Pound Sterling is rangebound near 1.3300 against the US Dollar as investors wait for two major events: the Bank of England’s (BoE) monetary policy announcement and a new leader to succeed outgoing Federal Reserve Governor Adriana Kugler. Market players expect the BoE to lower interest rates by 25 basis points to 4%, with eyes on upcoming policy guidance in the face of softening inflation concerns and labor market issues. By contrast, U.S. President Trump has announced the shortlist for the future Fed Chair, sparking concerns over central bank independence. All of these, combined with softer-than-expected U.S. jobs data and fresh tariff threats, are keeping market mood subdued.

KEY LOOKOUTS

• Markets generally anticipate a 25 bps rate reduction to 4%; attention will be on the central bank’s forward guidance and inflation projection.

• Expectation surrounds Trump’s appointment of a replacement for Fed Governor Kugler, with fear about the politicization of monetary policy.

• Recent disappointing NFP data and climbing unemployment may underpin a Fed rate reduction in September.

• Trump’s teasing on future tariffs on chips, semiconductors, and pharma could have some effect on market sentiment and the strength of USD.

Pound Sterling is trading cautiously around 1.3300 against the US Dollar as market participants wait for important central bank news. Everyone is watching the Bank of England’s next monetary policy announcement, where markets are expecting a 25 basis point cut in interest rates as inflation moderates and labor demand softens. Around the same time, there is uncertainty about the direction of the Federal Reserve as President Trump is set to appoint a successor to departing Fed Governor Adriana Kugler, which has raised questions about whether politics could interfere with monetary policy. These, along with poor U.S. job data and fresh tariff threats, are fueling the Pound’s muted movement and increased investor wariness.

Pound Sterling is rangebound around 1.3300 while traders wait for the BoE’s interest rate decision and new Fed appointment. The markets are expecting the BoE to cut rates by 25 bps, and the political influence issues surrounding Trump’s Fed appointment. Overall sentiment is also guarded on the back of soft U.S. jobs reports and tariff concerns.

• GBP/USD remains steady around 1.3300 in anticipation of major central bank events.

• BoE expected to reduce interest rates by 25 basis points to 4% in Thursday’s meeting.

• Investors are paying attention to BoE’s forward guidance as inflation and labor market worries ease.

• Fed Governor Adriana Kugler’s resignation leaves it open for Trump to make a nomination.

• Trump shortlists Fed Chair candidates to four, stoking concerns over central bank independence.

• US NFP report falls short with below-forecast job growth and increasing unemployment.

• Tariff tensions return as Trump threatens fresh levies on semiconductors, chips, and pharma.

The Pound Sterling is holding firm in the 1.3300 region as market players exercise caution ahead of key announcements by both the Bank of England (BoE) and the U.S. Federal Reserve. The BoE is expected to lower interest rates by 25 basis points but the most attention will be on the bank’s observations about inflation, labor market and prospective policy. As consumer inflation expectations rise while labor demand weakens, investors want to see hints about whether the central bank will continue to hold back or signal additional easing.

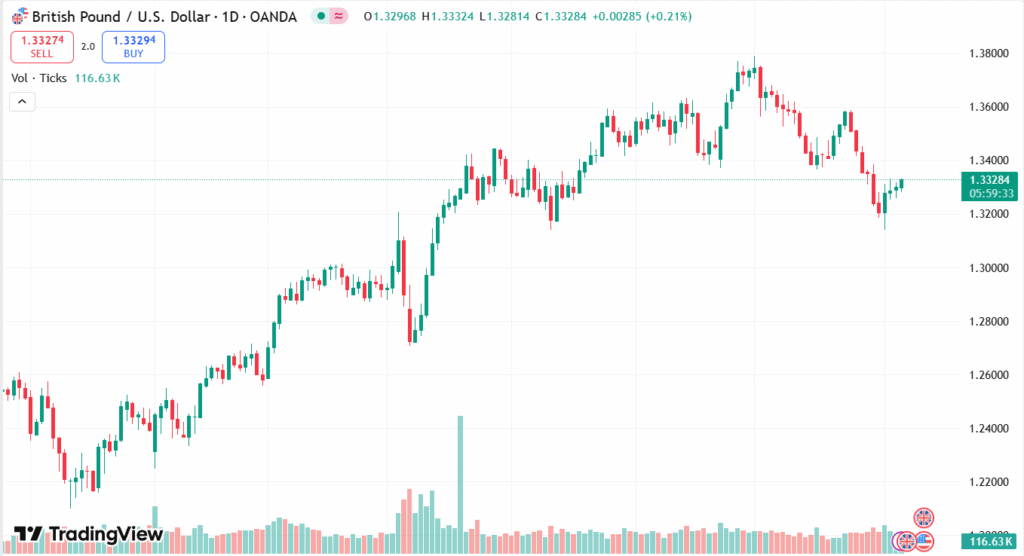

GBP/USD DAILY PRICE CHART

SOURCE: TradingView

In the US, the focus is on President Trump’s impending choice to succeed departing Fed Governor Adriana Kugler. On the shortlist of candidates are influential names like Kevin Hassett and Kevin Warsh, sparking controversy over the likelihood of greater political pressure on monetary policy. Meanwhile, woes for the US economy persist, particularly in the wake of softer job data and Trump’s renewed threats of tariffs. These trends are helping to promote a careful market sentiment, keeping the GBP/USD currency pair relatively flat for the time being.

TECHNICAL ANALYSIS

GBP/USD currency pair is under pressure as it hovers around the 1.3300 level, with a bearish sentiment dominating. The failure of a Head and Shoulders (H&S) pattern is still impacting sentiment negatively, while the 20-day Exponential Moving Average (EMA) is moving lower around 1.3395, serving as dynamic resistance. The 14-day Relative Strength Index (RSI) is trading at 40.00, reflecting modest bearish pressure. A further drop may be stimulated in the event that the RSI continues on its downward trend, with important support at the May 12 low of 1.3140 and resistance at the July 30 high of 1.3385.

FORECAST

If the Bank of England catches markets by surprise by delivering a more positive economic forecast or by signaling an end to further rate reductions, the Pound Sterling may rally. The GBP/USD pair may move up on hawkish rhetoric from BoE officials or better UK economic data—more stable inflation and stronger labor statistics. This would see the pair test resistance close to 1.3385 and potentially move up towards the 1.3450 level if buying interest increases.

To the negative, if the BoE sends a dovish signal to accompany the anticipated rate cut or signals ongoing economic fragility, the Pound could be faced with fresh selling pressure. Moreover, any indication of political interference in the Fed’s next leadership or fresh tariff threats from America may boost the Dollar, further hampering GBP/USD. A break and sustained trade below 1.3300 could provide access to a drop towards crucial support around 1.3140.