Silver (XAG/USD) fell to close to $38.50 in Wednesday’s Asian session as profit-taking and a firmer US Dollar dragged the white metal lower. The pressure to the downside, though, could be restricted in light of renewed fears over the independence of the Federal Reserve following President Trump’s move to remove Fed Governor Lisa Cook. The move sparked debate about political influence on monetary policy, which could support safe-haven demand for Silver. Looking ahead, traders will closely watch the US July PCE Price Index report on Friday, as hotter inflation data could reinforce the US Dollar and cap Silver’s recovery, while softer numbers may revive expectations of a September Fed rate cut, boosting the metal’s appeal.

KEY LOOKOUTS

• Political uncertainties surrounding Trump’s bid to remove Fed Governor Lisa Cook create doubt, potentially encouraging safe-haven demand for Silver.

• Friday’s July PCE numbers will be a major mover; hotter inflation could make the USD stronger and put pressure on Silver, with softer readings likely to support bets for a rate cut.

• Increasing speculation of a September Fed rate cut may minimize the opportunity cost of holding non-yielding Silver, supporting its price.

• A stronger US Dollar is still a short-term headwind for Silver, and price action will continue to remain sensitive to USD movements.

Silver (XAG/USD) dipped to just below $38.50 during Wednesday’s Asian session as a stronger US Dollar and profit-taking weighed on the metal, but its downside can still be capped by fresh worries about the Federal Reserve’s independence. President Trump’s bid to oust Fed Governor Lisa Cook has created doubts regarding political interference in monetary policy, prompting safe-haven buying of Silver. Traders are also eagerly waiting for the US July PCE Price Index report, due to be released soon, which will be instrumental in setting up expectations for a likely September rate cut. A gentler inflation print might revive demand for the white metal, whereas a firmer reading might ensure that the USD remains supported and crush Silver further.

Silver (XAG/USD) dropped to $38.50 in the face of a firmer US Dollar and profit-taking. Fears over Fed independence and bets on a September rate cut might cap the downside. Traders now look to Friday’s US PCE inflation report for new direction.

• Silver price fell close to $38.50 in Wednesday’s Asian session.

• A rising US Dollar and profit-taking weighed on the white metal.

• Fears of Fed politicization emerged following Trump’s bid to remove Fed Governor Lisa Cook.

• Political interference with the Fed introduces uncertainty, favoring safe-haven demand for Silver.

• Market attention is now on the US July PCE Price Index report on Friday.

• Benign hotter inflation data may curb Fed rate cut possibilities, supporting the USD and dragging on Silver.

• Weaker inflation may resurrect September rate cut speculation, lowering the cost of carry for Silver.

The Silver market is at this point being driven by political and economic considerations that transcend short-term price fluctuations. One of the biggest concerns among investors is the Federal Reserve’s autonomy, which was put into question following President Trump’s bid to fire Fed Governor Lisa Cook. Such actions create worries of politicking in monetary policy, leading to uncertainty among financial markets. This mood tends to send investors towards safe-haven assets such as Silver, which has been described as a store of value in moments of instability.

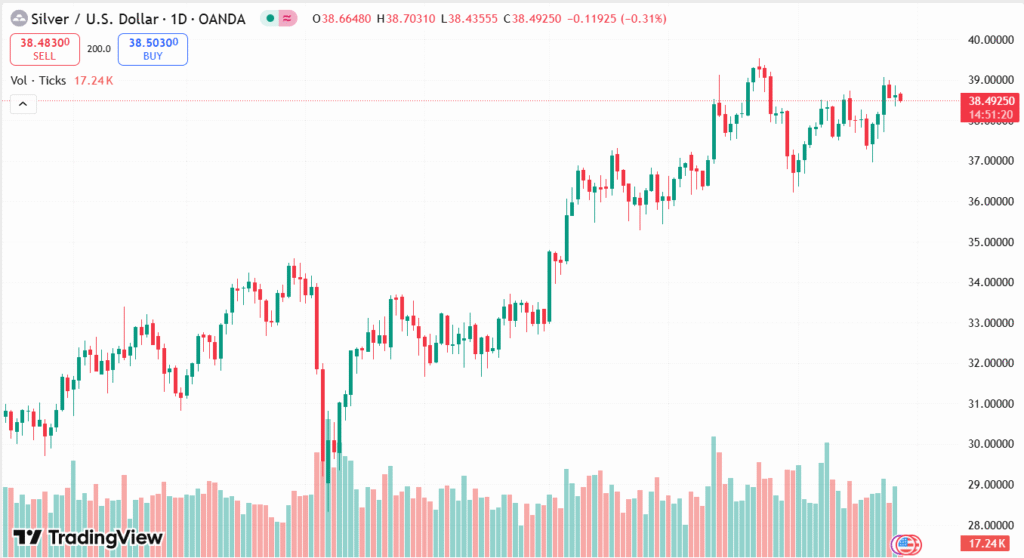

XAG/USD DAILY PRICE CHART

SOURCE: TradingView

Yet another sentiment-sustaining factor is the soon-to-be-released US July PCE Price Index, a leading indicator of inflation. The figures will give new clues to the Fed’s policy course, particularly in light of increasing speculations regarding a potential rate reduction in September. Concurrently, the wider global environment of economic stability and risk appetite of investors will remain in a position to influence demand for Silver. As political tensions and economic uncertainty are in the limelight, Silver remains sensitively aligned with market sentiments about safety and monetary policy direction.

TECHNICAL ANALYSIS

Silver (XAG/USD) is under pressure at the $38.50 level after pulling back from recent highs, with the metal trading near a two-week low. Near-term support is found at the $38.20–38.00 range, where buying demand could reappear, while a break through this area could expose the $37.50 level. Upward, first resistance appears at $39.00, followed by a solid barrier at $39.50, which coincides with recent swing highs. Momentum indicators are signaling caution, since buyers would require a sustained break above $39.50 to validate a recovery, or else breaking of support would maintain the near-term bias negative.

FORECAST

Silver might find shelter if political uncertainty surrounding the Federal Reserve’s independence continues to intensify. Safe-haven demand can potentially intensify as investors seek stability in the face of Trump’s bid to oust Fed Governor Lisa Cook, questioning central bank autonomy. Also, if the next US July PCE Price Index figures reveal softer-than-anticipated inflation, it would resurface hopes of a September rate cut. Lower rates make the opportunity cost of holding non-yielding instruments such as Silver lower, causing prices to return to the $39.00–$39.50 resistance level.

Conversely, Silver is still susceptible to additional losses if the US Dollar continues its recovery. A stronger Greenback increases the cost of USD-denominated commodities to foreign purchasers, putting a lid on demand. In addition, if the PCE inflation report prints hotter than expected, it may lower the prospects for near-term rate cuts, supporting USD strength and tugging Silver towards the $38.20 floor, with room for additional losses to $37.50 if bearish momentum continues.