NZD/USD weakened beneath 0.5950 yesterday, easing close to 0.5930 in early European activity as the US Dollar regained poise in advance of the release of the US Consumer Price Index (CPI) for August. Investors are considering bets on future Federal Reserve interest rate cuts, with Barclays predicting three 25-bps cuts through the end of the year, versus the Reserve Bank of New Zealand’s (RBNZ) intention to cut the Official Cash Rate (OCR) to 2.5% by 2025 year-end. While additional Fed cuts may help defend the Kiwi, nervousness regarding economic statistics and worldwide growth issues continues to dog the pair.

KEY LOOKOUTS

• Traders will closely watch the August CPI data, as it could influence the USD direction and impact NZD/USD volatility.

• Market sentiment is focused on potential Federal Reserve rate cuts, with three 25-bps reductions projected for 2025.

• Any updates from the Reserve Bank of New Zealand regarding the pace of OCR reductions could affect the Kiwi’s performance.

• Signs of New Zealand’s economic weakness or rebound, such as US tariff effects, can influence investor attitudes and the NZD/USD pair.

NZD/USD dipped lower to near 0.5930 in early European trades on Thursday as a recovery in the US Dollar weighed ahead of the significant US CPI report for August. Traders are balancing hopes for three possible Federal Reserve rate reductions by the end of 2025, as predicted by Barclays, against Reserve Bank of New Zealand’s strategy to bring down the Official Cash Rate to 2.5% gradually by the end of the year. Unidades. Though chances of Fed easing may favor the Kiwi, continued concerns regarding New Zealand’s recovery and the challenges of global growth, such as from US tariffs, continue to cap upside for the pair.

NZD/USD fell to near 0.5930 as the US Dollar gained on the eve of the release of August CPI. Market participants are waiting for Fed rate cuts and RBNZ’s OCR trajectory while cautiousness remains prevailing due to concerns about global growth.

• NZD/USD retreated below 0.5950, sliding close to 0.5930 during early European trading.

• The US Dollar recovered in anticipation of the release of August US CPI, weighing on the Kiwi.

• Barclays is predicting three 25-bps Fed rate cuts within 2025.

• Market expectations of Fed easing have increased following a softer-than-anticipated Nonfarm Payrolls report.

• RBNZ Governor Christian Hawkesby expects the OCR to decline to 2.5% by the end of the year.

• The timing of RBNZ rate cuts will be data- and recovery-dependent.

• Global growth fears and US tariff effects can persist to drive NZD/USD volatility.

NZD/USD is coming under pressure as markets prepare for the release of the US Consumer Price Index (CPI) for August. Investor sentiment is being driven by hopes of future Federal Reserve rate cuts, with Barclays seeing three 25-basis-point cuts through the end of 2025. The latest soft US Nonfarm Payrolls print has only added to speculation of Fed easing, while the Reserve Bank of New Zealand (RBNZ) has also indicated a steady cut in the Official Cash Rate (OCR) to 2.5% by the end of the year.

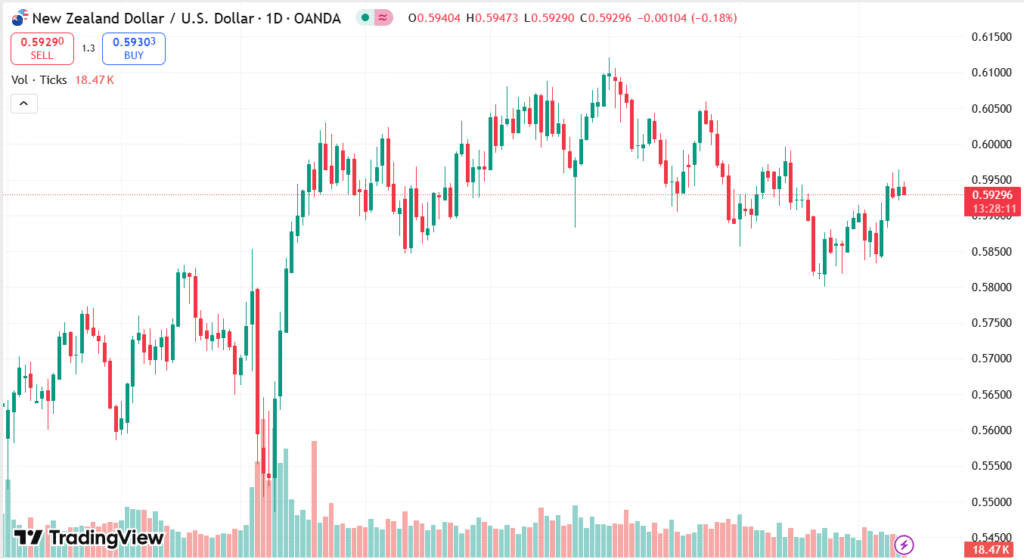

NZD/USD DAILY CHART PRICE

SOURCE: TradingView

RBNZ Governor Christian Hawkesby emphasized that how quickly the rate cutting will proceed hinges on new data and the overall health of New Zealand’s economic upturn. Policymakers are paying attention to global trends in growth and US tariffs affecting local businesses, which may have a bearing on future policy settings. Market participants are still careful, watching both US and New Zealand data keenly to gauge the wider prospects for the Kiwi and international financial markets.

TECHNICAL ANALYSIS

NZD/USD is exhibiting a reluctant downward bias as it hovers below the 0.5950 mark, with short-term support around 0.5925. Resistance should be found around 0.5965–0.5980, where intraday highs in recent sessions have been halted. Mild bearish pressure is indicated by momentum indicators, while moving averages are converging, pointing toward potential consolidation on the horizon. Buyers and sellers alike might look for a decisive break above resistance or below support to indicate the direction of the next move, especially in response to Friday’s upcoming US CPI figures.

FORECAST

In the event that NZD/USD picks up, a higher Kiwi could drive the pair to the 0.5965–0.5980 resistance area. Better-than-expected New Zealand economic data or below-forecast US CPI inflation would be needed to attract risk appetite and trigger further upside momentum. A break through key levels of resistance might set the path towards 0.6000, drawing short-term traders wanting to take advantage of a reversal.

On the negative side, fresh US Dollar strength or weak New Zealand economic data might pull NZD/USD down to the 0.5925 support level. Any indications of slower-than-anticipated New Zealand recovery or increased world growth fears might add bearish momentum. A break of support might speed the fall further to 0.5900, dictating caution among traders and investors in the short term.