West Texas Intermediate (WTI) crude oil remained flat at around $61.80 on Tuesday following OPEC+’s move to raise production by 137,000 barrels per day from November, smaller than the anticipated 500,000 bpd. The restricted production increase alleviated concerns of a supply-drenched market, while recent Ukrainian attacks on Russian energy targets provided a risk premium to prices. The issue of the continuing US government shutdown and possibility of economic slowdown also fueled market uncertainty, supporting WTI despite neutral demand signals.

KEY LOOKOUTS

• Watch for any additional changes to production levels, where minor changes can make an impact on WTI prices.

• Monitor the Russia-Ukraine conflict and other geopolitical threats that might interfere with oil supply.

• Monitor the US government shutdown and trade policies that might influence oil demand.

• Monitor global economic data and forecasts of demand that can influence the balance of supply and demand and price action.

WTI crude oil is trading up around $61.80 as a mix of supply and geopolitical issues underpins the market. OPEC+’s November output increase of 137,000 barrels per day, short of market expectations, has alleviated supply glut worries, though the risk premium comes with disruptions from the Russia-Ukraine war, including physical damage to Russian refineries. Meanwhile, worries regarding the ongoing shutdown of the US government and possible slowdown in the economy continue to weigh on sentiment, keeping WTI prices on a risk-averse upward path.

WTI crude oil remains close to $61.80 as a small OPEC+ production increase and geopolitical tensions prop up prices. Russia-Ukraine conflict supply disruptions and US economic uncertainty put additional upside pressure.

• WTI crude is at about $61.80 in early European trading.

• OPEC+ will raise production by 137,000 barrels per day from November.

• The production increase is smaller than the market expectations of a rise of up to 500,000 bpd.

• Geopolitical tensions, such as Ukrainian attacks on Russian energy facilities, underpin oil prices.

• Russia’s Kirishi oil refinery shut down its most efficient distillation unit following a drone attack.

• The current US government shutdown contributes economic uncertainty impacting oil demand.

• Trade policy concerns about slowing global demand may affect future WTI prices.

WTI crude oil is demonstrating steady resilience as international supply and geopolitical events influence sentiment. OPEC+ declared a modest output boost of 137,000 barrels per day in November, which is less than anticipated and has alleviated concerns of oversupply. At the same time, continuing tensions out of the Russia-Ukraine conflict, such as Russian energy infrastructure attacks, have imparted a risk component that favors crude prices.

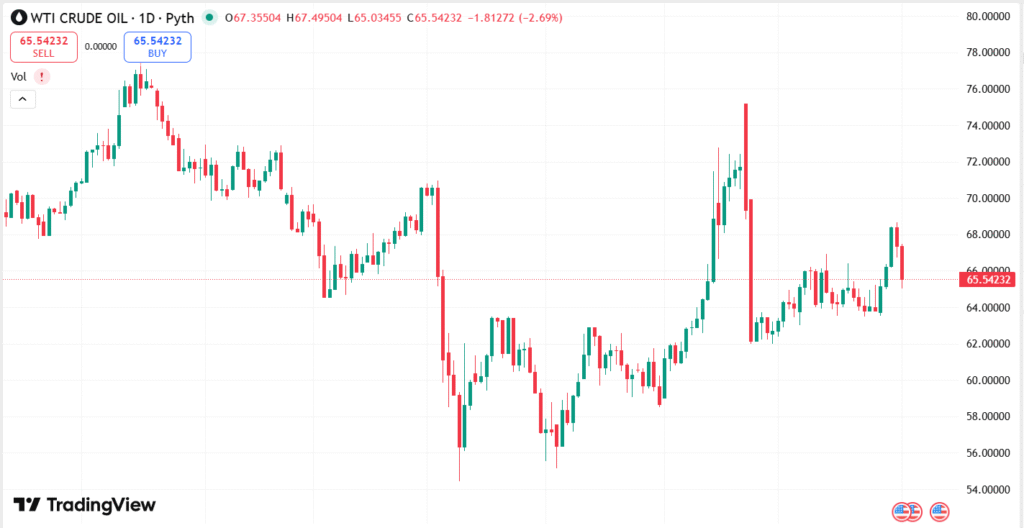

WTI CRUDE OIL Daily Chart Price

SOURCE: TradingView

Meanwhile, economic uncertainties in the United States, including the prolonged government shutdown and trade-related slowdowns, remain shaping market outlooks. These conditions lead to a defensive environment where investors and traders are monitoring events in both supply dynamics and geopolitical events closely to assess future market action.

TECHNICAL ANALYSIS

WTI crude is consolidating around the $61.50–$61.80 range, demonstrating strength above important short-term support levels. The price has been respecting recent moving averages, suggesting a potential continuation of the bullish trend if it can hold above the $62 resistance level. Traders are most likely monitoring volume trends and momentum indicators, as any breakout or rejection at these levels may indicate the next direction for the benchmark.

FORECAST

WTI crude would have potential for further upside should geopolitics heat up or if OPEC+ continues to stick to a cautious script of raising production. Disruptions in major regions, particularly in Russia, could attach a risk premium to prices, and that could drive WTI to the $63–$64 band in the short term.

On the negative side, extended uncertainty in the US economy or slowing global demand might put downward pressure on prices. If the US government shutdown persists or trade pressures escalate, WTI can test the support at $61 or lower, since weaker demand would undermine the prevailing supply issues.