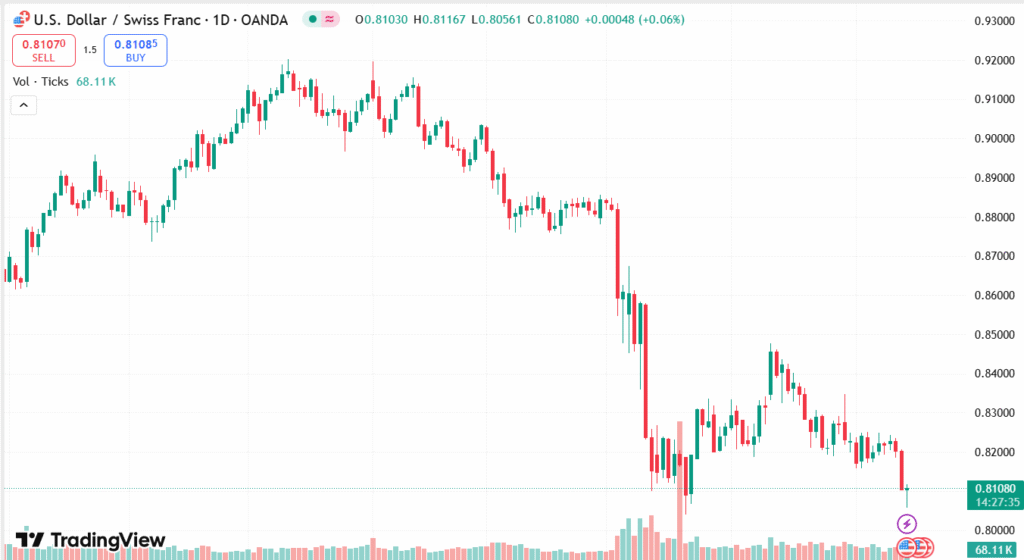

USD/CHF continued its losing momentum, falling to a two-month low at 0.8056 following increasing Middle East geopolitics-related tensions that boosted the Swiss Franc’s safe-haven appetite. The duo remained weak around 0.8070 in the Asian session, under pressure from Israel’s said military attacks on several Iranian nuclear facilities, heightening concerns about a broader regional war. Israel’s officials announced a state of emergency, while the US dissociated itself from the attacks, highlighting the protection of its staff. Moreover, US President Trump’s move to broaden steel tariffs on in-bound derivative products lowered market sentiment further, adding to the bear pressure on the USD/CHF.

KEY LOOKOUTS

• Escalating tensions in the Middle East, with Israel launching airstrikes on Iranian nuclear facilities, continue to fuel safe-haven demand for the Swiss Franc.

• The United States distances itself from Israel’s actions and is focused on defending American troops and preventing further escalation.

• The Swiss Franc strengthens as investors look for cover with rising geopolitical tensions and possible retaliatory threats from Iran.

• US President Trump’s widening of steel tariffs on derivative products imported into the US contributes to worldwide trade worries, continuing to pressure the USD.

The USD/CHF pair continued falling, hitting a two-month low as investors turned to safe-haven assets amid rising tension between Israel and Iran. Reports had it that Israel conducted raids on various Iranian nuclear facilities, and the fears of increased regional turmoil ensued. In reaction, Israeli authorities announced a state of emergency, but the US administration maintained its affirmation of non-engagement, stressing its commitment to protecting its personnel deployed in the area. Meanwhile, risk sentiment suffered another blow with President Trump’s move to widen tariffs on steel derivative products imported into the US, piling pressure on the already strained US Dollar.

USD/CHF falls to a two-month low as heightened Middle East tensions and increased safe-haven demand for the Swiss Franc drag it down. Increased US tariffs and Israeli attacks on Iranian nuclear facilities further sully market sentiment, piling pressure on the US Dollar.

• USD/CHF reaches two-month low of 0.8056 on increased geopolitical tensions.

• Israel launches series of attacks on Iranian nuclear facilities, escalating fears of regional conflict.

• Israeli Defense Minister declares emergency in preparation for potential retaliation.

• Swiss Franc benefits from enhanced safe-haven demand amid heightened risk-off mood.

• The United States stays away from Israel’s actions, emphasizing protecting its troops.

• US President Trump widens steel tariffs on derivative goods imported from overseas, weighing down world trade outlook.

• USD/CHF continues to be pressured by ongoing geopolitical and trade risks weighing over market sentiment.

The Middle East geopolitical landscape has moved to the forefront as Israel conducted a string of airstrikes against Iranian nuclear sites. Israeli leadership referred to the existential threat presented by Iran’s nuclear ambitions as the motivation behind these pre-emptive strikes. As a response to the escalating tensions, Israeli Defense Minister Israel Katz announced a special state of emergency, threatening missile and drone strikes as a retaliatory measure from Iran. This escalated conflict has contributed to heightened investor anxieties over wider regional stability, with markets responding quickly to the unfolding drama.

USD/CHF DAILY PRICE CHART

CHART SOURCE: TradingView

Simultaneously, US political and economic events contributed to overall market reserve. The White House, through Secretary of State Marco Rubio, clarified that the United States did not partake in Israel’s military action and highlighted its priority of protecting American personnel who are stationed in the region. In addition, US President Trump declared an increase in tariffs on steel derivative products, further increasing trade-related uncertainties. These collective factors have produced a volatile environment for investors, promoting changes in market dynamics as well as global risk sentiment.

TECHNICAL ANALYSIS

USD/CHF broke below important support levels and touched a two-month low of 0.8056. The pair continues trading under pressure, below its 50-day and 100-day moving averages, reflecting continuous bearish pressure. The Relative Strength Index (RSI) is making its way towards oversold levels, which indicates a possibility of minor corrective ups; however, the dominant bearish bias is still in place unless the pair is able to recapture resistance around the 0.8120-0.8150 area. Ongoing geopolitical uncertainty can keep the pair under pressure in the short term.

FORECAST

If geopolitics improve or diplomatic initiatives succeed in reducing tensions between Iran and Israel, risk sentiment might pick up, and hence safe-haven demand for the Swiss Franc could diminish. Under this scenario, USD/CHF may try to make a comeback with initial resistance around the 0.8120 level. A break above this area would open the way towards 0.8180 and even towards the psychological 0.8200 level.

Downside: In the event of further escalation of tensions or more retaliatory attacks, safe-haven demand for the Swiss Franc will be likely to gain strength, sending USD/CHF down. A clear break below the new low of 0.8056 may open the way for the pair to suffer further falls to 0.8020 and even 0.8000. Ongoing trade policy uncertainties can also fuel persistent bearish pressure on the US Dollar.