Silver (XAG/USD) continues to sink, trading below $38.00 per ounce for the fourth consecutive session as weakening safe-haven demand acts as a drag on the metal. Enhanced geopolitical optimism with the Trump-Zelenskyy summit and hopes of future trilateral negotiations with Russian President Putin have knocked down demand for the grey metal. Though, dovish expectations about the policy direction of the US Federal Reserve, where the markets anticipate a high chance of a rate cut in September, may offer some support. Traders now await the Jackson Hole Symposium and the comments from Fed Chair Jerome Powell for more information about the policy outlook.

KEY LOOKOUTS

• Silver is trading below $38.00 for the fourth session in a row as safe-haven demand deters.

• Geopolitical optimism surges following Trump-Zelenskyy summit, with possible trilateral negotiations involving Putin.

• Fed policy expectations remain dovish, with markets assigning an 84% probability of a September rate cut.

• Attention shifts to Jackson Hole Symposium, where Jerome Powell’s address may determine short-term market sentiment.

Silver prices remain under downward pressure, falling below the $38.00 threshold as safe-haven demand tapers off with improving geopolitical sentiment. Optimism increased following the Trump-Zelenskyy summit, which suggested potential trilateral talks with Russian President Putin, alleviating war-related fears. In spite of weakness, silver could receive some support from dovish anticipation regarding the US Federal Reserve, with markets expecting a September rate cut. Investors currently look to the Jackson Hole Symposium and Fed Chairman Jerome Powell’s address for new leads on the monetary policy direction and whether silver prices may find a direction.

Silver (XAG/USD) is still low around $38.00 as declining safe-haven demand gets under the metal in the context of bettering geopolitical sentiment. Dovish expectations at the Fed and the Jackson Hole Symposium later this week may see prices find some potential lift.

• XAG/USD is trading lower than $38.00 for the fourth consecutive session.

• Safe-haven appetite deters due to improving geopolitical optimism.

• Meeting between Trump and Zelenskyy generates optimism for trilateral talks with Putin.

• Macron and Starmer, among other European leaders, were present at the high-level meeting.

• US Fed policy outlook remains dovish, and markets are anticipating a September rate cut.

• CME FedWatch tool indicates 84% chance of 25 bps cut.

• Investors look to Jackson Hole Symposium and Powell’s address for new direction.

Silver prices are now driven by changing geopolitical and economic narratives and not conventional safe-haven flows. The recent summit meeting between US President Donald Trump and Ukrainian President Volodymyr Zelenskyy, where top European leaders were in attendance, saw guarded hope for prospective diplomatic breakthroughs with Russia. Expectations of trilateral negotiations that include Russian President Vladimir Putin eased global risk concerns somewhat, tempering silver’s safe-haven demand in the short term. This has redirected investor attention from near-term geopolitical risks to the potential for an expanded peace discussion.

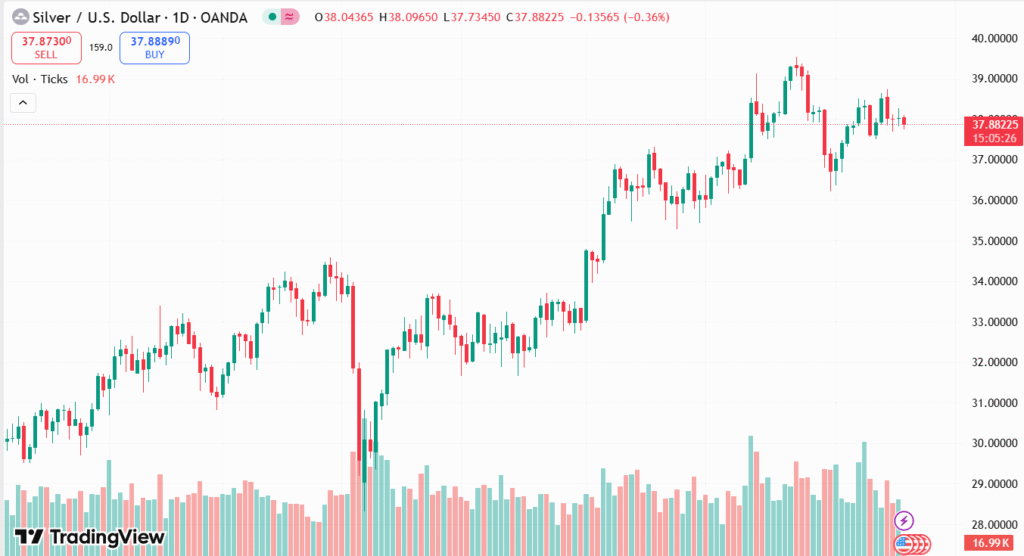

XAG/USD DAILY PRICE CHART

SOURCE: TradingView

From an economic perspective, the focus stays on the US Federal Reserve’s policy direction since recent data continues to support the expectation of monetary easing. With markets already pricing in a high probability of a September rate cut, investors are waiting for cues from the forthcoming Jackson Hole Economic Symposium. The speech of Fed Chair Jerome Powell is especially noteworthy, as it might offer some clarity regarding the next central bank moves. The convergence of de-escalating geopolitical tensions and dovish Fed expectations puts silver at the crossroads of international diplomacy and monetary policy, influencing its near-term path.

TECHNICAL ANALYSIS

Silver (XAG/USD) is finding it hard to stay above the $38.00 mark, indicating relentless selling pressure in the market. The metal has been under pressure for the last four consecutive sessions, indicating bearish momentum in the near future. A sustained decline below the $38.00 support would open up the next layers of resistance on the downside, and any attempt at recovery would have to regain the $38.50–$39.00 zone to draw new buying interest. Dealers will be taking a very close look at price action near these levels, because they will decide whether silver continues its fall or initiates a corrective rally.

FORECAST

Silver would be able to pick up positive momentum if dovish Federal Reserve expectations firm up, particularly if Fed Chief Jerome Powell reaffirms the chances of a September rate cut during the Jackson Hole Symposium. A weaker US Dollar and reduced yields would render the interest-free metal more desirable, and XAG/USD could be pushed towards the $38.50–$39.00 band again. Any further intensification of geopolitical tensions or any hold-up in peace talks would rekindle safe-haven buying, giving further support on the upside.

Conversely, silver could stay under pressure should optimism on the possible peace talks between Ukraine, Russia, and Western leaders persist in suppressing safe-haven flows. A strong grip below the $38.00 level would serve to entice sellers to force prices lower, aiming at new support levels. In addition, should Powell play it safe and signal slower or smaller rate cuts, the US Dollar might gain strength, putting more downward pressure on silver prices and capping its potential recovery.