Japanese Yen (JPY) continues to come under pressure due to hopes over a US-China trade deal and the hawkish tone of the Federal Reserve driving the USD/JPY pair higher, with the pair near the 145.00 level. In spite of the Fed’s rate pause cues, the USD remains supported by the continued hopes for trade deals fueled by US President Trump’s statement about the announcement of a big deal. While the Bank of Japan (BoJ) provides cues about prospective interest rate increases in 2025, the global economic risks, especially about the US tariffs, may cap firmer JPY losses. Technical indicators are indicating further upside in USD/JPY, with levels to keep an eye on at 144.00 and 145.00.

KEY LOOKOUTS

• The USD/JPY currency pair is moving up as a result of optimism over a US-China trade agreement and the Federal Reserve’s policy of maintaining rates unchanged, which indicates support for the US Dollar.

• The minutes of the BoJ indicate possible future interest rate increases in 2025, although global uncertainty and economic unpredictability will constrain the Japanese Yen’s losses.

• President Trump’s statements on a significant trade deal announcement also increase investor optimism in the US Dollar, supporting JPY’s underperformance as a safe-haven currency.

• The duo is set to test the 145.00 psychological level, with major technical resistance at 144.00 and support levels near 143.40, which affect market mood and price action.

USD/JPY pair maintains its rally, supported by a mix of US trade agreement optimism and the hawkish bias of the Federal Reserve, which supports US Dollar confidence. President Trump’s recent remarks over a big announcement of a trade deal have even further added fuel to anticipation, boosting the USD against the Japanese Yen. The Bank of Japan has even threatened to hike interest rates in 2025 but with worldwide economic uncertainties surrounding the tariffs imposed by the US having checked the ascent of the Yen. Consequently, the duo is getting close to the 145.00 level, with technical charts indicating that resistance at 144.00 and support at 143.40 will be the key determinants of the next direction.

USD/JPY pair keeps on moving upwards, fueled by US trade deal optimism and a dovish Fed attitude. Although the Bank of Japan hints at future rate rises later in 2025, global uncertainties continue to put pressure on the Japanese Yen, taking the pair towards the 145.00 level.

• Optimism over US-China trade discussions increases investor confidence, favoring the US Dollar relative to the Japanese Yen.

• The Fed’s hold on interest rates has supported the US Dollar, which has helped its strength against safe-haven currencies such as the Yen.

• In spite of worldwide economic uncertainty, the Bank of Japan indicates that it can increase interest rates in 2025, curbing further losses for the Yen.

• President Trump’s words regarding a significant trade deal announcement later today further support USD sentiment, pressuring the Yen.

• Continuous uncertainty stemming from US tariffs and geopolitical unrest, including the Russia-Ukraine crisis, dents the safe-haven value of the Yen.

• The pair is close to crucial resistance at 145.00, with levels of support at 143.40 and 143.00 probably shaping subsequent price action.

• Traders expect President Trump’s press conference to offer fresh cues on the course of US trade policy and impact the overall market mood.

USD/JPY currency pair is picking up speed, spurred on by increasing hope surrounding US-China trade negotiations and the recent dovish tilt in Federal Reserve monetary policy. Supportive comments by President Trump on a big trade deal announcement due later today again boosted confidence in the US Dollar, as global economic volatility remains a source of concern that keeps the Japanese Yen on the back foot. The expectation of a possible US trade agreement and the Fed’s choice to wait before lowering rates have helped push the US Dollar higher, which has undermined the safe-haven status of the Yen.

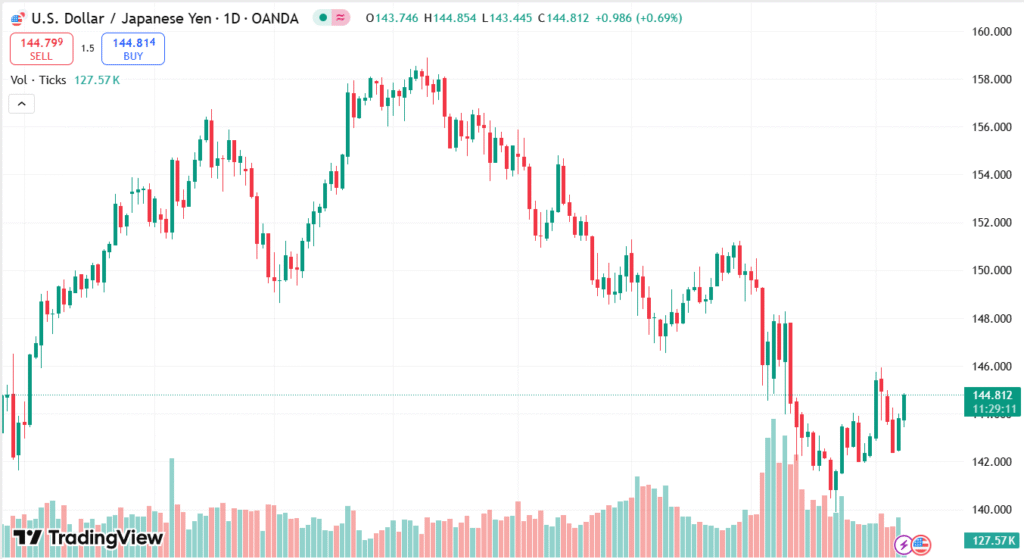

USD/JPY DAILY PRICE CHART

CHART SOURCE: TradingView

At the same time, the Bank of Japan (BoJ) is also cautious but indicates that it might hike interest rates in 2025 if inflationary trends persist. In spite of these possible plans to tighten, the BoJ remains wary of global economic uncertainty, notably regarding US trade policy. Consequently, the potential for the Yen to recover is subdued, notably as the US Dollar remains buoyed by optimism over trade deals and general market sentiment. Traders are following events closely, which influence the current direction in USD/JPY.

TECHNICAL ANALYSIS

USD/JPY currency pair is now probing major resistance levels near the 144.00 level, and has the potential to move past 145.00, which is a psychological level. The 200-period Simple Moving Average (SMA) on the 4-hour chart is still a key metric to monitor, as it has acted as a resistance level in the past. If the pair is able to break above 144.30, it may lead to a rally up to the 145.00 level and further to 146.00. On the other hand, the immediate support areas are around 143.40-143.35, and a break below these levels would likely send the pair to the 142.35-142.00 region. These technical considerations, in addition to overall market sentiment, will most probably dictate the near-term direction of USD/JPY.

FORECAST

USD/JPY pair is expected to continue its bullish trend, particularly if the pair successfully crossed the 144.30 resistance level. A prolonged movement above this level may set the stage towards the psychological 145.00 level, a key level to watch for traders. If the US Dollar continues to be strong on sustained optimism regarding US trade agreements and the hawkish policy of the Federal Reserve, USD/JPY may continue its rally, possibly testing levels around 146.00 in the near future. Momentum indicators also indicate that if the pair continues to be bullish, it may move higher, driven by investor optimism regarding the US economy and declining global risk concerns.

Conversely, if the pair is rejected around the 144.00-144.30 levels and cannot stay above these levels, a corrective retrace might ensue. Levels of support around 143.40-143.35 are significant; in case these levels are broken, the pair would move down to 142.35 or even test the level of 142.00. This bearish scenario would most likely occur if risk sentiment turns to increased uncertainty or if economic indicators releases indicate the slowing of the US economy. Additionally, any changes in global trade policies, especially between US-China, can put pressure on the USD and cause a decrease in USD/JPY.