USD/CHF cements position close to the 0.9150 handle as the fray atmosphere overshadows ahead of President-elect Donald Trump’s inauguration. Expectations of Donald Trump’s pro-growth and inflationary economic policies-possible immigration controls, higher tariffs and tax cuts-have carved confidence levels about a stronger US Dollar and protracted hiked rates by the Federal Reserve. Meanwhile, the Swiss Franc has been losing ground on fears that the SNB might continue cutting interest rates to combat the threat of inflation below target. Expectations over market sentiment from a new global trade environment under the Trump administration would likely spur demand for US-produced goods but fuel fears of potential trade wars.

KEY LOOKOUTS

• The pair stabilizes around 0.9150 as investors await Trump’s inauguration and anticipate the impact of his pro-growth, inflationary policies on global trade dynamics.

• Market eyes initial executive orders, including immigration controls, higher tariffs, and tax cuts, which could boost US inflation and growth while reshaping global trade.

• Speculation grows that the Swiss National Bank may further cut interest rates amid inflation risks, adding downward pressure on the Swiss Franc against the US Dollar.

• Expectations rise for prolonged elevated US interest rates as Trump’s policies support inflation and growth, with markets pricing in potential rate adjustments starting in June.

Markets were focused on USD/CHF consolidating at 0.9150 while awaiting the inauguration of President-elect Donald Trump as investors closely follow his expected economic policies. Important areas of attention include initial executive orders on controls over immigration, higher tariffs, and tax cuts, which would boost US inflation and growth, but also fundamentally alter global trade dynamics. These policies may continue to maintain high Federal Reserve interest rates for a long time, as markets price in possible adjustments mid-year. At the same time, the Swiss Franc is going to come under pressure from below, as speculative concerns about potential interest rate cuts by the Swiss National Bank amid growing inflation pressures.

The USD/CHF pair stabilizes at 0.9150, as markets await Trump’s inauguration and his pro-growth policies. The Swiss Franc is under pressure due to expected SNB rate cuts and inflation risks.

• The pair stabilizes at 0.9150 as investors remain cautious ahead of Trump’s inauguration.

• Expected pro-growth measures include higher tariffs, tax cuts, and immigration controls, which can boost US inflation and growth.

• A trade war could ensue from a global reaction to higher import tariffs, making imports expensive and increasing demand for US-produced goods.

• Markets expect long-term high interest rates, as the first rate cut is anticipated in June under Trump’s inflationary policies.

• The CHF is also under pressure amid speculation of further interest rate cuts by the Swiss National Bank.

• Swiss inflation risks dipping below target, which may prompt further rate cuts by the central bank.

• The US Dollar Index is trading near 109.00, which marks the third month of sustained strength as market optimism prevails.

The USD/CHF pair consolidates around 0.9150 as investors take a cautious stance ahead of President-elect Donald Trump’s inauguration. Market participants are paying attention to Trump’s expected economic policies, such as higher import tariffs, immigration controls, and tax cuts. All these are likely to boost US inflation and economic growth, thereby creating a pro-growth environment that may support the US Dollar. However, there is still a concern of potential trade wars because higher tariffs will increase demand for US-produced goods while making imports expensive. For this reason, the Federal Reserve is also thought to keep raised interest rates a bit longer as well, while the first likely rate hike would come in mid-2025.

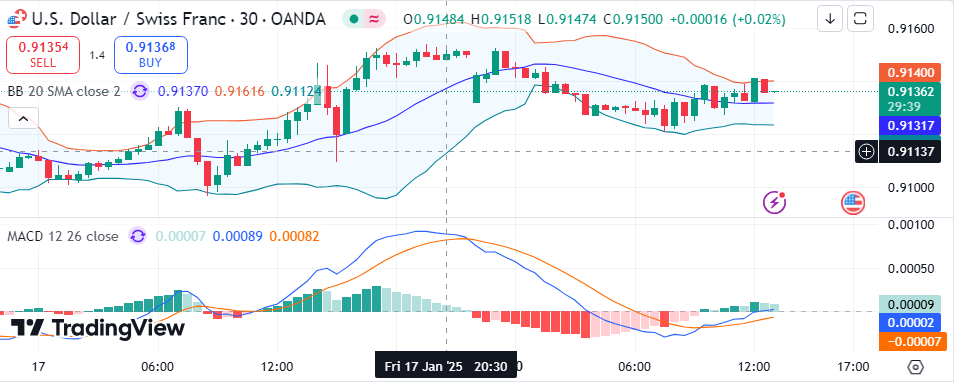

USD/CHF Daily Price Chart.

Source: TradingView, Prepared By ELLYANA

However, the Swiss Franc remains relatively weak due to speculation of an even further cut of the interest rate by the SNB. With inflation risks expected to fall below the target set by the central bank, the SNB may implement further measures to strengthen the Swiss economy. The dovish scenario puts more pressure on the CHF, creating a wider gap between US and Swiss monetary policies. As the USD/CHF pair consolidates sideways, investors are left waiting for a clearer signal of Trump’s policies and their global implications.

TECHNICAL ANALYSIS

From a technical perspective, the USD/CHF pair is trading in a narrow range around 0.9150, which reflects consolidation after recent volatility. Key support levels are observed near 0.9120, with a break below potentially opening the door to further downside. Resistance is positioned around 0.9185, which aligns with previous swing highs, acting as a critical barrier for bullish momentum. The Relative Strength Index (RSI) has just recently moved into neutral territory, and the Moving Average Convergence Divergence (MACD) histogram has flattened out, suggesting fading momentum. The range that a breakout could give some clearer directional clues.

FORECAST

The USD/CHF still may continue upward if the policies of President-elect Donald Trump continue to drive the US economy upwards into stronger economic growth and inflation as expected. Measures in the form of high tariffs, tax cuts, and immigration controls should be helpful to support domestic demand. Furthermore, this may give support to the USD, since it is perceived that the Fed has extended a longer period for a high level of interest rate than previously envisaged. Additional upside in the USD/CHF pair could also be derived if the Swiss National Bank continues on its dovish stance and announces further interest rate cuts.

Conversely, the pressure could come in when the markets take a negative approach to Trump’s policies, with the possibility of a heightened risk of a global trade war. Higher tariffs could disrupt international trade, reducing investor appetite for riskier assets and potentially weakening the US Dollar. Furthermore, if the Federal Reserve signals a faster pace of rate cuts due to any unforeseen economic slowdown, the USD could lose ground. The Switzerland country would benefit if there was an unexpected positive economic data or even a shift in the SNB’s monetary policy, and that would help to support the CHF and push the USD/CHF downwards.