USD/CHF pair continued to fall below the level of 0.8250, weakening to near 0.8230 in early European session on Friday, as it was motivated by chronic trade-related uncertainties and safe-haven flows for the Swiss Franc. These developments, ranging from a temporary tariff truce against the US and geopolitical tensions in the Middle East and Ukraine, still bear down on the US Dollar. On the other hand, the Swiss National Bank should be holding fire on its monetary policy, with an upcoming rate decision under strict market scrutiny. Traders now turn their focus to the US April Personal Consumption Expenditures (PCE) Price Index and other key economic data due later in the day, which could provide fresh direction for the pair.

KEY LOOKOUTS

• Market eyes the upcoming Personal Consumption Expenditures data for signs of inflation trends and potential impact on the USD.

• Policymakers’ remarks and SNB’s expected rate cut to 0% on June 19 will drive CHF strength.

• Uncertainties regarding US tariffs and the temporary reprieve by the federal court cause volatility and underpin safe-haven flows.

• Rising Middle Eastern tensions and Russia-Ukraine conflict continue to support demand for the Swiss Franc as a safe-haven currency.

Traders are concentrated on a number of determinantal factors driving the USD/CHF outlook. The US April Personal Consumption Expenditures (PCE) Price Index, a key inflation gauge, is expected later today and could significantly influence the US Dollar’s near-term direction. Meanwhile, the Swiss National Bank’s upcoming policy meeting on June 19, where a rate cut to 0% is widely anticipated, continues to underpin the Swiss Franc’s appeal. Recurring uncertainty over trade, such as the recent federal court temporary halt on US tariffs and the potential introduction of new tariff instruments, continues to contribute to market volatility and safe-haven demand. Moreover, recurrent geopolitical tension in the Middle East and Russia-Ukraine conflict are further supporting the Swiss Franc as investors gravitate towards stability against emerging global threats.

Market focus is on the US April PCE release, which may influence the path of the USD. The anticipated rate cut from the Swiss National Bank and persistent trade tensions continue to favor the safe-haven Swiss Franc. Geopolitical tensions also contribute to the CHF’s allure in the environment of global risk aversion.

• USD/CHF has fallen below 0.8250, down to approximately 0.8230 during early European trading.

• Ongoing trade-related uncertainty is stimulating demand for the safe-haven Swiss Franc.

• A federal appeals court suspended temporarily a broad ruling on US tariffs, introducing uncertainty into trade policies.

• The US administration has weighed tariffs of up to 15% for 150 days but no final action has been taken.

• Middle East geopolitical tensions and the war between Russia and Ukraine continue to underpin safe-haven flows to CHF.

• The Swiss National Bank is due to lower its benchmark rate to 0% on June 19 and effectively terminate a cycle of positive monetary policy.

• Dealers wait for US April Personal Consumption Expenditures (PCE) Price Index and other major economic releases for new market guidance.

The Swiss Franc has picked up momentum in recent times as global uncertainties keep unsettling the markets. Persistent trade-related issues and hesitations to finalize US tariff announcements have raised investor caution. Further, geopolitical tensions in hotspots such as the Middle East and the Russia-Ukraine conflict are leading most to look for safe havens, which favors currencies such as the Swiss Franc.

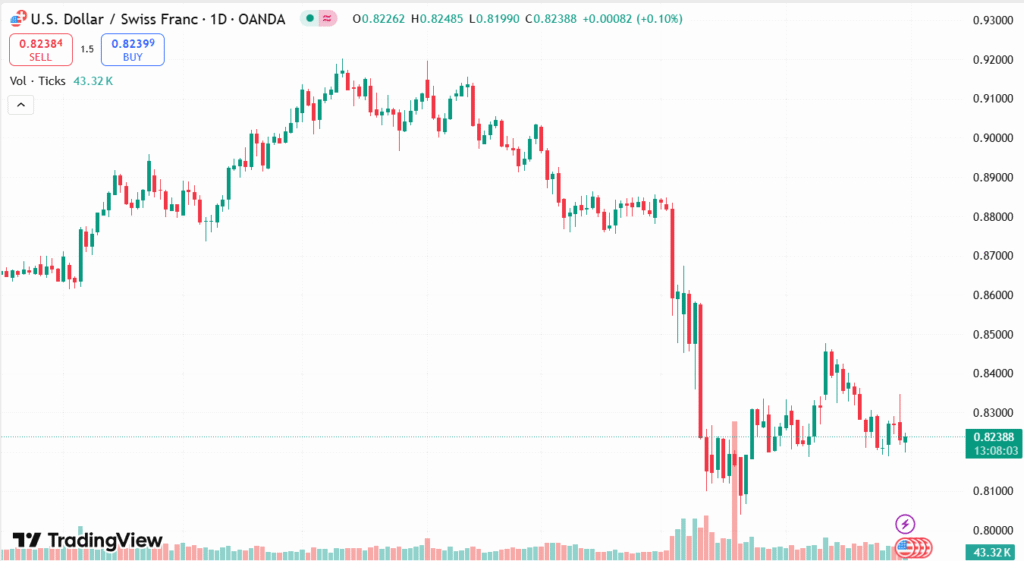

USD/CHF DAILY PRICE CHART

CHART SOURCE: TradingView

In the near future, there is focus on significant economic releases in the United States, such as the soon-to-be-released report on personal consumption expenditures, which serves as an indicator of inflation. At the same time, the Swiss National Bank is gearing up for a policy session during which there will be a shift in interest rates. These events, along with the uncertain global atmosphere, are bound to shape the performance of the Swiss Franc and US Dollar in the short run.

TECHNICAL ANALYSIS

USD/CHF currency pair is indicating bearish momentum since it fell below the 0.8250 level of support, now testing at the 0.8230 zone. The downtrend is underpinned by heightened selling pressure and no strong bull reversals in previous sessions. Critical moving averages are converging around current prices, which may serve as dynamic resistance if the pair tries to bounce back. Traders will be looking for a steady close below 0.8230 to validate further weakness, while any rebound back above 0.8250 could indicate short-term range bound or potential correction.

FORECAST

If the next US economic data, specifically the Personal Consumption Expenditures (PCE) report, reveals stronger-than-anticipated inflation or consumer spending, the US Dollar may gain fresh vigor. This would result in a short-term USD/CHF pair rebound, sending it back above significant resistance points such as 0.8250. Any indication of eased sentiments in the geo-political sphere or clearer signals from the Swiss National Bank on keeping rates unchanged could also underpin a revival in the pair.

Conversely, persistent trade uncertainties, geopolitical risks, and weak US economic reports could continue to weigh on the US Dollar, subjecting the USD/CHF to further pressure. A confirmed break and close below the 0.8230 mark could pave the way for further losses, potentially extending to lower support levels. The safe-haven appeal of the Swiss Franc and anticipation of an SNB rate cut could sustain downward pressure in the pair in the short term.