Pound Sterling traded generally stable on Thursday as Bank of England (BoE) policymakers sent mixed signals on the future direction of interest rates during testimony to the Treasury Committee. Governor Andrew Bailey pointed to high uncertainty over the pace of rate cuts, citing inflation and employment risks, while other policymakers were hawkish, warning against premature easing. Conversely, MPC member Alan Taylor preferred faster cuts, highlighting internal divisions within the BoE. Meanwhile, GBP/USD edged lower toward 1.3435 as investors turned attention to key US economic releases, including ADP Employment and ISM Services PMI, with markets also considering increased expectations of a September Federal Reserve rate cut.

KEY LOOKOUTS

• Governor Bailey pointed to uncertainty on the pace of rate cuts, while some policymakers emphasized inflation risks and others urged faster easing.

• The pair trades around 1.3435, below the 20-day EMA, with a near-term bearish bias.

• Markets look to ADP Employment and ISM Services PMI, key releases for Fed policy expectations.

• Weaker US job data has driven the probability of a September rate cut to almost 98%, maintaining USD volatility high.

The Pound Sterling is trading steadily against major counterparts as mixed signals from Bank of England (BoE) policymakers leave investors in the dark about the direction of interest rates. Governor Andrew Bailey pointed to doubts over how rapidly cuts can be delivered, while some officials cautioned against premature easing due to ongoing inflation risks. Conversely, others called for faster reductions to support growth, highlighting a divided policy outlook. Against this backdrop, GBP/USD edged lower toward 1.3435 as traders turned attention to key US economic releases, with Fed rate cut expectations already fueling increased volatility in the Dollar.

Pound Sterling remains steady as BoE policymakers send mixed signals on the pace of future rate cuts. GBP/USD trades around 1.3435, with investors looking to key US ADP Employment and ISM Services PMI data to assess the Fed’s policy outlook.

• The Pound Sterling trades generally stable following BoE policymakers’ comments before the Treasury Committee.

• BoE Governor Andrew Bailey indicated doubt over the speed of future rate reductions, citing inflation and employment market risks.

• Deputy Governor Clare Lombardelli and policymaker Megan Greene were hawkish, cautioning against premature easing.

• MPC member Alan Taylor preferred more rapid cuts, describing recent inflation rises as temporary and advocating more aggressive rate reductions.

• GBP/USD fell towards 1.3435, below the 20-day EMA, suggesting short-term bearish momentum.

• Markets now assign a 97.6% probability of a Fed rate cut in September after weak US job openings data.

• Investors look to US ADP Employment and ISM Services PMI data, due to guide near-term USD direction.

The Pound Sterling held firm on Thursday as the Bank of England (BoE) officials provided a combination of cautious and hawkish signals on the interest rate outlook. Governor Andrew Bailey emphasized uncertainty over how rapidly the central bank could cut rates, citing concerns over both inflation pressures and employment market risks. Meanwhile, Deputy Governor Clare Lombardelli and policymaker Megan Greene were firm on inflation, cautioning that easing monetary policy too early could jeopardize the BoE’s 2% inflation target. Their comments were in line with the central bank’s cautious approach to balancing growth with price stability.

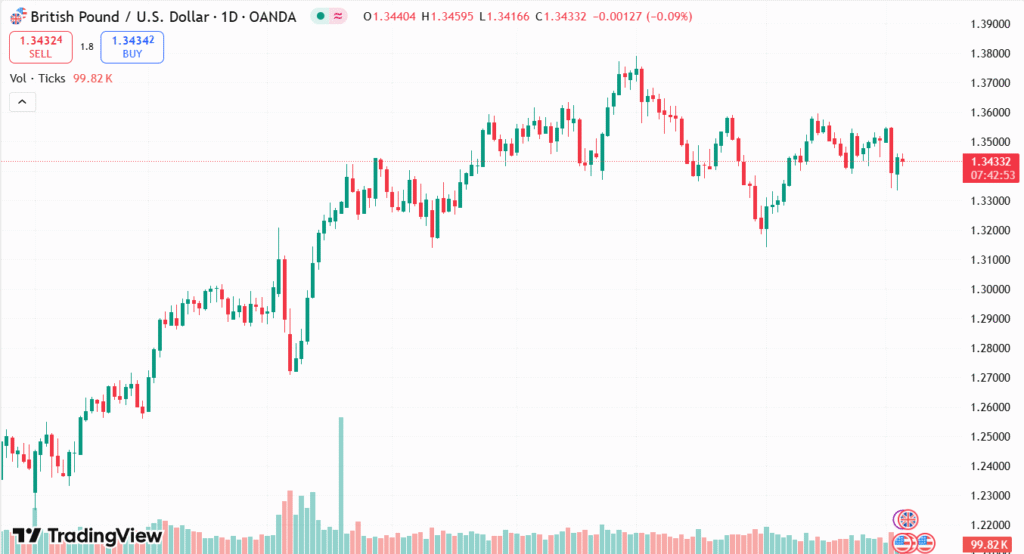

GBP/USD DAILY CHART PRICE

SOURCE: TradingView

Conversely, Monetary Policy Committee member Alan Taylor advocated a more rapid pace of rate reductions, seeing recent inflation rises as temporary and calling for more aggressive action to support economic activity. This split within the BoE highlights the nuance of the current policy debate, with officials divided between tackling inflationary risks and avoiding stress on the labor market. Meanwhile, investor focus has turned to forthcoming US economic releases, in particular the ADP Employment and ISM Services PMI data, as these will shape expectations for the Federal Reserve’s policy trajectory in the weeks ahead.

TECHNICAL ANALYSIS

GBP/USD pair is indicating near-term weakness as it trades below the 20-day Exponential Moving Average (EMA) at 1.3463, indicating bearish momentum. The 14-day Relative Strength Index (RSI) is in the neutral 40–60 zone, reflecting a lack of strong directional bias but leaning slightly to the downside. The key support is near the August 1 low of 1.3140, which, if breached, could pave the way for further losses. On the upside, the August 14 high around 1.3600 is a major resistance level, and a sustained break above it would be needed to indicate a bullish reversal.

FORECAST

If US data, especially ADP Employment and ISM Services PMI, fails to meet expectations, the US Dollar may weaken, supporting GBP/USD. A sustained rally above the 20-day EMA at 1.3463 may pave the way towards 1.3600, the August 14 high, which is a key resistance level. Positive surprises from UK economic data or a more dovish bias from the Federal Reserve could also support Sterling, keeping buyers engaged in the near term.

Conversely, better-than-expected US economic data may support the Dollar, putting further pressure on GBP/USD. A break below near-term support levels may drive the pair towards the August 1 low of 1.3140, which is a critical downside target. Moreover, ongoing uncertainty regarding the BoE’s monetary policy direction and ongoing inflation concerns in the UK may cap Sterling’s resilience, raising the risk of deeper losses if global risk sentiment is in favor of the Greenback.