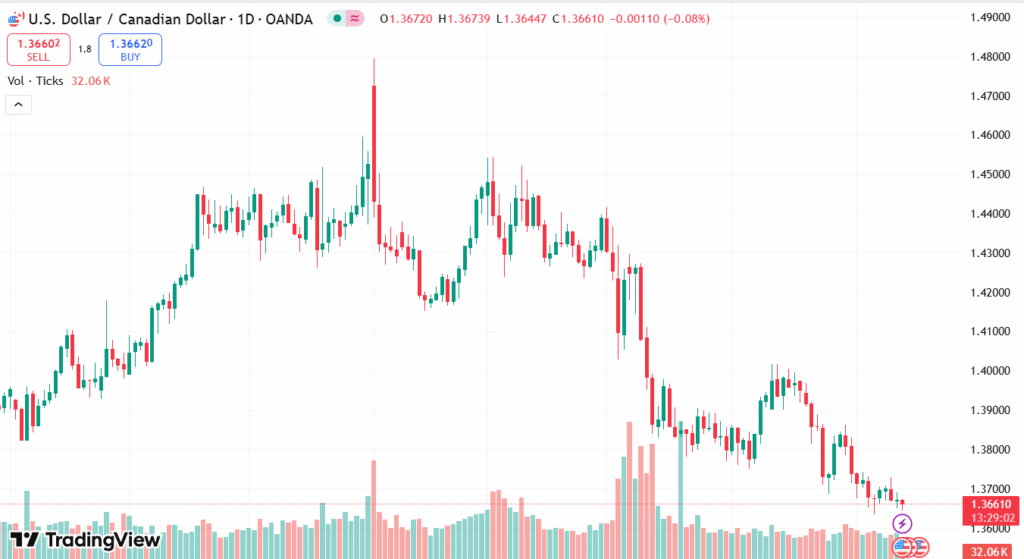

The USD/CAD currency pair continued its downward slide, dipping to around 1.3650 on Thursday’s Asian trading session, near its eight-month low of 1.3634. The pair continues to be under constant bearish pressure, moving within a falling channel pattern. Technical indicators, including the 14-day Relative Strength Index (RSI) holding marginally above 30 and the price below the nine-day Exponential Moving Average (EMA), still point to weak momentum. A clean break below 1.3634 may set the stage for further declines to 1.3450 and 1.3419. On the other hand, any rally may encounter initial resistance at 1.3695, with firmer hurdles around 1.3720 and 1.3874.

KEY LOOKOUTS

• The duo is near its eight-month nadir; a breach below may induce further falls towards 1.3450 and 1.3419.

• The 14-day RSI is still just above 30, which continues bearish pressure; a decline below this level might indicate an oversold situation and potential bounce.

• Near-term resistance is near the nine-day EMA and the top of the falling channel, which may cap any upside attempts.

• If upward momentum is regained, the pair can aim at the 50-day EMA at 1.3874 and subsequently the high of two months at 1.4016.

USD/CAD pair is still experiencing selling pressure, trading close to 1.3660 and testing major support levels with bearish sentiment prevailing in the market. The duo is still held in a bearish descending channel, and indicators like the 14-day RSI resting just above 30 and price remaining below the nine-day EMA at 1.3695 indicate minimal upside momentum. If bears drive the pair under key 1.3634 support, additional losses toward 1.3450 and 1.3419 may develop. Conversely, any upward correction can find resistance around 1.3695 and 1.3720, with a better recovery possibly aiming for 1.3874 and 1.4016.

USD/CAD is trading around 1.3660, nearing its eight-month low in the wake of continuous bearish pressure. Its key support stands at 1.3634, with further decline possible if this support is breached. Its nearest resistance comes at 1.3695, capping any possible recovery.

• USD/CAD is trading at 1.3660, near the eight-month low of 1.3634.

• The pair is under bear pressure, trading in a falling channel pattern.

• The 14-day RSI remains marginally above 30, reflecting bear momentum with minimal upside potential.

• A decline below 1.3634 may take the pair to 1.3450 and 1.3419 support levels.

• Intraday resistance is at the nine-day EMA of 1.3695, followed by 1.3720.

• A break above 1.3720 can clear the way to the 50-day EMA of 1.3874 and May’s high of 1.4016.

• Short-term sentiment in the market remains negative unless major resistance levels are taken out.

The USD/CAD currency pair remains in the spotlight as wider market forces and economic fundamentals dictate investor attitude. Global risk appetite, commodities prices, and monetary policy expectations of the Federal Reserve and the Bank of Canada have been key drivers in recent changes. Other factors include oil prices, as they tend to influence the Canadian Dollar because Canada is a top oil producer, that are currently directing the pair’s overall trajectory.

USD/CAD DAILY PRICE CHART

CHART SOURCE: TradingView

At the same time, investors are also watching closely for upcoming releases of economic data such as inflation rates, employment reports, and central bank statements from both nations. All these help support continued volatility and uncertainty across currency markets as the traders move to adjust their positions in line with changing economic signals and geopolitical events. The interaction between the global safe-haven status of the US Dollar and the commodity-linked dynamics of the Canadian Dollar continue to be a primary propellant for the pair.

TECHNICAL ANALYSIS

USD/CAD is under pressure in a defined bearish channel on the daily chart. The pair is below the nine-day Exponential Moving Average (EMA), which reflects poor short-term momentum. The 14-day Relative Strength Index (RSI) is just above the 30 level, which means the bearish slope is still in place but is reaching oversold levels. A dramatic drop below the recent low at 1.3634 would precipitate deeper losses, and any rally would encounter initial resistance at the nine-day EMA of 1.3695, followed by the channel’s upper edge at 1.3720.

FORECAST

USD/CAD could drop below the crucial support level of 1.3634, leaving the pair vulnerable to further losses towards 1.3450. Ongoing selling pressure could later even drive the price down to 1.3419, levels last witnessed in February 2024. Weaker US Dollar sentiment, more robust Canadian economic news, or higher oil prices could potentially speed up this falling path.

On the positive side, a continued recovery above the nine-day EMA at 1.3695 could mean a short-term reversal of the uptrend. A break above the upper edge of the descending channel at around 1.3720 might set the way for a move to the 50-day EMA at 1.3874. If buying pressure gains further, USD/CAD might try to reapproach the two-month high of 1.4016, which was last witnessed in mid-May.