WTI oil prices have recovered to almost $63.50 per barrel, fueled by short-covering after a sharp decline on Monday. Investors took advantage of the opportunity to cover losses as uncertainty over the US economy and monetary policy continues to plague the market. President Trump’s attacks on the Federal Reserve and threats of an impending economic slowdown have contributed to market uncertainty. In addition, concerns over a potential recession, fueled by persistent trade tensions and unstable US-Iran relations, are further weighing on crude oil demand. In spite of these issues, the WTI price continues to be stuck in a $55–$65 range, as analysts expect ongoing volatility in the near term.

KEY LOOKOUTS

• Following a precipitous sell-off on Monday, investors took advantage of the price fall, covering short positions, and this helped lift WTI prices, sending them to close to $63.50 per barrel.

• President Trump’s threat of a possible US economic slowdown if interest rates are not cut at once has sparked fears regarding monetary policy, which has heightened market volatility and affected oil demand.

• Experts cite increasing fears of a US recession, with almost a 50% likelihood of it happening in the next 12 months, mainly because of trade tensions and tariffs, which would suppress crude oil demand.

• Events in US-Iran relations, such as the writing of a possible nuclear agreement, could soften supply worries, as Iran is still a major oil producer. Any development would further impact oil prices.

WTI oil prices have recently surged to about $63.50 per barrel, as investors took advantage of Monday’s steep sell-off to roll over short positions. The bounce comes amid escalating uncertainty over the US economy, with President Trump warning that the economy may slow unless the Federal Reserve lowers interest rates. His comments have created fears over the Fed’s autonomy and rising financial market volatility. Analysts are also pointing to increased risk of recession, driven by trade tensions and tariffs, that could negatively impact crude oil demand. Any potential resolution in US-Iran relations, especially around a nuclear deal, could alleviate supply concerns, further impacting price action. Despite all this, the WTI price is still likely to trade in the $55–$65 range in the near future.

WTI crude oil prices have jumped to approximately $63.50 a barrel after investors covered shorts from Monday’s selloff. This gain follows increased economic uncertainty as President Trump threatened that there would be a slowdown if interest rates were not reduced, as worries of a US recession and tensions related to Iran geopolitics remain an influence on crude oil demand.

• WTI oil prices jumped to about $63.50 per barrel, fueled by short-covering following Monday’s heavy sell-off.

• Investors took advantage of Monday’s price drop, short-covering, causing WTI prices to rebound.

• President Trump has threatened the US economy would slow unless the Federal Reserve lowers interest rates, further fueling market uncertainty.

• Generalized uncertainty regarding US monetary policy continues to burden financial markets, fueling fears over future crude oil demand.

• A virtually 50% probability of a US recession in the next year, as reported by a Reuters survey, is heightening market nervousness, which might curdle crude oil demand.

• Increasing tensions between Iran and the US, as well as the possibility of a nuclear agreement, may have further implications on oil prices, particularly in terms of supply fears.

• WTI oil prices are expected to stay within a $55–$65 band as a result of sustained fears of economic slowdown and trade tensions.

WTI crude oil prices have lately witnessed a rebound, going up to approximately $63.50 per barrel. The move is prompted by investors taking the opportunity to close short positions in the wake of Monday’s aggressive sell-off. As this recovery in price sets in, the fears surrounding the US economy have been escalating. President Trump’s cautions on a looming economic slowdown and a call for interest rate reductions have been spreading doubt, which is complementing the turbulent environment over the market.

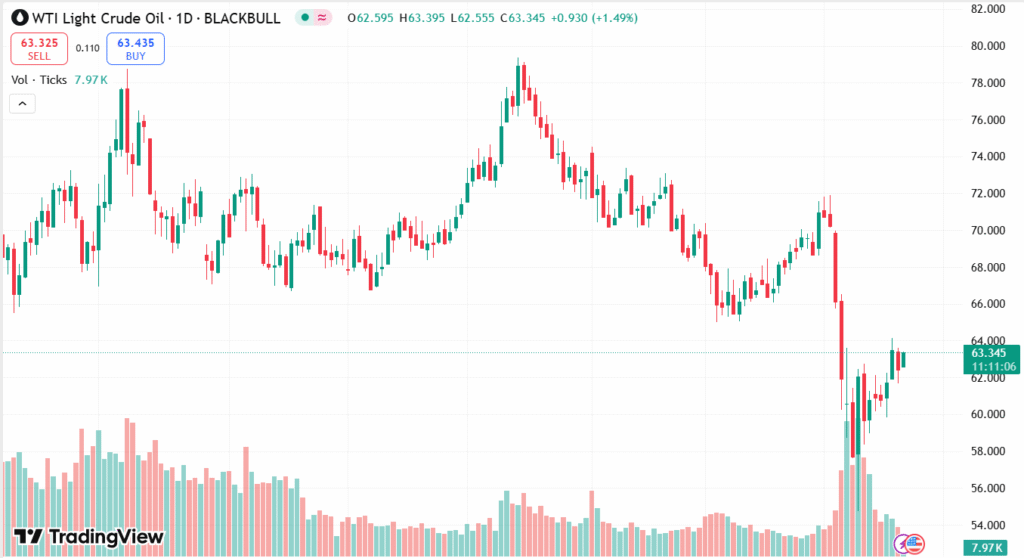

WTI CRUDE OIL DAILY PRICE CHART

CHART SOURCE: TradingView

Meanwhile, geopolitical tensions, especially those surrounding US-Iran relations, are also contributing to the movement of the oil market. Both countries have agreed to start working on a framework for a possible nuclear deal, which would alleviate supply worries. Although there is increasing worry regarding a possible US recession because of continuing trade tensions and tariff measures, these events indicate that the oil market will most probably remain affected by both economic considerations and geopolitics in the near term.

TECHNICAL ANALYSIS

WTI oil prices when it comes to interpreting market trends and possible price actions. By examining past price data and volumes, technical analysts employ different tools such as moving averages, trendlines, and support and resistance levels to predict future price movements. For example, if WTI oil prices are approaching a support level, it may mean a reversal or rise. On the other hand, if prices are approaching resistance, it may mean a possible decline. Spearhead indicators such as the Relative Strength Index (RSI) or MACD can also assist in detecting overbought or oversold conditions, providing cues for entry or exit points for traders. Using these methods, technical analysis aids investors in handling price movements due to market sentiment, geopolitical considerations, and economic statistics more effectively.

FORECAST

WTI oil prices are likely to face further gains from a number of factors. Investor sentiment, fueled by short-covering and recent market rallies, may continue to drive prices higher. Moreover, geopolitical events, especially any positive developments in US-Iran relations, may take some heat out of supply concerns and support price appreciation. If economic indicators point toward a more stable future for world markets, with some strengthening in demand or lessening of trade tensions, WTI may continue its upward trend. The potential for a more robust-than-anticipated rebound in worldwide oil demand, particularly from leading economies, would also support bullish sentiment.

Yet there are a number of risks on the downside that would bear down on WTI crude oil prices. Increasing fears of a US recession, driven by ongoing trade tensions and uncertainty about US monetary policy, would cause reduced demand for crude oil. In case the Federal Reserve maintains or raises interest rates, this might even curtail economic growth further and lead to bearish pressure against the prices of oil. Whatever notable development emerges between the US and Iran is also likely to unleash extra supply onto the market and place pressure downward on the prices. Sustained volatility in financial markets and a change in investor perception may also lead to further plunges in WTI oil prices, particularly if the world’s demand is short of estimates.