West Texas Intermediate (WTI) crude oil prices have extended their rally above the $64.00 mark, driven by renewed optimism over ongoing US-China trade talks in London and improved business sentiment in the United States. Positive comments from US officials, including President Trump and Commerce Secretary Lutnick, have boosted market confidence, reinforcing hopes for stronger global demand. Additionally, the US NFIB Business Optimism Index for May surpassed expectations, indicating a healthier outlook for energy consumption. Traders now await the American Petroleum Institute’s weekly stockpile report, which could further influence price direction depending on whether it signals tightening or expanding supply.

KEY LOOKOUTS

• Continued negotiations between the world’s two largest economies remain a major driver for oil prices. Any breakthroughs or setbacks could significantly sway market sentiment and demand forecasts.

• The upcoming API report is expected to show a 0.7 million barrel increase. A surprise drawdown could support further gains in WTI, while a larger-than-expected build may pressure prices lower.

• WTI is approaching the key resistance level of $65.00, with the 100-day SMA near $66.00. The RSI at 61 reflects continued bullish momentum, but traders should watch for signs of overbought conditions.

• On the downside, failure to hold above $64.00 could invite selling pressure, with technical support seen near the 20-day Simple Moving Average around $62.00.

WTI crude oil prices remain in focus as markets monitor several key factors influencing the current rally. The ongoing US-China trade talks in London have lifted global demand expectations, providing strong upward momentum to oil prices. Traders are closely watching the $65.00 resistance level, with technical indicators like the RSI suggesting continued bullish sentiment. In the meantime, focus shifts to the next API crude stockpile report that may either solidify the rally or send the market into a pullback based on inventory patterns. To the downside, $64.00 represents prompt support, with deeper support nearby the 20-day SMA at $62.00 should bearish pressure mount.

WTI crude oil continues to trade above $64.00, supported by optimism around US-China trade talks and improved US business sentiment. Traders now await the API stockpile report and watch the $65.00 resistance level for signs of further upside.

• WTI crude oil prices have extended gains above $64.00, marking a fourth consecutive day of upward momentum.

• Ongoing US-China trade talks in London are boosting market optimism and improving the global demand outlook.

• Positive comments from US officials, including President Trump and Commerce Secretary Lutnick, have strengthened investor confidence.

• The US NFIB Business Optimism Index rose to 98.8 in May, surpassing expectations and signaling increased energy demand.

• Traders are closely watching the $65.00 resistance level, with the 100-day SMA near $66.00 as the next potential target.

• The API crude oil stockpile report is expected to show a 0.7 million barrel increase, which could influence price direction.

• Support is seen at $64.00 and further at $62.00, near the 20-day SMA, in case of a pullback.

WTI crude oil prices are gaining momentum as optimism surrounding US-China trade talks continues to build. The ongoing negotiations in London between the two economic powerhouses have improved market sentiment, with both sides signaling progress toward better trade cooperation. Positive remarks from US leaders, including President Trump and Commerce Secretary Lutnick, have contributed to a brighter outlook for global trade, which in turn supports expectations for stronger energy demand.

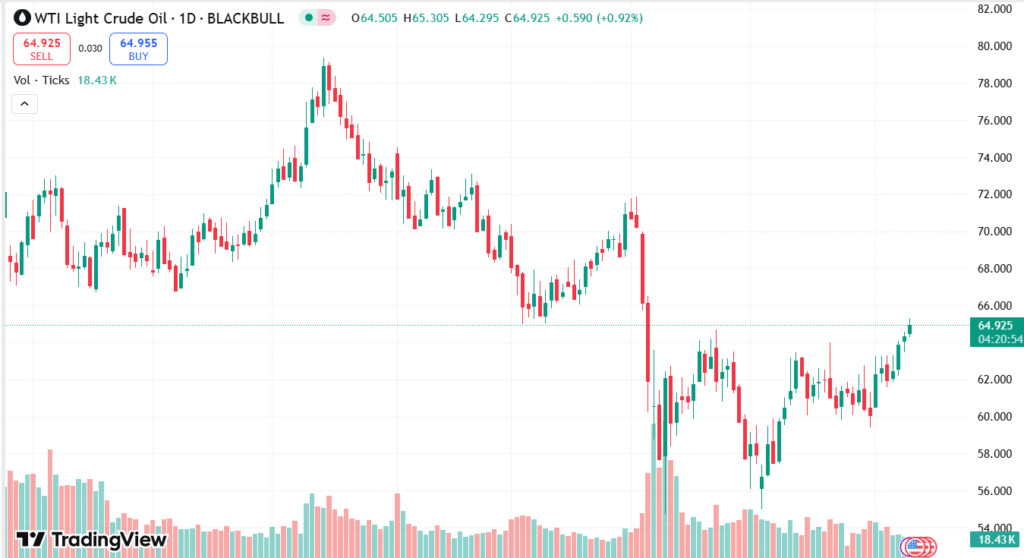

WTI Crude Oil DAILY PRICE CHART

CHART SOURCE: TradingView

Adding to the positive tone, the US NFIB Business Optimism Index showed an improvement in May, indicating increased confidence among small businesses. This suggests a healthier economic environment, which typically translates into higher industrial and commercial energy use. As global and domestic demand expectations improve, market participants are keeping a close eye on upcoming developments, including the weekly oil inventory data, for further insight into supply dynamics.

TECHNICAL ANALYSIS

WTI crude oil is maintaining its bullish momentum, trading above the key $64.00 level. The current price action suggests strong buying interest, with the next significant resistance seen near the psychological $65.00 mark. The Relative Strength Index (RSI) stands at 61 on the daily chart, indicating healthy upward momentum without entering overbought territory. If the bullish trend continues, the 100-day Simple Moving Average (SMA) just below $66.00 could act as the next target. On the downside, $64.00 remains an important support level, followed by the 20-day SMA around $62.00, which could limit any potential pullback.

FORECAST

WTI crude oil may continue its upward trajectory if positive momentum from the US-China trade talks persists and economic data remains supportive. A successful outcome in the negotiations could boost global demand expectations, further encouraging bullish sentiment in the oil market. If demand outlooks improve and US inventory data shows tighter supply, prices could move toward the $65.00 level and potentially test the 100-day SMA near $66.00 in the near term.

On the other hand, if trade discussions face setbacks or if the upcoming API report reveals a larger-than-expected increase in crude stockpiles, WTI prices could come under pressure. A break below the $64.00 mark might trigger selling, with the next support level seen around the 20-day Simple Moving Average at $62.00. Additionally, any signs of slowing economic activity or a drop in business confidence could weaken demand projections, increasing the likelihood of a short-term pullback.