Silver price (XAG/USD) is trading at around $36.30 with a bullish inclination as it remains within the path of an upward channel pattern. The precious metal has immediate resistance around $36.89, the highest since February 2012, while the lower boundary of the ascending channel around $36.10 provides crucial support. Technical charts, such as the 14-day RSI and nine-day EMA, indicate that bullish momentum is still intact, although a possible pullback cannot be discounted. A move above $36.89 may push silver towards $38.50, whereas a dip below the key support area may lead to a further correction to the 50-day EMA of $33.74 or even the two-month low of $31.65.

KEY LOOKOUTS

• Silver has a vital resistance level at $36.89; a breakout above this could firm the bull outlook and pave the way towards $38.50.

• The upper edge of the rising channel at $36.10, and then the nine-day EMA at $35.77, are vital supports to monitor for short-term stability.

• The 14-day RSI continues to be below 70, showing sustained bull momentum but also predicting scope for near-term pullback or consolidation.

• A strong fall below the 50-day EMA at $33.74 can result in further loss to the two-month low of $31.65.

Silver price (XAG/USD) is trading around $36.30, indicating consolidation after the recent rise. The metal is still in the uptrend channel, and hence the overall bullish trend continues. Immediate resistance is at $36.89, a price point not visited since February 2012, and a move above this has the potential to drive prices to the channel’s upper boundary at $38.50. In the event of a decline, support can be expected at the channel’s lower boundary at $36.10, followed by the nine-day EMA at $35.77. While the 14-day RSI indicates continuous bullish momentum, its location below the overbought threshold also suggests the potential for a short-term correction should major support levels fail.

Silver (XAG/USD) is trading at close to $36.30, above major support at $36.10 in a rising channel. A break above $36.89 might initiate fresh bullish momentum, while a fall below $35.77 could initiate a deeper correction. The 14-day RSI indicates bullish momentum continues but with caution for possible pullbacks.

• Silver is around $36.30 in the Asian session, retracing slightly from recent gains.

• Price is still within an uptrending channel, representing a dominant bullish trend.

• Primary resistance is at the February 2012 high of $36.89.

• Support is at the lower trend line of the uptrending channel near $36.10 and the nine-day EMA at $35.77.

• The 14-day RSI remains below 70, representing bullish strength with scope for minor pullbacks.

• A fall below $35.77 can result in a test of the 50-day EMA at $33.74.

• Non-closure below the 50-day EMA can pull the price down to the two-month low of $31.65.

Silver remains in the interest of investors as economic uncertainty and inflation fears around the globe fuel demand for safe-haven assets. Demand for the metal remains high, buoyed by its dual function as a precious metal and an industrial metal. Rising interest from investors looking to diversify has continued to keep silver on the radar, particularly as market participants seek alternatives in precious metals amid volatile currency exchanges and changing monetary policies.

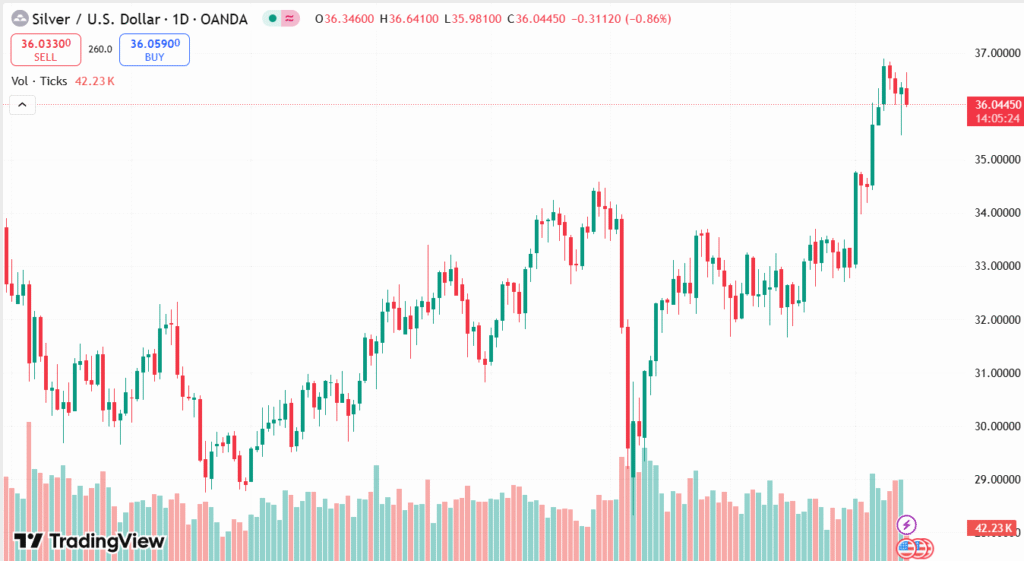

XAG/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Aside from its investment attractiveness, silver’s industrial demand remains strong, especially in applications like electronics, solar panels, and electric vehicles. The global move towards renewable energy and emerging technologies continues to support silver’s long-term prospects. As the industries increase their usage of silver for its particular conductive and reflective characteristics, the metal can continue to have strong demand growth in the future.

TECHNICAL ANALYSIS

Silver price is still in a clearly defined upward channel, showing continued bullish momentum. Price is trading above the nine-day Exponential Moving Average (EMA), which shows that short-term support is very strong. The 14-day Relative Strength Index (RSI) is just below the overbought region, meaning that while buyers are in control, the market can expect occasional consolidations or pullbacks. A successful breakout over the immediate resistance would further confirm the bull structure, while a breakdown below important support levels would signal a possible change in momentum.

FORECAST

If silver pierces the near-term resistance at $36.89, it may spur new bullish momentum, pushing the price towards the ceiling of the uptrend channel at $38.50. Ongoing strength in industrial demand, coupled with safe-haven demand in the face of global economic uncertainty, could also fuel the upside. Investor optimism and firm macroeconomic conditions could spur the bullish trend in the near term.

To the negative, a breakdown below support at $36.10 or the nine-day EMA level at $35.77 could set the stage for a more severe correction. A prolonged decline below these levels might leave silver vulnerable to the 50-day EMA at $33.74, and if bearish momentum accelerates, the price could challenge the two-month low at $31.65. Deteriorating industrial demand, superior U.S. dollar performance, or changes in interest rate expectations might put a lid on silver prices.