USD/CHF currency pair is holding above the 0.7900 level, sandwiched by offsetting market forces. The weaker US Dollar, fueled by doubts over the path of rate cuts by the Federal Reserve and fears regarding its autonomy, remains a headwind for the pair. At the same time, weakening demand for the safe-haven Swiss Franc, while renewed optimism in global trade and improving risk appetite, assists in curbing further losses. As investors wait to hear important economic data and central bank announcements, the pair is stuck in a range close to a multi-week low, indicative of risk-averse market tone.

KEY LOOKOUTS

• The market’s interest continues to focus on the timing and speed of prospective rate cuts and pressure on the Federal Reserve’s autonomy.

• Geopolitical tensions ease and trade optimism lower demand for the Swiss Franc, driving USD/CHF movement.

• Flash PMIs, US Weekly Jobless Claims, and New Home Sales data are likely to fuel short-run volatility in the pair.

• The European Central Bank policy statement can influence overall market sentiment and, through that, impact USD/CHF dynamics indirectly.

The USD/CHF currency pair is directionless around the 0.7920 level, as market participants balance shorts against opposing forces in the market. The US Dollar remains under pressure as there is uncertainty regarding the Federal Reserve’s next step and growing concern over political intervention in monetary policy. In contrast, global trade optimism and a favorable risk environment are easing demand for the Swiss Franc, which has historically been considered a safe-haven currency. This tug-of-war has left the pair range-bound, with investors waiting for new catalysts from future economic data and central bank announcements to define the next clear directional path.

USD/CHF trades at a narrow range above 0.7900 as opposing forces keep the pair weighed down. Weak US Dollar and declining safe-haven demand for the Swiss Franc cancel each other out. Traders wait for major economic data for new directional signals.

• USD/CHF consolidates higher around 0.7900, close to a three-week low.

• US Dollar weakens on uncertainty regarding Fed’s rate cut trajectory and political interference issues.

• Safe-haven demand for CHF dissolves in the face of growing global trade optimism and risk-on sentiment.

• Trump’s public rebuke of Fed Chair Powell and buzz surrounding a new Fed nominee join the pressure on USD.

• Favorable trade updates with Japan and the EU underpin market risk appetite.

• Market participants look to subsequent economic indicators, such as flash PMIs, US jobless claims, and property sales.

• Later today’s ECB policy decision might have an effect on sentiment and market volatility worldwide.

The USD/CHF currency pair is right now moving through a challenging environment influenced by both economic and political trends. On the one hand, the US Dollar is under pressure by increasing doubt regarding the Federal Reserve’s direction for interest rates. Speculation regarding possible political meddling in the Fed’s autonomy has merely reinforced market prudence. President Trump’s frequent disparagement of Fed Chairman Jerome Powell and speculation regarding a probable leadership shake-up have created anxiety among investors, inhibiting any robust bounce-back by the greenback.

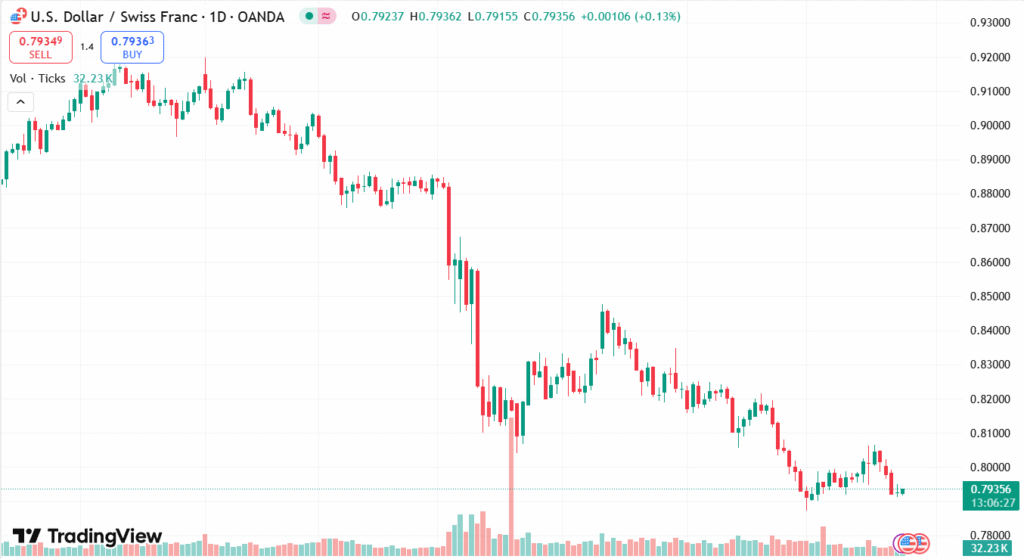

USD/CHF DAILY PRICE CHART

SOURCE: TradingView

Meanwhile, a tide of trade optimism is shaping market sentiment. Buoyant hints from continuing trade talks, such as an agreement with Japan and advances in negotiations with the European Union, have helped raise investor optimism. The optimism has deflated demand for safe-haven currencies such as the Swiss Franc, providing some support to the USD/CHF pair. As there are upcoming releases of economic data and announcements from the central banks, traders remain cautious, waiting for more definitive signals to inform their next decisions.

TECHNICAL ANALYSIS

USD/CHF is in a tight consolidation close to the 0.7920 level, slightly above the critical support of 0.7900. The pair stays below its short-term moving averages, suggesting a bearish bias, whereas momentum indicators such as RSI are close to neutral levels, showing indecision in the marketplace. A persistent break below 0.7900 would open up the next support at 0.7860, while any attempt at a rebound would have to overcome 0.7960 to stimulate fresh buying interest and change the short-term outlook to the upside.

FORECAST

Unless sentiment improves further and future US economic reports surprise to the upside, the USD/CHF currency pair may experience a mild rebound. Encouraging news around the US economy or खबर regarding the policy direction by the Federal Reserve could encourage the US Dollar to gain strength. In that scenario, a breakout above the 0.7960 resistance level could initiate a journey towards the 0.8000 psychological level, with additional bullish pressure potentially aiming for 0.8040 in the near term.

Conversely, if uncertainty about the Fed leadership picks up or US economic releases disappoint, the USD could continue on the back foot. This might keep pushing USD/CHF below that crucial 0.7900 support level. A strong breach of this level could result in additional losses down to 0.7860, with prolonged weakness potentially setting the stage for a fall to the 0.7820 region, particularly if risk appetite remains upbeat and safe-haven demand into the CHF rises.