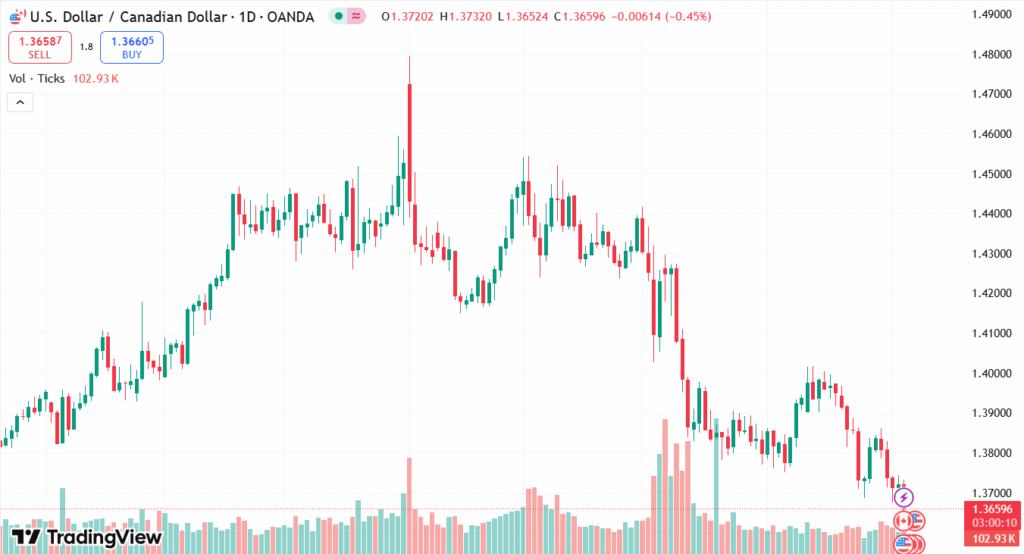

USD/CAD fell below the critical 1.3700 level following the Bank of Canada (BoC) decision to maintain interest rates at 2.75%, an indication of caution in light of continued inflation and trade uncertainty with the US. The Canadian Dollar found support from the high Q1 GDP growth and the BoC cautious outlook. Meanwhile, the US Dollar fell broadly after disappointing May data, including a sharp miss in ADP employment and a softer ISM Services PMI, increasing bearish pressure on USD/CAD. The BoC remains watchful of ongoing trade tensions and domestic demand softness, indicating that future rate cuts could be possible if economic conditions worsen.

KEY LOOKOUTS

• Bank of Canada’s hold on interest rates at 2.75% as it takes a conservative approach in the face of inflation and trade volatility.

• Influence of lackluster US economic news, particularly the poor ADP employment reading and lower-than-anticipated ISM Services PMI.

• Ongoing momentum of the Canadian Dollar led by strong Q1 GDP growth and resilient exports in the face of trade tensions.

• Probability of future cuts in the BoC policy rate if economic performance worsens further in response to rising US tariffs and weakening domestic demand.

The Bank of Canada’s policy rate decision to leave the policy rate at 2.75% represents a balanced stance given the prevailing pressures from inflation and pervasive uncertainty triggered by US trade policy. Although Canada’s economy recorded better-than-projected growth during the first quarter, propelled by gains in exports and inventory accumulation before tariffs, the outlook is guarded. The BoC pointed to risk around cooling domestic demand and susceptible trade-sensitive industries fueled by uncertain US tariff policies. This conservative tone, coupled with weak US employment and services numbers, has placed bearish pressure on the US Dollar and aided the Canadian Dollar’s rally against the currency in recent times.

The Bank of Canada left rates unchanged at 2.75%, citing inflation risk and trade uncertainty with the US. Underwhelming US jobs and services data further dented the US Dollar, allowing the Canadian Dollar to appreciate against it. Traders are still wary of future rate action in spite of ongoing economic threats.

• The Bank of Canada left its policy rate unchanged at 2.75%, as expected by the markets.

• BoC mentioned sustained inflation and continued US trade policy uncertainty as justification for keeping rates.

• Canadian Q1 GDP growth surprised above estimates, helped by export spikes and inventory accumulation.

• The US Dollar lost ground overall after May ADP jobs growth disappointed and ISM Services PMI dipped below estimates.

• USD/CAD fell below the important psychological level of 1.3700, reaching a lowest since October 2024.

• BoC Governor Tiff Macklem highlighted the volatility of US trade policies as a key economic headwind.

• The BoC indicated that future rate reductions are still possible if economic conditions worsen due to rising tariffs and moderating demand.

The Bank of Canada’s recent move to maintain interest rates unchanged at 2.75% is a testament to its conservative tone in the face of uncertainty in the economy. Although the Canadian economy experienced robust growth in the first quarter, much of that strength was based on rising exports and inventory accumulation in preparation for fresh US tariffs. Nevertheless, persisting trade tensions with the US remain a dark cloud over economic prospects. The central bank is keeping watch on inflation developments, observing that supply chains disrupted by tariffs have caused core inflation to rise, while headline inflation has moderated.

USD/CAD DAILY PRICE CHART

CHART SOURCE: TradingView

Meanwhile, on the other side of the border, softer-than-expected US employment and services sector data have dulled the US Dollar, further affecting currency markets. Bank of Canada’s focus on US trade policy uncertainty emphasizes the challenges for the two economies. As Canadian domestic demand has been languid and there are labor market challenges in trade-sensitive industries, the BoC’s prudence communicates the potential for future policy loosening if conditions deteriorate. This setting reflects the continued influence of geopolitical issues on economic stability and monetary policy making.

TECHNICAL ANALYSIS

USD/CAD has fallen below the critical psychological support level of 1.3700, indicating heightened bearish momentum for the pair. The pair’s drop to its October 2024 lows indicates sellers are firmly in charge with prevailing US Dollar weakness. Moving averages are beginning to steepen downwards, supporting the bearish bias, with momentum indicators such as the RSI also declining but not yet oversold, suggesting scope for further falls. Traders will be looking closely for signs of support at the 1.3600 level, which could temporarily stem the decline, but overall technical bias is skewed towards further weakness as long as the BoC holds its cautious line and US data remains weak.

FORECAST

USD/CAD can continue to be pressured downward in case the Bank of Canada is guarded and US economic releases do not indicate improvement. The Canadian Dollar could gain further, particularly if trade tensions subside or if the BoC indicates preparedness to initiate easing measures such as rate cuts if economic conditions deteriorate further. Levels around 1.3600 will be the key to monitor for possible halts or reversals of the pair’s downtrend.

Nonetheless, any surprise hawkish BoC signals or shock upside in US employment and services statistics would see the US Dollar rebound, sending USD/CAD above the 1.3700 level again. Global risk appetite and commodity price action, especially oil, may also dictate the direction of the pair. Market participants should be on guard for spikes in volatility driven by geopolitical events or central bank commentary that might turn the trend around.