Pound Sterling (GBP) trades within a narrow range of 1.3440 against the US Dollar (USD) as markets are cautious in anticipation of new US tariff actions and important UK economic figures. Market participants have reduced hopes for a Bank of England (BoE) rate cut in September after above-consensus UK inflation and labor market data. In contrast, the US Dollar continues to hold solid near recent highs as wagers on the Federal Reserve cutting rates in September dissipate after June’s CPI numbers revealed inflationary pressures from import tariffs. GBP/USD is overall range-bound bearish since it is trading below crucial moving averages.

KEY LOOKOUTS

• Global trade sentiment and USD movements can be influenced by potential updates on US tariff announcements, particularly for the EU.

• Expectations are lower in markets for a BoE rate cut in September with a firmer UK CPI and solid labor data; any change in tone would influence GBP.

• Attention will center on the July S&P Global PMI and June Retail Sales, which might yield new indications on UK economic health and inform BoE policy.

• Traders are reconsidering Fed policy expectations as the likelihood of a September rate reduction has fallen, tightening the US Dollar and affecting GBP/USD momentum.

Pound Sterling is trading firm at 1.3440 against the US Dollar as market players wait for greater clarity on US tariff policy and major UK economic data. Latest data which depicted higher-than-anticipated inflation and a robust labor market in the UK have prompted major financial institutions to reduce expectations of a Bank of England rate cut in September. In the meantime, the US Dollar is resolute, buoyed by diminishing hopes for a September Fed rate cut following the June CPI report that showed fresh inflationary pressures associated with new import tariffs. Both currencies are affected by disparate monetary policy expectations as well as geopolitics, leaving the GBP/USD pair to stay locked in a tight range, mirroring investor risk aversion.

The Pound Sterling hovers steadily at 1.3440 as markets look forward to US tariff news and major UK data. Robust UK inflation and employment numbers have cut BoE rate cut chances, while the US Dollar remains firm on dwindling Fed cut expectations.

• GBP/USD hovers at 1.3440 as market sentiment is cautious in anticipation of new US tariff updates.

• UK inflation and labor data beat expectations, prompting analysts to dial back Bank of England rate cut forecasts for September.

• Major banks like Citigroup and Goldman Sachs now anticipate fewer BoE cuts in 2024.

• US Dollar remains supported, with DXY hovering near its four-week high due to stronger CPI data.

• Traders reduce Fed rate cut expectations, the probability of a September cut dropping to 58.5% from close to 70%.

• GBP/USD technicals are still bearish, and they move below the 20-day and 50-day EMAs.

• Look ahead to UK PMI and Retail Sales, which may affect near-term GBP direction.

The Pound Sterling is stable as market attention turns to future news on global trade and central bank policies. With the US government setting new tariffs in preparation for the August 1 deadline, the global market mood is still cautious. Investors are closely watching how heightened trade tensions between the US and the European Union might affect international commerce and currency flows. At the same time, recent trade deals with Vietnam, the UK, and other countries have given relief, but fear is still high as Washington contemplates putting baseline tariffs of 15% to 20% on imports from the EU.

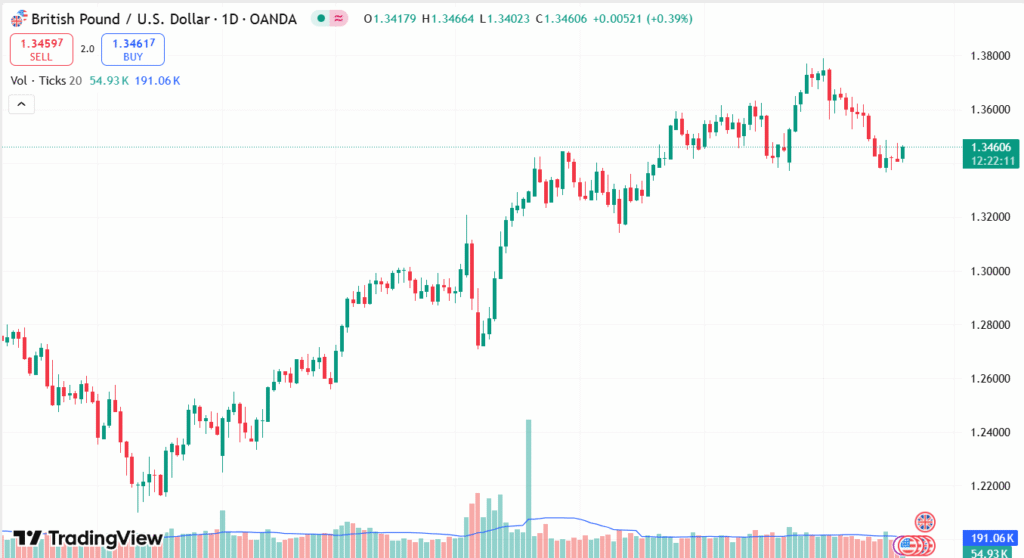

GBP/USD DAILY PRICE CHART

SOURCE: TradingView

On the UK side, economic resilience is transforming market expectations. More robust-than-anticipated inflation readings and a less dramatic labor market fall have compelled major financial institutions to update downward their interest rate reduction forecasts. Bank of America, Citigroup, and Goldman Sachs analysts have reduced their expectations of a September BoE rate cut as they become increasingly optimistic regarding the UK economy’s future prospects. This week, investor focus will be on important domestic data releases, such as S&P Global PMI and Retail Sales, which are expected to provide further guidance on the direction of the UK economy.

TECHNICAL ANALYSIS

GBP/USD currency pair still shows a bearish inclination as it trades below the 20-day and 50-day Exponential Moving Averages (EMAs), which are currently placed around 1.3470 and 1.3510, respectively. The failure of the pair to close above these levels indicates continuing selling pressure. Moreover, the 14-day Relative Strength Index (RSI) is floating slightly above the 40 level, indicating weakening momentum; a fall below this level may set off fresh bearish action. Support is close to the May 12 low of 1.3140, and resistance is at the July 11 high of around 1.3585.

FORECAST

UK’s PMI or Retail Sales this week may boost confidence in the British economy and provide sterling with support. Moreover, if the US indicates easing trade tensions or if Fed officials become increasingly dovish due to global economic threats, the US Dollar can soften, giving a boost to GBP/USD to recover. A break above 1.3510 on a sustained basis can change sentiment and pave the way towards retesting July’s high at 1.3585.

Pound Sterling may be subject to downward pressure if US tariff tensions intensify or if the next UK economic data falls short of market forecasts. A strong US Dollar, fueled by lower Federal Reserve rate cut chances, could also put pressure on GBP/USD. If bearish pressure gains strength, the pair may slide toward the important support level of 1.3140, particularly in the event of weakening global risk appetite or if the Bank of England indicates a more dovish policy than expected.