The USD/CHF currency pair continues to go lower, trading around 0.8960 in Asian trading and sustaining losses for the third straight session. The technical indicators are indicating a persistent bearish bias, with the pair trading below both the nine- and 14-day EMAs and the RSI holding below the 50 mark, supporting further weakening. Market sentiment is pointing towards a move towards the psychological support level of 0.8900, and a break below this level may open the way for a further fall, possibly to the two-month low of 0.8736. On the other hand, a bounce above the nine-day EMA of 0.9009 may indicate a short-term bounce, opening the way for an advance towards the nine-month high of around 0.9201.

KEY LOOKOUTS

• The pair remains under bearish pressure, trading below both the nine- and 14-day EMAs, which reinforces a continued downtrend and potential further depreciation.

• An RSI persistently below 50 underscores the bearish trend, signaling oversold conditions that may prompt an upward correction after further downside extension.

• A break below the key support at 0.8900 would trigger further declines, with possible targets being the two-month low of 0.8736 if the selling pressure accelerates.

• On the other hand, a break above the nine-day EMA of 0.9009 could be a sign of short-term bounce and lay the groundwork for moving higher towards the nine-month high of 0.9201.

USD/CHF is still under strong bearish pressure, trading below the nine-day and 14-day EMAs, which supports a strong downtrend and further weakening. The 14-day RSI always stays below 50, reflecting oversold levels that could trigger a corrective bounce after more price falls. If the pair breaks below the key psychological support of 0.8900, it may speed up a deeper fall towards the two-month low of 0.8736. In contrast, a breakdown below the nine-day EMA at 0.9009 can initiate short-term recovery with a potential stage set for the testing of the nine-month peak around 0.9201.

USD/CHF trades below crucial moving averages with the 14-day RSI below 50, indicating bearish sentiment and continued depreciation. Breaking below 0.8900 may send the pair towards the two-month trough at 0.8736, while advancing above 0.9009 may initiate a short-term correction.

• Trading close to 0.8960 during Asian trading.

• Sustained losses over three consecutive sessions.

• Trades below both the nine-day and 14-day EMAs, showing bearish momentum.

• The 14-day RSI is still below 50, supporting the bearish trend.

• Psychological support at 0.8900, a break potentially triggering more declines.

• A fall below 0.8900 might have the pair targeting the two-month low at 0.8736.

• On the positive side, the nine-day EMA of 0.9009 is serving as the key resistance, with rebound potentially stretching to the nine-month high around 0.9201.

USD/CHF continues to be mainly bearish since the pair still continues to display vulnerability in the market. The pair is supported mainly by the sustained selling pressure that has held the pair below critical levels of support. Although the duo has seen its third straight losing day, there is a need to watch for possible changes in market sentiment that may affect its direction in subsequent sessions. Lacking major reversals, USD/CHF may continue being susceptible to more downgrades in light of its prolonged bearish momentum. But traders need to monitor general economic trends or geopolitical events that may influence market trends and investor sentiment.

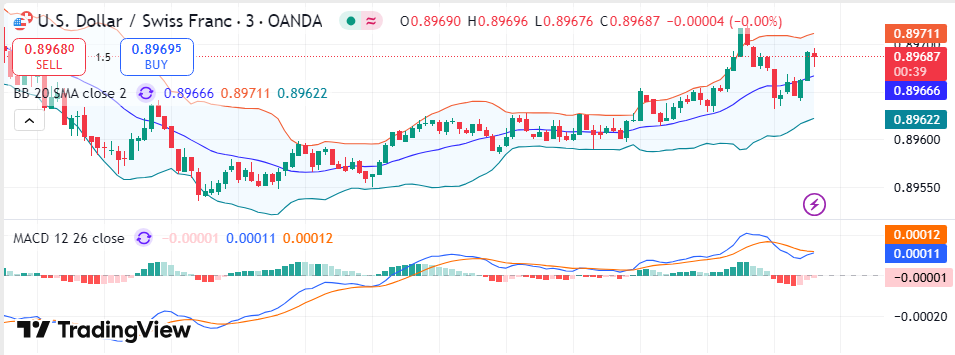

USD/CHF Daily Price Chart

Chart Source: TradingView

Most market players are observing the pair with interest, given the general economic uncertainties and global financial trends that may be affecting investor sentiment. In the future, analysts are keeping an eye out for how changes in global economic policies and market risk appetite may affect the USD/CHF dynamic. While some believe the situation will stabilize as market conditions change, others foresee that ongoing caution may cause further adjustments, and thus, keeping an eye on key economic events is crucial.

TECHNICAL ANALYSIS

USD/CHF shows a strong bearish trend, with the pair persistently trading below its nine-day and 14-day exponential moving averages. The 14-day RSI remaining below the 50 level further indicates the bearish momentum, implying that the market is now in an oversold position. Levels of importance are closely watched, with psychological support at 0.8900 potentially acting as a key hurdle, and potential support around the nine-day EMA of 0.9009 providing a potential turning point should the buyers enter.

FORECAST

Should market sentiment change and the general public regain confidence in buying the pair, the USD/CHF may break beyond near-term resistance levels, which can trigger a reversal move that would likely drive the pair toward higher ground. Increased buying interest and positive macroeconomic news may help sustain this recovery, and it is possible that a change in momentum is on the cards. If the pair reverses the current bearish momentum and can break above the nine-day EMA, increased buying interest may be seen. A recovery in the 14-day RSI, rising from oversold levels, can aid in forming a short-term uptrend, putting the USD/CHF on course to challenge resistance levels and target the nine-month high.

On the other hand, if there’s sustained selling pressure, the pair may continue probing lower support levels. A breakdown below the 0.8900 threshold could lead to further losses, with ongoing RSI weakness support for bearish sentiment and pushing the pair towards the lower lows seen in the last couple of months. A breakdown below key support levels may deepen the fall, suggesting that persistent bearish conditions may push USD/CHF to challenge lower levels.