of 0.5765. Although the pair is still oversold following the last few days of straight decline, support levels are limited to 0.5835 and 0.5870, maintaining the overall bearish stance. The pair needs a clean break above these support points to start a sustained rebound, but as long as the pair is below 0.5870, the downward momentum is likely to prevail.

FORECAST

In the near term, NZD/USD may experience a limited bounce if oversold levels prompt profit-taking or Powell’s speech provides a dovish surprise. A rally back to 0.5835 and perhaps 0.5870 is feasible, although gains are likely to be limited unless general market sentiment turns positive towards risk assets. Any indications of stabilisation from the RBNZ or positive local data would also support the Kiwi.

On the negative side, a convincing break below the 0.5800 level would leave the pair vulnerable to further weakness, with the next substantial support at 0.5765. Powdering hawkish statements by Powell or chronic risk aversion in world markets would drive selling pressure on the Kiwi. If short-term bearish momentum continues, the danger of a lengthy decline towards fresh yearly lows would rise, keeping NZD/USD under bearish dominance in the near future.