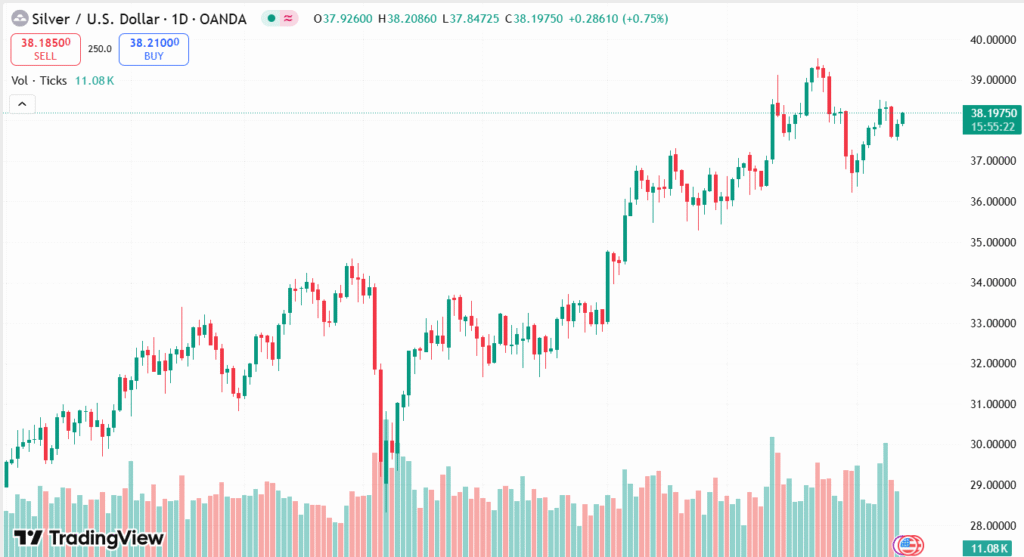

Silver (XAG/USD) is demonstrating fresh bullish vigor as it tests a pivotal descending trend-line resistance level around $38.20, its second day in succession of gains. Gauged by successive bounces off the 200-hour Simple Moving Average, silver is ready to break out higher to challenge important levels at $38.70, $39.00, and even $39.50—the level highest since early 2012. But a fall below $38.00, particularly below the $37.85 intraday low, can reinforce bearish sentiment and see prices fall further towards important support levels around $37.15 and $36.20. On the whole, the next steps in the market will depend on silver finding momentum staying above this key resistance.

KEY LOOKOUTS

• Observe the behavior of silver against this critical down trend-line; a solid breakout will point to further advances.

• The repeated bounces from this moving average indicate robust support for bulls on the underlying level.

• The $38.70, $39.00, and $39.50 levels are significant targets if the breakout is made.

• A prolonged decline below $38.00, particularly below $37.85, may pave the way for momentum to slide in favor of downside correction to $37.15 and $36.20.

Silver is now probing a pivotal resistance level at around $38.20, hovering near a falling trend-line that has capped advances since July. The metal’s recent bounces from the 200-hour Simple Moving Average lend good support, indicating that bulls are firmly in charge at least for the time being. If silver is able to clear this resistance, it could set up a rally to major targets at $38.70, $39.00, and even $39.50—prices not visited since the spring of 2012. On the other hand, an inability to stay above $38.00 could leave the door open for downward pressure, which could send prices back down to the $37.15 to $36.20 support zone.

Silver is challenging major resistance around $38.20, underpinned by sharp bounces off the 200-hour SMA. A move above here may propel prices to $39.50, while a fall below $38.00 may propel prices to lower levels.

• Silver (XAG/USD) is around $38.20, challenging a downtrend-line resistance line from July.

• The metal has risen two days in a row, indicating bullish momentum.

• Sustained bounces from the 200-hour Simple Moving Average signal heavy support.

• A move above $38.20 may drive silver to resistance levels at $38.70, $39.00, and $39.50.

• The $39.50 level is the highest since February 2012.

• A fall below $38.00 and the $37.85 intraday low could confirm resistance and lead to a bearish correction.

• Lower down moves may aim at support levels around $37.15 and $36.20.

Silver is drawing fresh interest from investors as it tests a critical resistance point of about $38.20. The metal’s recent upswing is a sign of increasing optimism surrounding its short-term outlook. Silver is gaining this attention during more general market forces favorable to precious metals such as inflation concerns and economic uncertainty. If silver is able to hold onto current strengths, it can continue to attract buyers seeking safe-haven assets or diversification within portfolios.

XAG/USD DAILY PRICE CHART

SOURCE: TradingView

Market players are keeping a close eye on the way silver behaves in the next sessions because it may dictate the course of the metal in the weeks to come. An extended move past present resistance levels would confirm the confidence of traders, which can induce more investment. Conversely, a breakdown may cause investors to stop and wait for better signals before committing. In general, silver continues to be a focus of commodity markets, with its behavior driven by a combination of economic, geopolitical, and sentiment-based factors.

TECHNICAL ANALYSIS

Silver is now probing a key declining trend-line resistance at $38.20 that has served as resistance since mid-year. The metal’s frequent bounces from the 200-hour Simple Moving Average signal a firm support level that has provided bullish drive. Bullish confirmation on the daily and hourly charts indicates that a breakout above this resistance would have the potential to trigger additional gains to key price levels at $38.70, $39.00, and $39.50. Failure to maintain above $38.00, on the other hand, would risk an upturn, with possible support levels around $37.15 and $36.20 potentially coming into force, highlighting the significance of these technical levels in determining short-term price action.

FORECAST

If silver is able to break and close above the $38.20 trend-line resistance, it may trigger fresh buying interest and propel prices upward towards the $38.70 and $39.00 levels. Further bullish pressure may even take silver up to the $39.50 level, a key level not visited since the early months of 2012. This would represent firm market confidence and may entice further investors wishing to profit from the rising trend.

Conversely, if silver is unable to hold support at or above the $38.00 mark and breaks down through the latest intraday low at around $37.85, it might see rising selling pressure. This fall could precipitate a more severe correction back to the $37.15 to $36.20 area of support. A breakout below $37.00 would more likely signal bearish sentiment, potentially paving the way for additional losses as market participants re-evaluate the metal’s short-term outlook.