Silver (XAG/USD) prices climbed to a 14-year record high of $40.85 per troy ounce on Tuesday, boosted by firm safe-haven demand as investors become increasingly uncertain over the US Federal Reserve’s policy direction and autonomy. The persistent inflationary pressures, as indicated in July’s PCE Price Index, and the increasing hopes of a rate cut in September have heightened investors’ interest in precious metals. Political tensions over the US President Donald Trump’s sacking of the Fed Governor Lisa Cook and the lingering tariff disputes have also contributed to added market volatility, solidifying silver’s position as an attractive hedge during uncertain times.

KEY LOOKOUTS

• Markets expect the September Federal Reserve decision to be clarified, with a high chance of a 25 bps rate cut priced in.

• ADP Employment Change, Average Hourly Earnings, and Nonfarm Payrolls are some of the critical labor market releases that may move Fed expectations and silver demand.

• Safe-haven flows, driven by controversy over Trump’s removal of Fed Governor Lisa Cook and tariff decisions, can continue.

• Silver rally above $40.50 is being driven by investor demand fueled by global uncertainty and inflation fears.

Silver prices have jumped to their highest level since 2011, exceeding $40.85 a troy ounce, as investors rush into the precious metal as safe-haven demand increases. The rally comes at the back of continued inflationary pressures evidenced by July’s PCE Price Index, increasing market wagers for a September Fed rate reduction, and increasing political uncertainty. Fears over the independence of the Federal Reserve after President Trump sent packing the Fed Governor Lisa Cook, together with continuing controversy over tariffs, have further driven market volatility, making silver’s allure as a hedge against uncertainty during tough economic times.

Silver (XAG/USD) rose to a 14-year high at $40.85 an ounce, buoyed by robust safe-haven demand and uncertainty over Fed policy. Ongoing inflation concerns and political tensions amid Trump’s actions are fueling the rally of the metal.

• Silver price rose to $40.85, the highest since September 2011.

• Safe-haven demand picked up on Fed policy uncertainty and political tensions.

• July’s US PCE Price Index showed ongoing inflation pressures.

• Market participants now expect a 89% chance of a September Fed rate cut by 25 bps.

• Fed decision-making could be influenced this week by crucial US labor market releases (ADP, wages, NFP).

• Legal and political uncertainty increases following Trump’s removal of Fed Governor Lisa Cook.

• US tariff rows and court decisions against Trump’s trade policies contribute to market volatility.

Silver has become the focus of attention among investors by rising to its 14-year high, trading at $40.85 an ounce. The rise is mainly driven by a tsunami of safe-haven buying as global markets struggle with economic and political turmoil. Inflation fears are still center stage after the latest US PCE Price Index flashed continued price pressures, sharpening speculation about the Federal Reserve’s next step. With more investors wagering on a September rate cut, silver remains a top choice among those looking for stability in uncertain times.

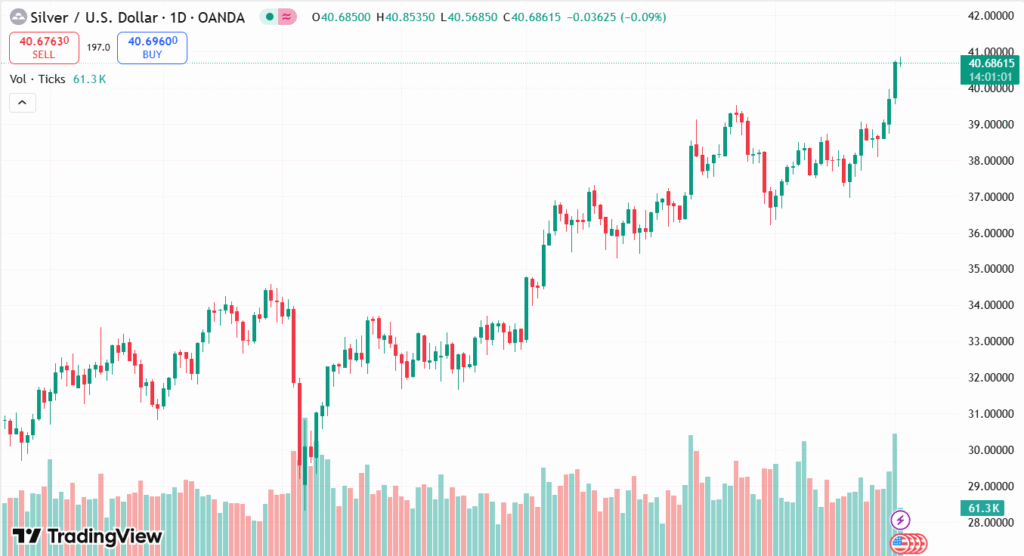

XAG/USD DAILY PRICE CHART

SOURCE: TradingView

In addition to economic statistics, political considerations are also influencing sentiment. Uncertainty over President Trump’s dismissal of Fed Governor Lisa Cook has cast doubt over the independence of the central bank, and persistent disagreements over tariffs further strained global trade ties. All these have reinforced silver’s position not only as a hedge against finance but also as a proxy for wider investor anxiety regarding governance, inflation, and the state of the world economy.

TECHNICAL ANALYSIS

Silver (XAG/USD) is firmly above $40.50, indicating strong bullish strength as it stays at all-time highs since 2011. A close above $40.85 for a sustained period would affirm the breakout and possibly pave the way for further increases, with the next resistance near $42.00. On the negative side, near-term support lies at $40.00, followed by $39.20, where purchases could resurface if the prices experience a retreat. The overall technical setup indicates buyers are still in charge with safe-haven demand propping up the rally.

FORECAST

If silver holds above $40.50, the trend of buying can carry on further, with the next resistance target at $42.00 in view. A solid break above will open the doors to $43.50 and higher, driven by continued safe-haven demand, uncertainty surrounding Fed policy, and lingering inflation pressures. Strong economic or political drivers have the potential to be catalysts for further gains.

Conversely, if silver cannot hold its rally and is hit by profit-taking, early support lies near $40.00, followed by deeper demand areas at $39.20. A fall below these levels may prompt further corrections to $38.50. Nonetheless, with increased global uncertainty and record investor demand for safe-haven assets, such a pullback may stay contained and draw in new buying interest.