West Texas Intermediate (WTI) crude oil is trading near $73.00 after dipping from recent peaks, with risks to the downside seeming minimal owing to growing Middle Eastern geopolitical tensions. Increased concerns of supply disruptions in the Strait of Hormuz, through which roughly 20% of the world’s seaborne oil travels, are buoying oil prices. The tensions ran hotter after the previous President Donald Trump demanded Iran’s “unconditional surrender” and America escalated its military build-up in the region. In the meantime, markets look to the U.S. Federal Reserve to raise interest rates this week, but potential cuts later in the year as fears of global growth worsen.

KEY LOOKOUTS

• Heightened conflict among the U.S., Iran, and Israel could result in possible supply disruptions via the critical Strait of Hormuz.

• Former President Trump’s demand for Iran’s “unconditional surrender” and heightened U.S. military operations could exacerbate market volatility further.

• The Fed is likely to maintain rates at 4.25%-4.50%, but subsequent cuts in September or even July are still in the spotlight.

• Even though there have been recent pullbacks, supply worries and geopolitical tensions can curtail downside action in WTI prices around the $73.00 level.

WTI crude oil prices are still bearish around the $73.00 handle after surrendering some of the sharp advances on Tuesday, fueled by the renewed specter of supply interference in the Strait of Hormuz—a critical shipping channel for global oil exports. Geopolitical tensions have heightened after former President Donald Trump’s call for Iran’s “unconditional surrender” and news of heightened U.S. military deployments within the region. The prospect of an expanded conflict between Israel and Iran is fueling the anxiety in the market. In the meantime, focus turns to the U.S. Federal Reserve’s forthcoming rate decision, with investors keen to see cues regarding the timing of potential interest rate reductions later this year.

WTI crude oil fluctuates at $73.00 as supply fears from the Strait of Hormuz cap losses. Geopolitical tensions between Iran and U.S. military actions fuel market fear, as investors wait for the Fed’s interest rate move.

• WTI crude oil trades at around $73.00, pulling back slightly after a 5% rise led by supply fears.

• Strait of Hormuz tensions flare, with concerns of interrupted global oil flow through the critical chokepoint.

• Ex-President Trump demands Iran’s “unconditional surrender”, heightening geopolitical uncertainty.

• U.S. sends additional fighter jets, further buttressing its presence in the Middle East in rising tensions.

• Israel can step up military activity against Iran, further increasing regional instability.

• The Fed is likely to keep rates at 4.25%-4.50% in its next meeting.

• Markets factor in expected rate cuts by September or sooner, as global growth fears return.

West Texas Intermediate crude oil is still in the limelight as tensions geopropolitically in the Middle East continue to escalate. Former U.S. President Donald Trump’s recent statement calling for Iran’s “unconditional surrender,” along with heightened U.S. military deployment across the region, has further raised fears of possible conflict. The Strait of Hormuz, which carries almost one-fifth of the world’s seaborne oil, is central to these fears, as any disruption would have a serious impact on international supply chains. With Iran said to be making overtures to neighboring nations to garner diplomatic support, the situation remains unstable and closely monitored by international markets.

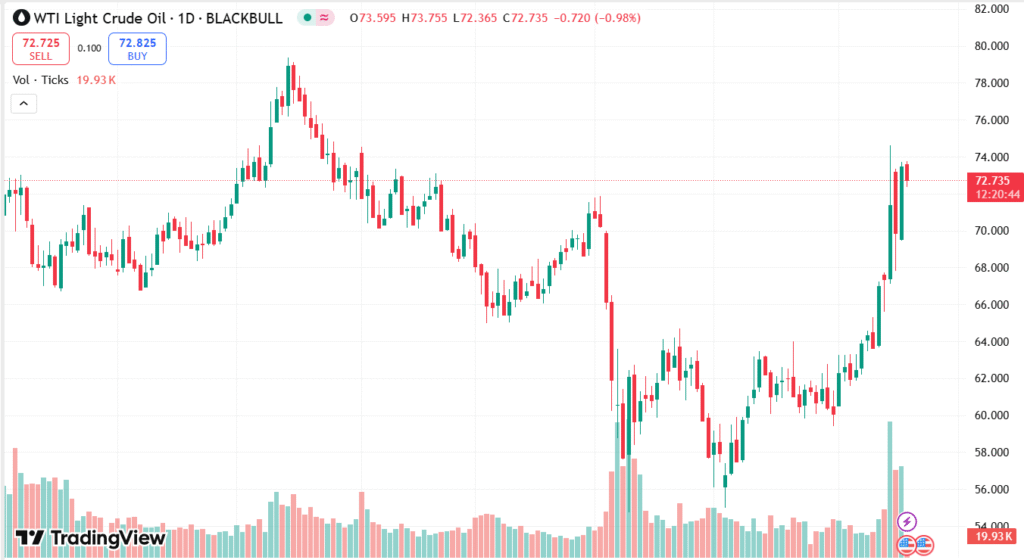

WTI CRUDE OIL DAILY PRICE CHART

SOURCE: TradingView

At the same time, market participants are focusing on the U.S. Federal Reserve’s next interest rate decision. Even though rates are universally predicted to stay flat in the short term, speculation is building on next policy steps, especially in reaction to diminishing global economic momentum. Analysts propose that sustained geopolitical uncertainties, combined with dimmed growth projections, may be enough to get the Fed to act prematurely. This combination of global stress and monetary policy uncertainty is having energy markets nervous, with investors considering both supply risk and economic indicators.

TECHNICAL ANALYSIS

WTI crude oil is consolidating around the $73.00 level following a steep rally in the last session. The price is just above its near-term support area, and any substantial advance beyond the $74.00 level could set the stage for a test of the $76.00 resistance. On the negative side, the initial support is around $71.50, followed by a firmer floor at $70.00. Momentum oscillators such as the RSI are neutral to weakly bullish, hinting at consolidation with a potential upside bias if geopolitical tensions continue to simmer and buying interest returns.

FORECAST

WTI crude oil could experience fresh upside strength if tensions in the Middle East continue to rise, especially around the Strait of Hormuz. Any confrontation or interference in oil shipping channels might spark a sudden surge in oil prices, which could lead WTI to the $76.00–$78.00 level. Secondarily, if the U.S. Federal Reserve hints at dovish policy adjustments or rate cuts earlier than anticipated, that might destabilize the dollar and prop up commodity prices, including crude.

On the negative side, WTI would risk pressure if diplomatic measures relieve tensions between Iran and America, or if transit of oil through the Strait of Hormuz remains unobstructed. Additionally, should global economic metrics continue to decline without proper stimulus, fear of diminished oil demand would send prices south. Under these circumstances, WTI would retest the levels around $71.50 and even move down towards the psychological $70.00 level.