USD/CAD currency pair remains in a bearish tendency, trading close to 1.3720 during early European trading on Tuesday. The downward trend is fueled by a weaker US Dollar, under pressure due to a truce between Iran and Israel as well as dovish utterances from the US Federal Reserve, with Fed Governor Michelle Bowman suggesting that the Federal Reserve might cut interest rates in July. Technically, the pair is still below the 100-day EMA and bears bearish momentum with the RSI in the low zone. Critical support is at 1.3635, while resistance is at 1.3820, maintaining the bearish outlook in place unless a decisive breakout above key resistance levels.

KEY LOOKOUTS

• A break below this level may trigger further decline to 1.3575 and 1.3540.

• The pair has to break this level in order to test higher resistance at 1.3862 and 1.3935.

• Being below the 100-day EMA and the RSI below 50 implies persistent bearish pressure.

• Any additional indications of Fed rate cuts would bear down on the US Dollar and add to CAD strength.

The USD/CAD currency pair is still under bearish pressure as it hovers close to 1.3720 in early European trade, pressured by dovish comments from the US Federal Reserve and de-escalation of geopolitical tensions in the Middle East. A short-term ceasefire between Iran and Israel has curbed safe-haven demand for the US Dollar, while Fed Governor Michelle Bowman’s mention of a possible July rate cut has contributed to weakness in USD. Technically, the pair remains below the 100-day EMA and the RSI is below the neutral 50 mark, adding credence to a bearish bias. Traders are watching the pivotal support level of 1.3635, with more significant downside risks on a break below this zone.

USD/CAD is trading around 1.3720 in a bearish fashion with a weaker US Dollar and dovish Fed cues. The pair remains below the 100-day EMA, and the support is at 1.3635 while the resistance is at 1.3820. Breaking below support may lead to further losses down to 1.3575.

• USD/CAD is trading around 1.3720 in early European trading, and it continues to be in a bearish mood.

• The pair remains below the 100-day Exponential Moving Average, indicating bearish pressure.

• RSI lingers below the 50 level, supporting weak bullish momentum.

• Fed Governor Michelle Bowman suggested a potential July rate cut, pressuring the US Dollar.

• Geopolitical tensions subside as Iran-Israel ceasefire comes into effect, cutting safe-haven demand.

• Support is at 1.3635, then 1.3575 and 1.3540 on sustained losses.

• The resistance is at 1.3820; breaking above it could pave the way to 1.3862 and 1.3935.

The USD/CAD pair is under pressure following the changing geopolitical and monetary policy trends. An agreement for a ceasefire between Israel and Iran has mitigated market tensions, leading to moving away from safe-haven currencies such as the US Dollar. This development has benefited commodity currencies such as the Canadian Dollar, particularly as global energy markets react to lower supply disruption risk. The diplomatic progress has introduced some stability into markets, which has enabled investors to begin to concentrate once again on economic fundamentals and central bank cues.

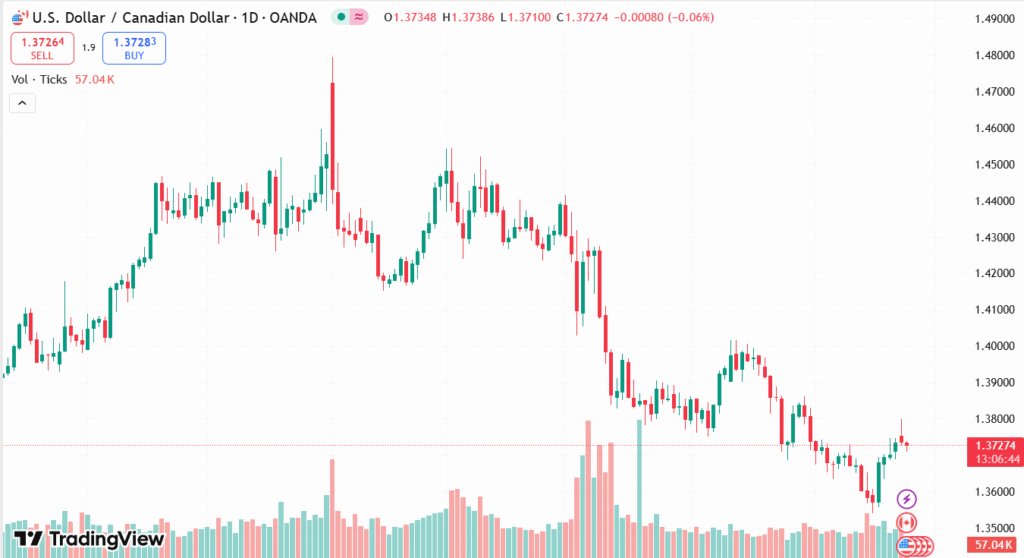

USD/CAD DAILY PRICE CHART

SOURCE: TradingView

Compounding the US Dollar’s weakness are dovish indications emanating from the Federal Reserve. Fed Governor Michelle Bowman’s rhetoric hinting at a willingness to cut rates in July has fueled hopes of a more accommodative policy. The change of tone is weakening demand for the Greenback and adding to the Canadian Dollar’s strength. As sentiment adjusts to the prospect of lower US interest rates and diminished geopolitical risk, USD/CAD can continue to be pressured unless later economic data turns the outlook drastically.

TECHNICAL ANALYSIS

USD/CAD has a bearish inclination as it moves below the 100-day Exponential Moving Average (EMA), which is one of the most important medium-term trend direction indicators. The 14-day Relative Strength Index (RSI) is also below the middle of the neutral 50 level at 47.75, indicating diminishing bullish momentum. The pair is immediately supported at 1.3635, the June 18 low, then at 1.3575 just below the lower Bollinger Band and 1.3540, the June 16 low. On the other side, resistance is at 1.3820, consistent with the upper Bollinger Band. An extended advance above this level may set the stage for a challenge of 1.3862 and possibly the 100-day EMA at 1.3935.

FORECAST

The USD/CAD currency pair is expected to stay pressured if it remains below the 100-day EMA and is unable to regain buying momentum. Breakout below the near-term support of 1.3635 may initiate further losses to 1.3575, which serves as the lower edge of the Bollinger Band. Should bearish sentiment continue, the next substantial support is at 1.3540, the low made on June 16. Further US Dollar weakness on account of dovish Fed rhetoric and calm geopolitical tensions could speed up the breakdown move.

Conversely, a rebound above the 1.3820 resistance level would alter the mood toward a short-term bullish reversal. If the duo is able to hold above this area, it can draw buying interest and move towards 1.3862, the May 29 high. Another break above it could set the stage towards the pivotal 100-day EMA level of 1.3935. Upside risk, though, remains limited unless backed by a more robust US Dollar or a change in risk appetite.