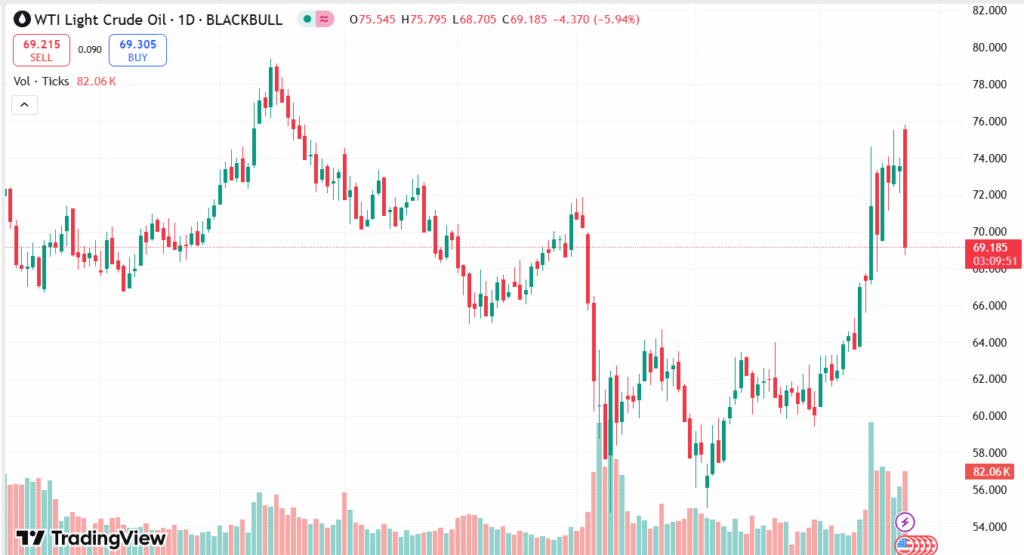

WTI Crude Oil saw intense volatility as word reached markets that Iran had launched missiles against US bases in Qatar, threatening to ignite a wider Middle East war. Prices surged to $76.74 initially as markets responded to possible risks to global oil supply, especially through the critical Strait of Hormuz. But since no meaningful damage or further escalation ensued, the market reverted swiftly, profit-taking fueling prices back down to around $70.80. Even though the intraday drama ensued, the absence of concrete supply disruption prompted a re-evaluation, leaving crude oil susceptible to further losses in the face of continued geopolitical unpredictability.

KEY LOOKOUTS

• Any established disruption of oil transit via this key passage has the potential to induce renewed buying demand and price spikes.

• Either side’s future military retaliation or escalation can quickly change market sentiment.

• Keep an eye on the $69.98 and $68.42 support levels; a break might be a sign of stronger bear momentum.

• Ongoing lack of actual supply disruption could continue to hold oil prices in check despite geopolitical chatter.

WTI Crude Oil was hit with high-intraday volatility as word of Iran firing missiles at US bases in Qatar spooked markets, sending prices to a multi-month high of $76.74. The early rally was led by concerns that heightening tensions could interfere with oil shipments across the Strait of Hormuz. But with no reported damage and subsequent attacks, optimism rapidly dissipated, triggering a surge of profit-taking that pulled prices down to just over $70.80. This dramatic about-face highlights how sensitive the oil market is to geopolitical events, but also how much traders prefer concrete supply threats over speculative anxiety.

WTI Crude Oil surged on reports of Iranian missile strikes but quickly reversed as fears of supply disruption faded. Prices dropped nearly 5% from their peak, settling near $70.80 amid profit-taking and easing tensions. Traders remain alert to any further escalation in the Gulf region.

• WTI Crude surged to $76.74 following reports of Iranian missile strikes on US bases in Qatar.

• Disruption fears for oil passage via the Strait of Hormuz first triggered the rally.

• No reported damage or escalation resulted in quick profit-taking and an abrupt reversal in prices.

• Prices declined close to 5%, settling at about $70.80 at the session’s end.

• Technical momentum shifted bearish, with important support now targeted at levels of $69.98 and $68.42.

• RSI fell to 63, showing weakening overbought levels and increasing downside pressure.

• Market is still guarded, waiting to see any additional military response or shipping interference.

WTI Crude Oil experienced increased volatility following news that Iran fired missiles at US military installations in Qatar, fueling concern of an expanded Middle East war. The news followed weekend bombing raids on Iranian nuclear facilities by US troops that drove regional tensions to a boil. Traders acted fast, wagering on a possible supply shock that might affect oil flows via the Strait of Hormuz—a strategic bottleneck for almost 20% of global crude exports. The initial market response indicated alarm over the vulnerability of peace in the Gulf and a risk of a broader military conflict.

WTI CRUDE OIL DAILY PRICE CHART

SOURCE: TradingView

In spite of the sensationalized headlines, the market stabilized as nothing consequential damage or escalation ensued from the missile attack. This soothed market nerves and led to a revision of the geopolitical risk premium. Although the episode highlights the continued risk of global oil markets to political turmoil in the region, traders do not yet seem to be rushing to capitalize on the situation. Meanwhile, the attention is on watching for diplomatic reactions and indications of retaliation, which may once more inject volatility in the energy market.

TECHNICAL ANALYSIS

WTI Crude Oil experienced a swift rejection at the $76.74 level and was unable to hold above the 78.6% Fibonacci retracement of the January–April slide at $74.11. The subsequent decline below the psychological $72.00 level reversed short-term momentum to the bears. Prices are currently sitting just above the 61.8% retracement level at $69.98, which is now immediate support. A slide below this may expose the 200-day Simple Moving Average at $68.42 and the 50% retracement around $67.08. The Relative Strength Index (RSI) has also retreated to 63, indicating dwindling bullish momentum and a potential shift towards further bear pressure in the absence of any bullish drivers.

FORECAST

In the event that further heightening of geopolitical tensions between Iran and the US—particularly with respect to direct attacks on US properties or interruptions of oil shipping channels within the Gulf—cause WTI Crude prices to experience renewed bullish pressure, a clear breakout above $74.00 can set the stage for a retest of the $76.74 high, with chances to test the $78.00–$80.00 band if fear in the market worsens and supply threats become more concrete.

On the negative side, if this situation is to remain contained without additional military involvement or supply disruption, WTI could still move lower as traders shed risk premiums. A fall below the crucial $69.98 support could leave the door ajar towards the 200-day SMA at $68.42, and the $67.00 level subsequently. Poor economic fundamentals or firmer U.S. Dollar underpinnings could also see further price softness in subsequent sessions.