USD/CAD is currently trading above 1.4300, consolidating as investors await Fed Jerome Powell’s testifying for future interest rate policies. The Fed kept its key rates unchanged at 4.25%-4.50%, with no cuts expected in 2025. In the meantime, the 25% tariffs of Trump on steel and aluminum create pressure on the Canadian economy, making the outlook for the CAD bearish. Market participants also keep an eye on US CPI data for further direction. Technical indicators remain sideways, while resistance is present at 1.4380 and the pair may rise as high as 1.4500. Support below 1.4270 could push prices lower.

KEY LOOKOUTS

• Investors await Powell’s speech to know whether the Fed is going to extend its interest rates at 4.25%-4.50% in 2025 or not.

• 25% tariffs on steel and aluminum may weigh heavily on the Canadian economy, bringing a bearish trend for CAD/USD.

• Tocky Wednesday, Consumer Price Index (CPI) data will be out. This will impact market sentiment and further provide cues about inflationary trends affecting Fed policy.

• The upside would be further possible only if the USD/CAD breaks above 1.4380. If it drops below 1.4270, a deeper correction can be witnessed.

Wednesday’s Fed testimony by Chair Jerome Powell and the subsequent silent of interest rate policy keep the USD/CAD under the spotlight, with investors watching carefully for further clues. Since the Fed has held rates at 4.25%-4.50%, it is of immense interest to see if cuts are delayed until the end of 2025. Meanwhile, tariffs imposed by Trump on steel and aluminum at 25% are going to devastate Canada and will continue to reinforce a bearish view of the CAD. The US CPI data is going to be an important driver for expectations around inflation and monetary policy. Tactically, key resistance is seen at 1.4380. A clear break above here should send prices higher, while any move below 1.4270 should put support at risk and ideally could see a stronger fall.

The USD/CAD pair still trades above the 1.4300 line as investors keep an eye out for Fed Chair Powell’s testimonial for key interest rate policies. The announcement of 25% tariffs imposed by Trump on steel and aluminum is weighing against the Canadian Dollar, while positive US CPI later in the session will have enough influence on sentiment. Key level to watch up: 1.4380. Key level to watch downside: 1.4270

• The pair remains steady pending key economic events.

• Traders look for signals on how long the Fed will keep rates at 4.25%-4.50%.

• The Canadian economy faces pressure as the U.S. imposes tariffs on steel and aluminum.

• The inflation report on Wednesday could influence future Fed policy decisions.

• Investors remain uncertain, leading to a tight trading range of 1.4270-1.4380.

• A breakout above this level could push USD/CAD toward 1.4500.

• A break below might push the price lower to 1.4195 and then to 1.4120.

The USD/CAD is still trading flat above 1.4300, as traders are waiting for Fed Chair Jerome Powell to testify before Congress. Market participants are looking for clues on how long the Federal Reserve will keep interest rates at 4.25%-4.50%, with many analysts expecting no rate cuts in 2025. Concerns over Trump’s 25% tariffs on steel and aluminum continue to weigh on the Canadian economy, as Canada is the largest exporter of aluminum to the United States. Such levies may mean higher inflation rates in the US, and by extension, that the Fed must continue its existing monetary policy much longer.

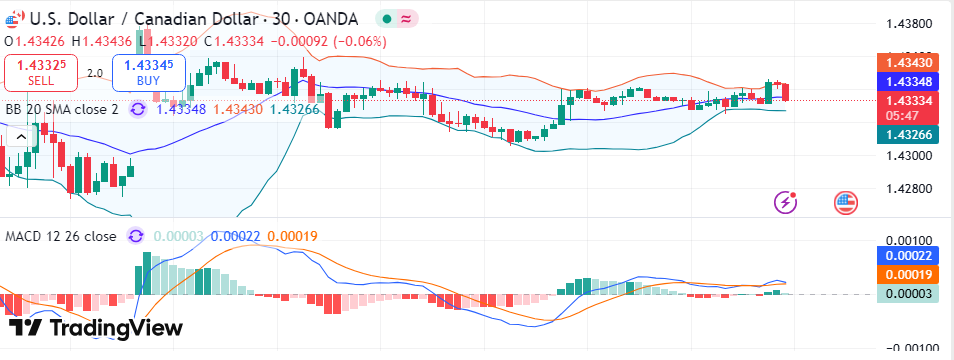

USD/CAD Daily Price Chart

TradingView Prepared by ELLYANA

USD/CAD is trading between 1.4270 and 1.4380; 1.4380 serves as a pivotal resistance point for the pair. A breakout above this could take the pair towards 1.4500, whereas a push below 1.4270 could lead to more losses toward 1.4195 and 1.4120. Another event that markets are eagerly awaiting is the U.S. Consumer Price Index (CPI) data scheduled on Wednesday; this will have considerable ramifications in shifting market sentiment and increasing demand for USD. With various economic and political factors present, the outcome of the USD/CAD seems uncertain, but Powell’s testimonial and then the CPI to be released shall be the primary drivers for a future price shift.

TECHNICAL ANALYSIS

In the USD/CAD, consolidation is seen over a tight band of 1.4270-1.4380 due to the scheduled economic events; the 50-period Exponential Moving Average has been seen resisting the upside trend at around 1.4365. Meanwhile, the 14-period Relative Strength Index (RSI) is in the 40.00-60.00 area, showing a neutral to sideways trend. A break above 1.4380 would be likely to push the pair to the round-level resistance of 1.4500, and then to the January 30 high of 1.4600. A break below 1.4270 could be seen as a trigger for further losses down to the December 10 high of 1.4195 and then to the December 11 low of 1.4120. Traders will watch for the volumes to build and confirmation signs before making a directional bet.

FORECAST

Should USD/CAD break out of the resistance line at 1.4380, further gains could occur for the currency, and that’s towards round number resistance 1.4500. An increased breakout through the latter would lead the currency pair to move further to January 30 highs at 1.4600 with the boost in positive economic numbers from the US or more hawkish speeches by Fed Chairman Powell. Additionally, sustained inflationary concerns in the U.S., potentially fueled by Trump’s 25% tariffs, could lead to higher USD demand, reinforcing the pair’s upward trajectory. If the Fed delays rate cuts throughout 2025, the U.S. dollar may strengthen further, keeping USD/CAD in an uptrend.

On the downside, if USD/CAD goes below the February 5 low of 1.4270, it might reflect increased bearish pressure that could drag the pair toward the December 10 high of 1.4195. Further below this level, it would open the door for a possible dip toward the December 11 low of 1.4120. Any signs of a softer U.S. Release of CPI data or dovish comment from Powell will weaken USD; hence the pair will increase the selling pressure. In case, oil price surges-the crude oil correlated Canada dollar could see strength against it, that in turn USD/CAD has an upside room in the bottom line.